No, record job openings in JOLTS do not mean that everything is Teh Awesome! Once again most of the commentary on yesterday’s JOLTS report for April was that job openings jumped, so everything is Teh Awesome! To recap one more time… In the one and only complete business cycle that we have for this data: First, hires peaked. They started a long plateau in 2005, making a 3 month peak in late 2005, with no meaningful progress thereafter. Second, quits peaked. They started to plateau in early 2006, making a 3 month peak in spring 2006, with no meaningful progress thereafter. Finally, openings peaked in Q1 2007 Hires and quits are the only *hard* economic data in the series. “Openings” can be aspirational trolling for a future bank of resumes or, worse, designed

Topics:

NewDealdemocrat considers the following as important: Journalism, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

NewDealdemocrat writes Constitutional Interregnum

No, record job openings in JOLTS do not mean that everything is Teh Awesome!

Once again most of the commentary on yesterday’s JOLTS report for April was that job openings jumped, so everything is Teh Awesome!

< Sigh >

To recap one more time…

In the one and only complete business cycle that we have for this data:

- First, hires peaked. They started a long plateau in 2005, making a 3 month peak in late 2005, with no meaningful progress thereafter.

- Second, quits peaked. They started to plateau in early 2006, making a 3 month peak in spring 2006, with no meaningful progress thereafter.

- Finally, openings peaked in Q1 2007

Hires and quits are the only *hard* economic data in the series. “Openings” can be aspirational trolling for a future bank of resumes or, worse, designed to fail and lay the groundwork for cheap H1-B foreign slaves.

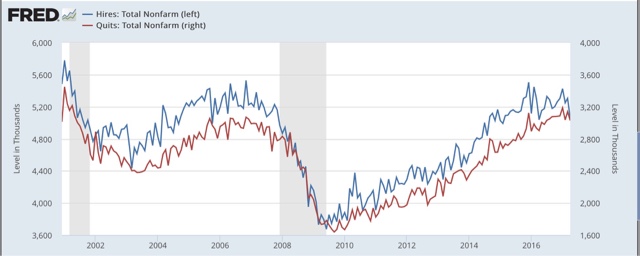

So, here is the entire history of hires and quits:

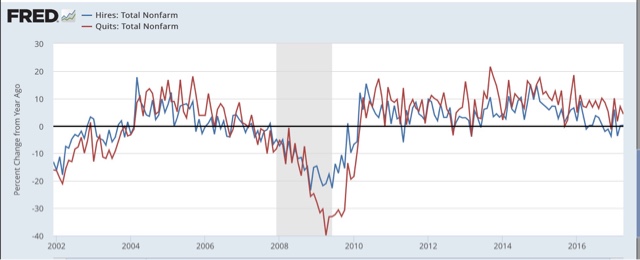

Noisy, but it sure looks like both have established plateaus again. Here’s the YoY look:

Hires are flat YoY, and quits have decelerated from roughly +10% to +5%.

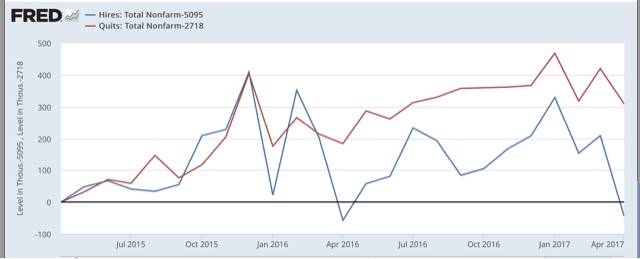

Here’s the close-up of monthly data for the last 24 months, with both hires and quits set to “zero” for April 2015:

Hires made a peak in December 2015, and are actually lower now than they were 24 months ago. Quits recently peaked in January. Beginning next month, they are going to have much more difficult YoY comparisons. For example Quits in April were only 1% higher than 11 months ago in last May.

The pattern looks very much like 2006.

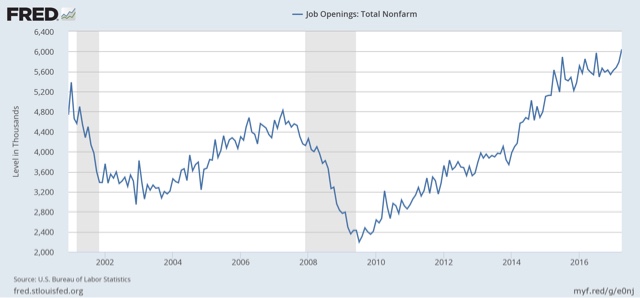

Finally, here are job openings:

New record! Whoop-de-doo. At least we aren’t in the equivalent of mid or late 2007.

The good news is, there is nothing in April’s JOLTS data suggesting any imminent economic downturn. The bad news is, it adds to the accumulating evidence of late cycle deceleration in the jobs market.