This is a Big Deal: housing permits and starts now a long leading negative I’ll have more to say next week, but let me just drop this right now: this morning’s housing report was a Big Deal. FRED doesn’t have the graphs yet, but here are the numbers from the Census Bureau cite. Graph of starts and permits: Note both have turned down significantly this year. Table of housing starts: The three month rolling average of starts, which smooths out the volatility, is at a 12 month low. the three month rolling average of single family starts is at a six month low. Table of housing permits: The much more stable single family permits is at the median value for the last 12 months. Total permits are at a 12 month low. In the past it has taken a decline of -175,000+ in

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

This is a Big Deal: housing permits and starts now a long leading negative

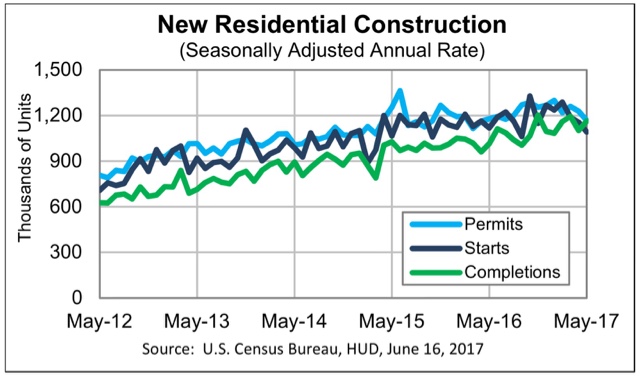

I’ll have more to say next week, but let me just drop this right now: this morning’s housing report was a Big Deal. FRED doesn’t have the graphs yet, but here are the numbers from the Census Bureau cite.

Graph of starts and permits:

Note both have turned down significantly this year.

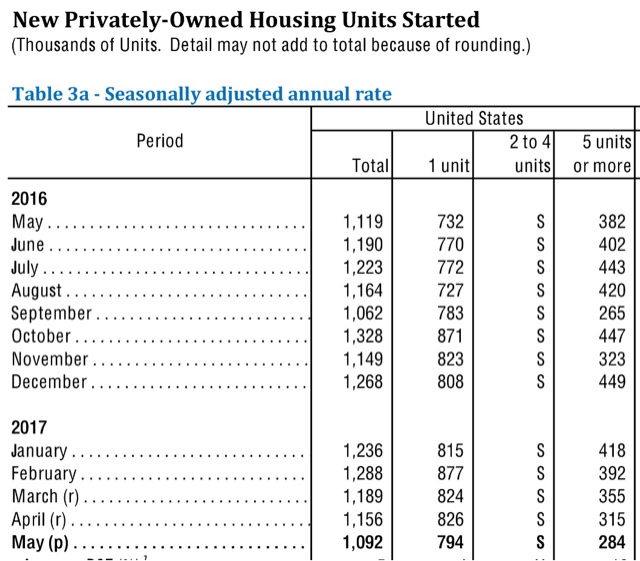

Table of housing starts:

The three month rolling average of starts, which smooths out the volatility, is at a 12 month low. the three month rolling average of single family starts is at a six month low.

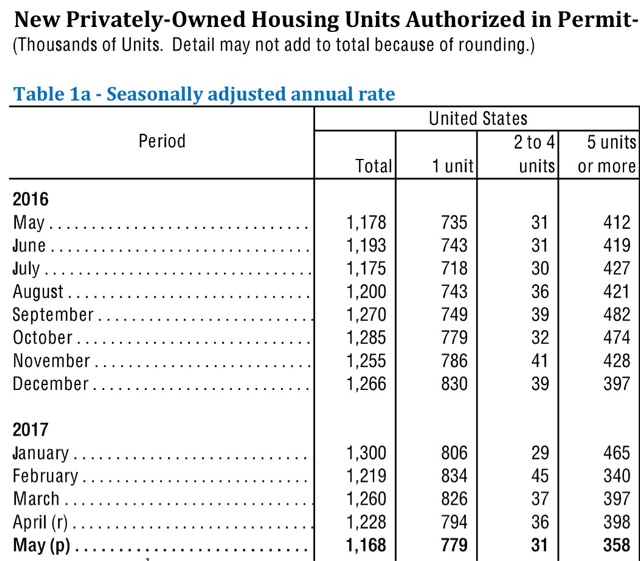

Table of housing permits:

The much more stable single family permits is at the median value for the last 12 months. Total permits are at a 12 month low.

In the past it has taken a decline of -175,000+ in permits to be consistent with the onset of recession. Today was -132,000 under January’s high.

I have been expecting a slowdown, based on the jump in interest rates since the Presidential election last November. It has clearly arrived, and it is significant enough to tip my rating of the housing market as a long leading indicator all the way to negative, pending next week’s report on single family home sales, which becomes all the more important.