Gas prices on verge of turning negative YoY There are two important aspects to the inflation rate right now. One, as Dean Baker reminds us today, is that most of core inflation has been caused by housing, via “owners equivalent rent.” Take that out, and inflation is only 1%: The second important aspect is that almost all the variation in headline inflation is due to the price of gas. At the beginning of this year, I thought one of the big issues would be whether gas prices would continue to increase off their January 2016 bottom at a similar rate as they did last year, or whether the increase would be more subdued. We have a pretty definitive answer at least for now, and it is the latter. Here’s the graph of gas prices since the beginning of 2014: And here

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Gas prices on verge of turning negative YoY

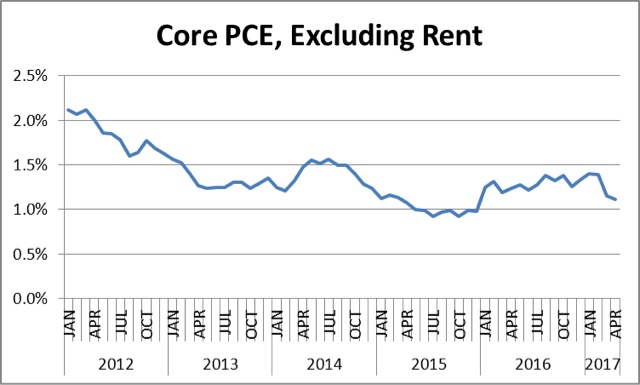

There are two important aspects to the inflation rate right now. One, as Dean Baker reminds us today, is that most of core inflation has been caused by housing, via “owners equivalent rent.” Take that out, and inflation is only 1%:

The second important aspect is that almost all the variation in headline inflation is due to the price of gas.

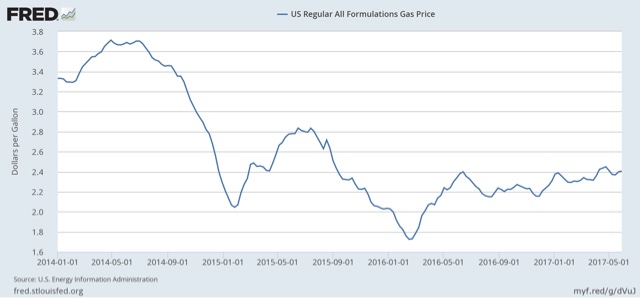

At the beginning of this year, I thought one of the big issues would be whether gas prices would continue to increase off their January 2016 bottom at a similar rate as they did last year, or whether the increase would be more subdued. We have a pretty definitive answer at least for now, and it is the latter.

Here’s the graph of gas prices since the beginning of 2014:

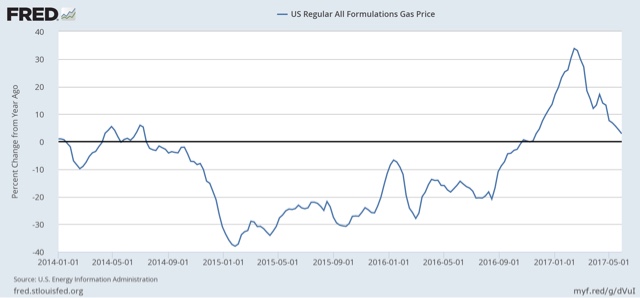

And here is the same information shown as a YoY% change:

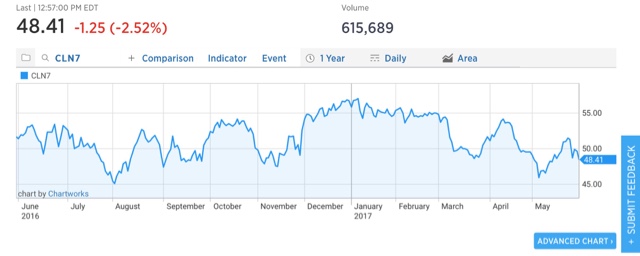

Gas prices were up less than 3% YoY as of yesterday.if the continue to go sideways for another week or so, they will actually be down YoY. This is already the case with crude oil prices:

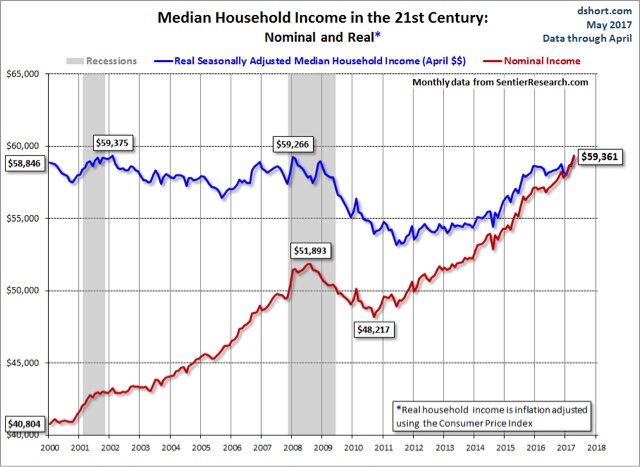

In the last few years, gas prices have made their seasonal peak in June. If we are near the peak for this year, this bodes well for a subdued inflation rate, which means it also bodes well for real wage growth and real median household income, for which here is the latest monthly report: