Q4 worse than expected and prior quarter revised lower, which means downward GDP revisions: Highlights The current-account deficit increased to a roughly as-expected 8.2 billion in the fourth quarter vs the third quarter’s slightly revised 1.5 billion deficit which benefited from .9 billion in hurricane-related insurance payments. As a percentage of GDP, the fourth-quarter deficit rose to a still moderate 2.6 percent from the prior quarter’s 2.1 percent. Fourth-quarter details include a swelling in the goods deficit, reflecting rising imports of industrial supplies and consumer goods, and also a deepening deficit in secondary income, here reflecting a decrease in U.S. government transfers. Notice how they’ve gone flat:

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

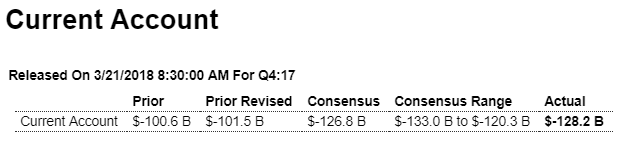

Q4 worse than expected and prior quarter revised lower, which means downward GDP revisions:

Highlights

The current-account deficit increased to a roughly as-expected $128.2 billion in the fourth quarter vs the third quarter’s slightly revised $101.5 billion deficit which benefited from $24.9 billion in hurricane-related insurance payments. As a percentage of GDP, the fourth-quarter deficit rose to a still moderate 2.6 percent from the prior quarter’s 2.1 percent.

Fourth-quarter details include a swelling in the goods deficit, reflecting rising imports of industrial supplies and consumer goods, and also a deepening deficit in secondary income, here reflecting a decrease in U.S. government transfers.

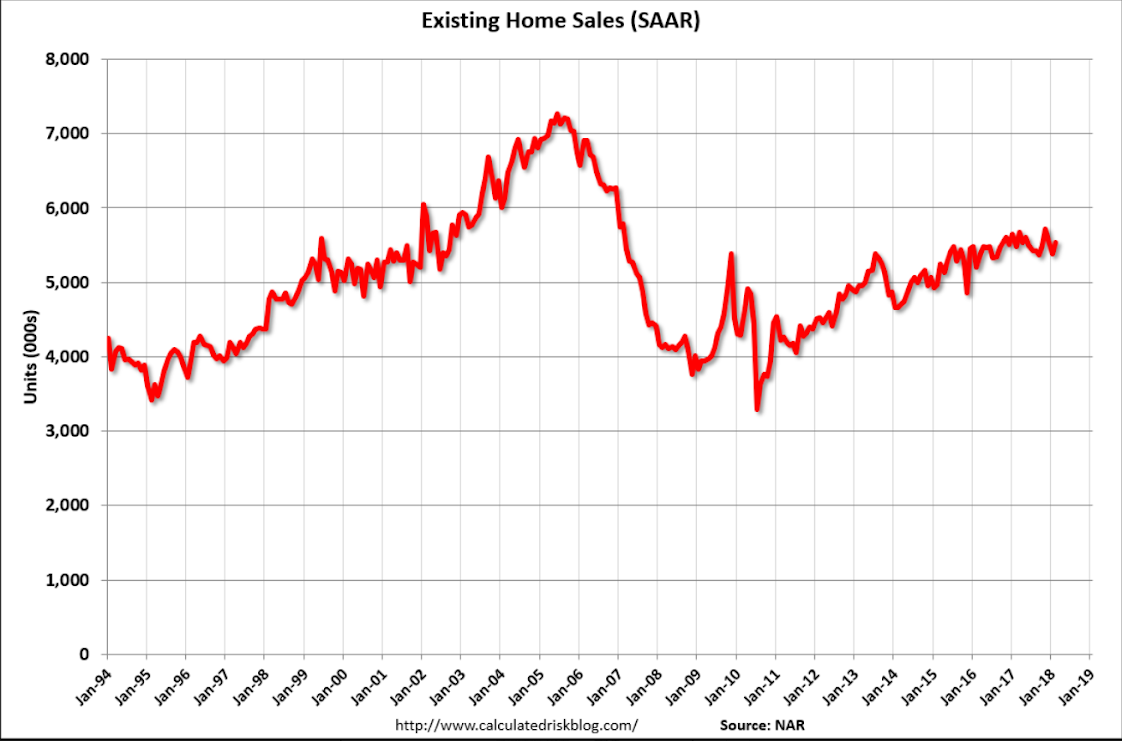

Notice how they’ve gone flat: