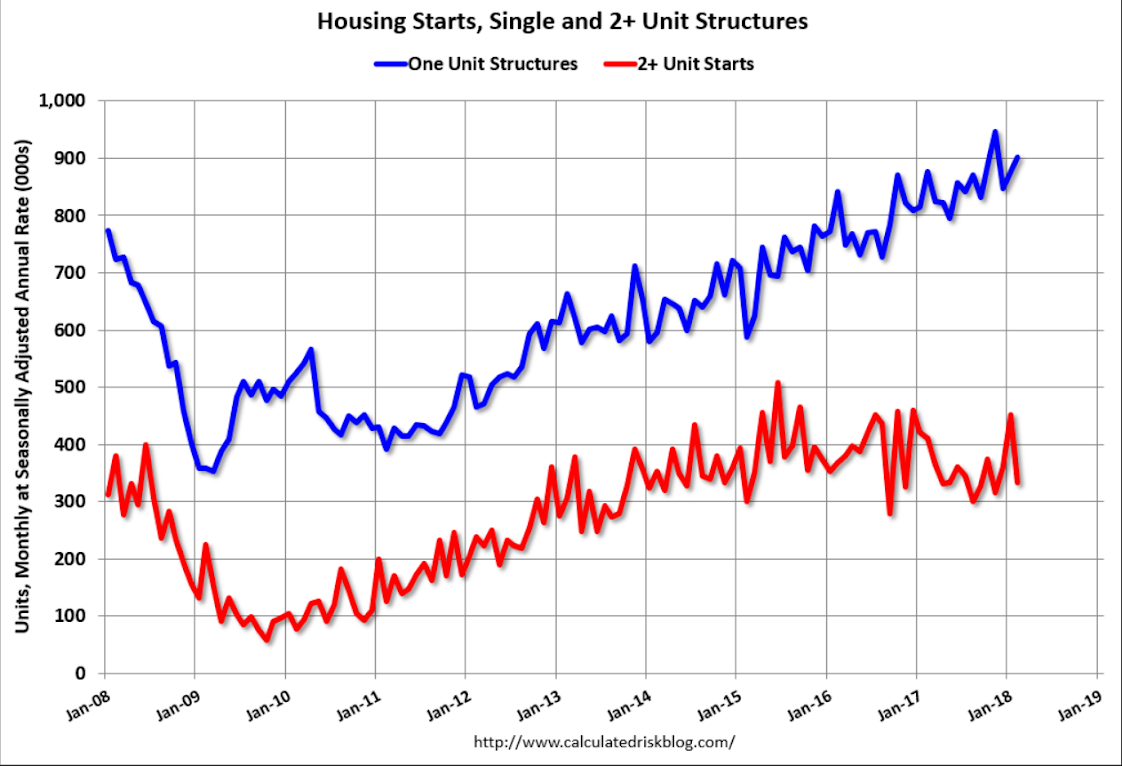

As previously discussed, the spike in multi family reported in Jan has reversed in Feb: Highlights Home sales turned lower in January as did housing starts and permits in February, and noticeably so. Housing starts fell 7.0 percent in the month to a much lower-than-expected annualized rate of 1.236 million while building permits fell 5.7 percent to 1.298 million which is also much lower than expected. Single-family homes are the key component in this report and permits fell 0.6 percent to an 872,000 rate. Year-on-year growth remains in the mid-single digits but is now under 5 percent at 4.6 percent. In a positive, single-family starts, which are key to restocking the new home market, rose 2.9 percent to a 902,000 rate which is up 2.9 percent from this time last year. And

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

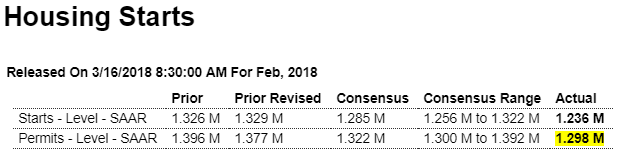

As previously discussed, the spike in multi family reported in Jan has reversed in Feb:

Highlights

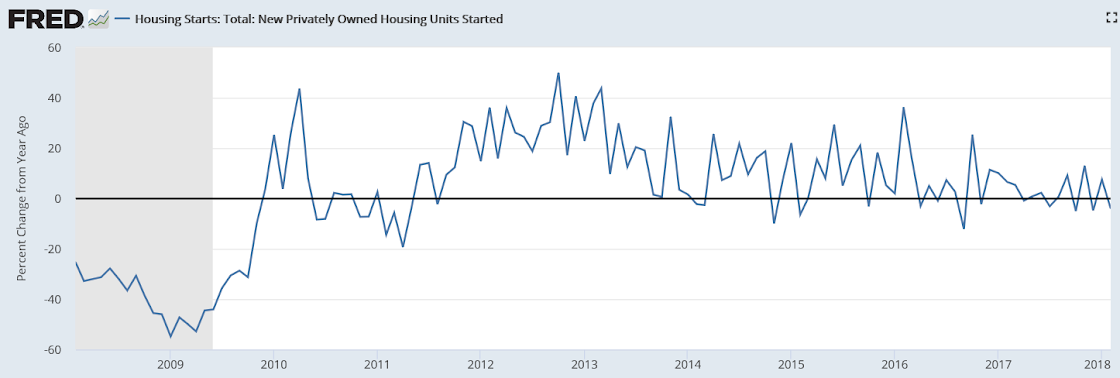

Home sales turned lower in January as did housing starts and permits in February, and noticeably so. Housing starts fell 7.0 percent in the month to a much lower-than-expected annualized rate of 1.236 million while building permits fell 5.7 percent to 1.298 million which is also much lower than expected.

Single-family homes are the key component in this report and permits fell 0.6 percent to an 872,000 rate. Year-on-year growth remains in the mid-single digits but is now under 5 percent at 4.6 percent. In a positive, single-family starts, which are key to restocking the new home market, rose 2.9 percent to a 902,000 rate which is up 2.9 percent from this time last year. And single-family completions rose 3.0 percent in the month to 895,000 and will offer immediate supply to the market.

Multi-family permits fell 14.8 percent but at a 426,000 rate are still up 10.6 percent year-on-year. Starts, however, fell 26.1 percent to 334,000 and are down a yearly 18.7 percent. Completions here are also positive, up 19.4 percent to a 424,000 rate.

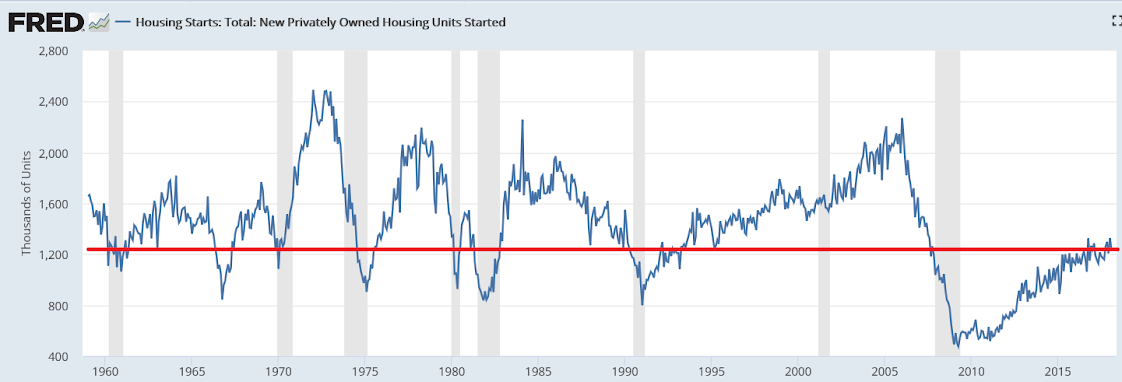

Besides completions, another positive is homes under construction, up fractionally to 1.115 million which is a new expansion high. But the bulk of this report is unexpectedly soft and confirms that the housing sector, despite strong year-end momentum and a very strong jobs market, opened 2018 on the defense, getting no help from rising mortgage rates which are at 4 year highs.

Up to the lows of 1960…

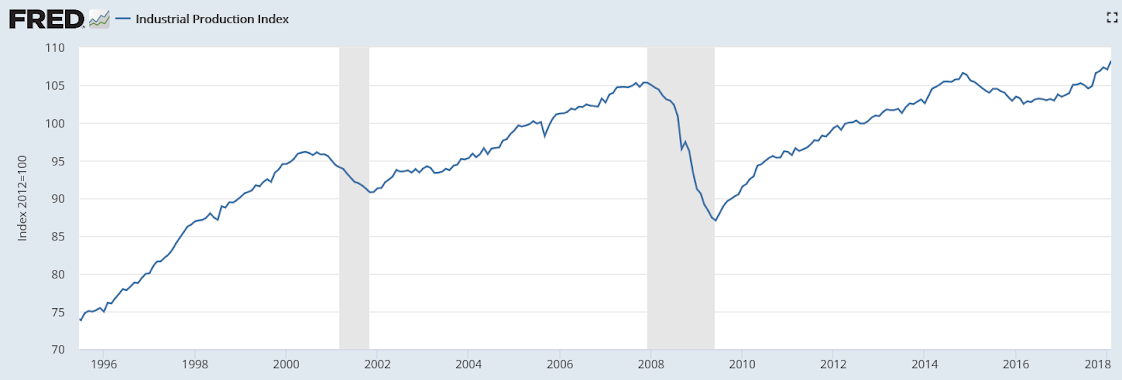

Chugging along at modest rates of growth, and up only 3% from 2008 peak: