On JOLTS, I continue to dissent The only two significant items of data in the second week of the month typically had been the JOLTS report and the Labor Market Conditions Index. I say, “had been” because the Fed has discontinued reporting the LMCI. Here’s their explanation: Although the LMCI was reconstructed back 50 years, it was only published in real time for the last few. I am disappointed. Even if the Fed believes the LMCI was not giving them the accurate information they were looking for, I wish they had at least continued to publish it in real time for one full economic cycle, because it may have given other valuable information — e.g., being a valid long leading indicator for the economy as a whole — that wasn’t on their radar. Turning to

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

On JOLTS, I continue to dissent

The only two significant items of data in the second week of the month typically had been the JOLTS report and the Labor Market Conditions Index.

I say, “had been” because the Fed has discontinued reporting the LMCI. Here’s their explanation:

Although the LMCI was reconstructed back 50 years, it was only published in real time for the last few. I am disappointed. Even if the Fed believes the LMCI was not giving them the accurate information they were looking for, I wish they had at least continued to publish it in real time for one full economic cycle, because it may have given other valuable information — e.g., being a valid long leading indicator for the economy as a whole — that wasn’t on their radar.

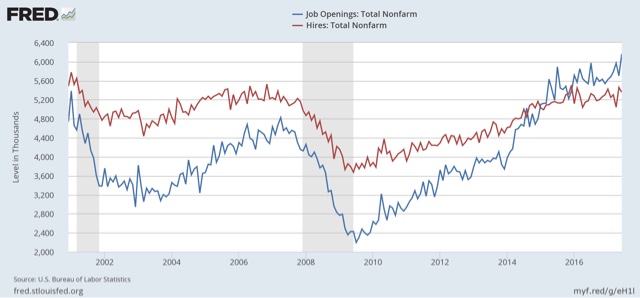

Turning to JOLTS, I have been a dissenter about this data series for the last year. The typical commentator has focused on job openings, which have been trending higher strongly (as they did in today’s report for June):

Thus even Bill McBride calls today “another strong report.”

But openings are the one aspect of the report that are not “nard” data. They can just as easily be skewed by employers trolling for resumes, perhaps laying the groundwork for visas for cheap immigrant labor, or simply refusing to offer the wage or salary that would call forth enough actual applicants to hire. Hence the disconnect between “openings” and “hires.”

Rather, I prefer to focus on the “hard” data series such as hires, quits, and layoffs. And here, the story hasn’t been nearly so strong.

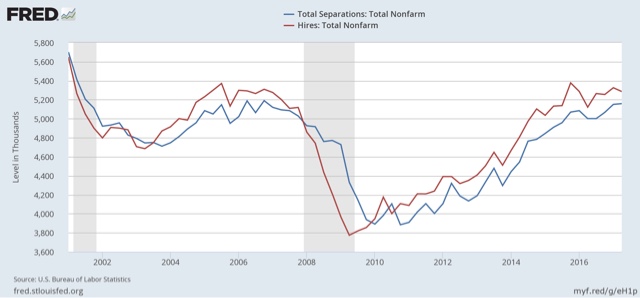

Let me start by comparing hires to total separations (averaged quarterly to cut down on noise):

We only have one full business cycle to compare, but since the outset of the series at the start of the Millennium, the trend has been for hires to slightly lead separations. And hires have been stagnant for going on 2 years.

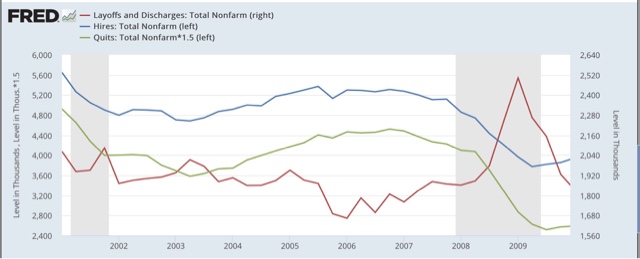

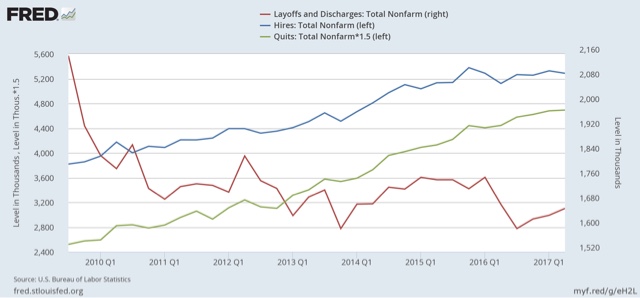

Let’s compare hires with voluntary quits and also layoffs and discharges. Here we see that in the last cycle, hires stagnated, and shortly thereafter involuntary separations began to rise, even as quits continued to rise for a short period of time as well:

And here is the current cycle:

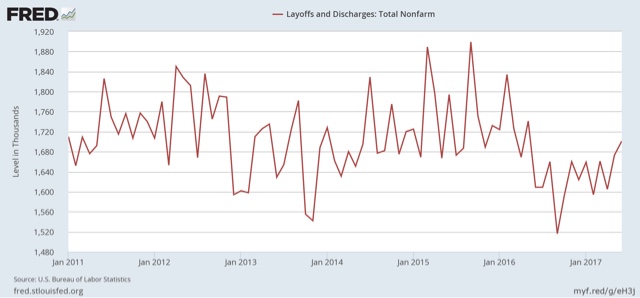

Once again, hires have stagnated. Perhaps even more significantly, even while quits have continued to rise, involuntary separations bottomed a year ago, and have risen on a quarterly basis ever since. In fact, on a monthly basis June’s level of layoffs was the highest in over a year:

Although FRED can’t show it, the three month rolling average of layoffs is also at a 12 month high.

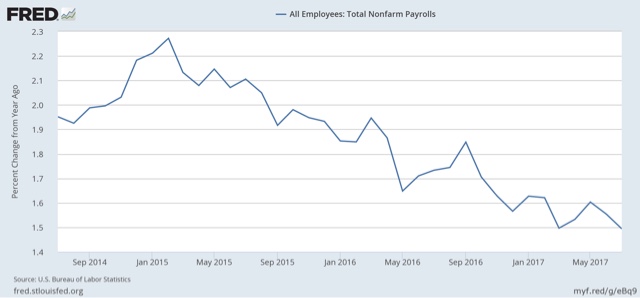

In short, despite the strong payrolls numbers of the last few months, JOLTS shows an employment situation that has been slowly decaying. And by the way, the same thing is shown in the YoY change in payrolls:

So I continue to dissent. I do not believe the JOLTS reports show strength, but rather have gradually trended weaker, even if they do not portend any imminent economic downturn.