Summary:

By New Deal democrat February update: real wages and real spending Now that we have February inflation, let’s take an updated look at real wages and real spending. First of all, real average hourly wages increased slightly in February, but are still -0.6% under their July peak: But, because the total hours worked surged so much in February, real aggregate wage earnings, which had stalled since July, rose to a new record: If it’s not revised away, this means that the middle and working classes have more income to spend, without dipping more into savings. Turning to retail spending, real retail sales declined for the third month in a row: But note that the big surge in sales from November has been untouched, and means that real retail

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

By New Deal democrat February update: real wages and real spending Now that we have February inflation, let’s take an updated look at real wages and real spending. First of all, real average hourly wages increased slightly in February, but are still -0.6% under their July peak: But, because the total hours worked surged so much in February, real aggregate wage earnings, which had stalled since July, rose to a new record: If it’s not revised away, this means that the middle and working classes have more income to spend, without dipping more into savings. Turning to retail spending, real retail sales declined for the third month in a row: But note that the big surge in sales from November has been untouched, and means that real retail

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by New Deal democrat

February update: real wages and real spending

Now that we have February inflation, let’s take an updated look at real wages and real spending.

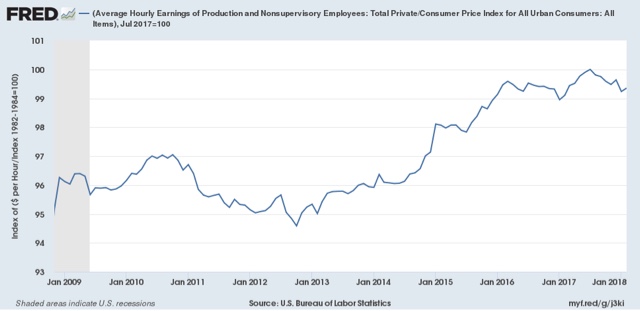

First of all, real average hourly wages increased slightly in February, but are still -0.6% under their July peak:

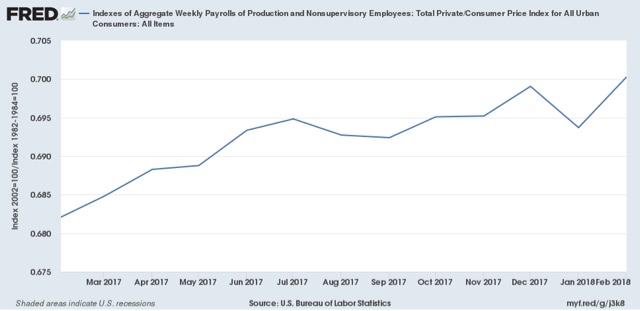

But, because the total hours worked surged so much in February, real aggregate wage earnings, which had stalled since July, rose to a new record:

If it’s not revised away, this means that the middle and working classes have more income to spend, without dipping more into savings.

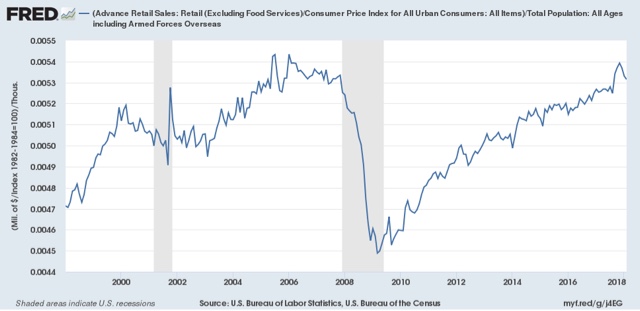

Turning to retail spending, real retail sales declined for the third month in a row:

But note that the big surge in sales from November has been untouched, and means that real retail sales remain higher than at any point before then.

This is true even if we adjust for population:

Since population-adjusted real retail sales have been a long leading indicator for the economy, I’m not terribly concerned about the recent small decline at this point.