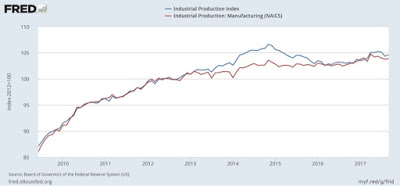

Underlying industrial production trend ex-hurricanes remains positive A few weeks ago, I suggested a hurricane workaround for industrial production. That approach was to average the four regional Fed indexes excluding Dallas, and add the Chicago PMI, and finally discount for the unusual strength this year in these regional indexes vs. production. Here was my conclusion: The average of the 5 is 22.9. Dividing that by 5 gives us +.5. Subtracting .3 gives us +.2. We can be reasonably confident that underlying trend in industrial production in September, despite the hurricanes, has been positive. That approach was borne out yesterday when overall September Industrial Production was reported at +0.3%, with manufacturing production up +0.1% as shown in the

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Underlying industrial production trend ex-hurricanes remains positive

Here was my conclusion:

The average of the 5 is 22.9.

Dividing that by 5 gives us +.5.

Subtracting .3 gives us +.2.

We can be reasonably confident that underlying trend in industrial production in September, despite the hurricanes, has been positive.

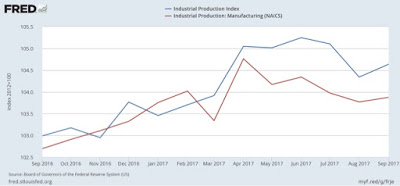

That approach was borne out yesterday when overall September Industrial Production was reported at +0.3%, with manufacturing production up +0.1% as shown in the graphs below.:

If we were to apply the same workaround for August as we did for September, however, the forecast would have been a manufacturing reading of +0.2% for that month as well. That would be enough to put us slightly above where manufacturing production was earlier this year. Indeed, the Fed suggested that but for the hurricanes, September would have been +0.25% higher.

So despite the softness in industrial production the past few months, I believe the overall trend remains slightly positive and not suggestive of any underlying downturn in the economy.

— From Bonddad

Something to remember about industrial production is that, this cycle, it is the weakest coincident indicator. Consider the following two charts: