By New Deal democrat Housing, production, and JOLTS all good news We’ve had a good run of economic news this week. First, in the leading housing sector, both of the most important datapoints made new highs. Single family permits, which are just as leading as permits overall, but much less volatile, made yet another post-recession high. Further, the three month rolling average of housing starts, which are more volatile and a little less leading, but represent actual economic activity, also made a new post-recession high: The headline number for industrial production for February was flat, but once again that was due to the seasonally-adjusted big decline in utility production due to a very warm February (sure glad that global warming is a hoax perpetrated by the international scientific community).

Topics:

Dan Crawford considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by New Deal democrat

Housing, production, and JOLTS all good news

We’ve had a good run of economic news this week.

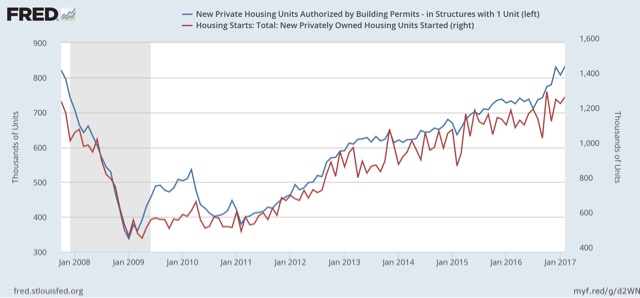

First, in the leading housing sector, both of the most important datapoints made new highs. Single family permits, which are just as leading as permits overall, but much less volatile, made yet another post-recession high. Further, the three month rolling average of housing starts, which are more volatile and a little less leading, but represent actual economic activity, also made a new post-recession high:

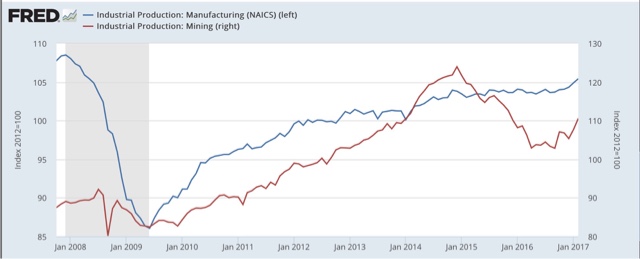

The headline number for industrial production for February was flat, but once again that was due to the seasonally-adjusted big

decline in utility production due to a very warm February (sure glad that global warming is a hoax perpetrated by the international scientific community). Manufacturing output rose to another new post-recession high (although, to be fair, still below its peak from one decade ago), and mining output continues its big bounce off last year’s bottom:

Finally, for once we got a truly good JOLTS report (for January), showing that the quits rate rose to a post-recession high that also equalled its high (save for one month) during the Bush expansion:

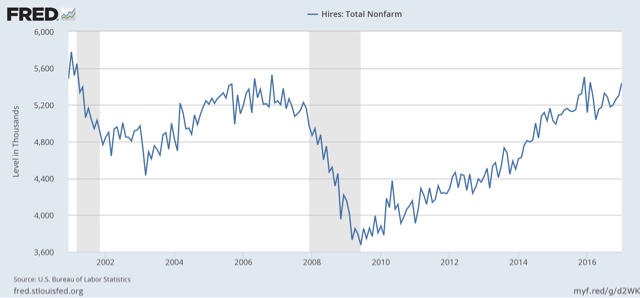

and actual hires (as opposed to the overrated and somewhat fictitious openings) also rose, although not quite to a new post-recession high:

Not perfect, but really good news on a number of fronts representative of the Indian Summer of this expansion.