A belated Happy Thanksgiving and a note about the Index of Leading Indiators The past few days have been spent entertaining and gorging on turkey et al., so I haven’t been posting, but there wasn’t much in the way of economic data, so really nothing has been missed. I hope you, your family, and your loved ones had a happy Thanksgiving! One item that did get reported on Wednesday worth a quick mention was the Conference Board’s Index of Leading Indicators, up +0.1%. Here’s what the monthly readings look like over the last two years since the last Presidential election (h/t Briefing.com): Note the huge spike in October of last year, that was just replaced YoY, and the continued readings above +0.6% through February with the exception of one month. Sine

Topics:

NewDealdemocrat considers the following as important: US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

A belated Happy Thanksgiving and a note about the Index of Leading Indiators

The past few days have been spent entertaining and gorging on turkey et al., so I haven’t been posting, but there wasn’t much in the way of economic data, so really nothing has been missed. I hope you, your family, and your loved ones had a happy Thanksgiving!

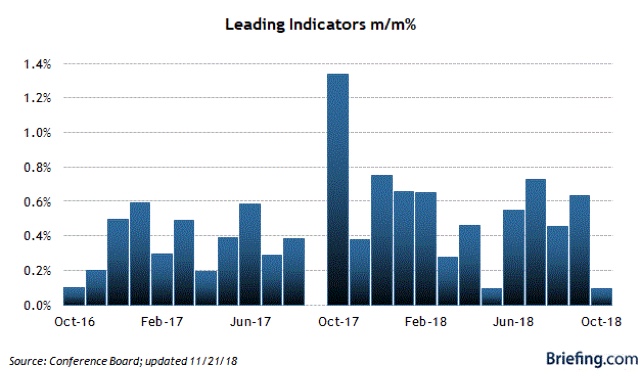

One item that did get reported on Wednesday worth a quick mention was the Conference Board’s Index of Leading Indicators, up +0.1%. Here’s what the monthly readings look like over the last two years since the last Presidential election (h/t Briefing.com):

Note the huge spike in October of last year, that was just replaced YoY, and the continued readings above +0.6% through February with the exception of one month. Sine the LEI forecast about 6 to 8 months ahead, that is consistent with the strong growth we’ve had generally throughout this year.

While the readings are certainly still positive, they have decelerated since then, and are more on the order of what we saw earlier in 2016. In short, they’re forecasting somewhat slower growth in the first half of next year. They’re not quite at the point of validating – or not – my forecast of a significant slowdown about next summer.