A business cycle theory of labor force participation and wage growth I’ve devoted a lot of time and thought, and typed a lot of pixels of commentary, about wage growth in the last few years. Some of it has panned out: based on past expansions,I expected YoY wage growth to bottom consistent with an unemployment rate of about 6%. A little later I refined that to an underemployment rate of 9%. In retrospect that is indeed about when wage growth bottomed out in this expansion. But even three years ago, I expected wage growth to rather quickly reach 3% YoY once that level of underemployment was breached to the downside. Obviously, that didn’t happen. Rather than ignore the call that didn’t pan out, I have tried to understand why. One important part is the

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

A business cycle theory of labor force participation and wage growth

But even three years ago, I expected wage growth to rather quickly reach 3% YoY once that level of underemployment was breached to the downside. Obviously, that didn’t happen.

Rather than ignore the call that didn’t pan out, I have tried to understand why.

One important part is the changed behavioral set-points of both employers and employees. Ever since the 1980s, when unions were effectively broken, employers have found that they can get away with paying less and less to maintain employees. Those employees learned to expect less and less in the way of raises from employers. During each successive expansion, employers have tightened the screws more and more, until by now giving raises has become a taboo, where employers would rather sacrifice at the least short term profits from more production than give in to the necessity of raising pay.

But if the taboo against raising wages is a secularly increasing phenomenon, on another level I think we can still tease out a lot of information in terms of the order and direction of employment and wage trends.

To that end, I want to propose a general theory of labor force participation and wages within business cycles. To wit, at least in the modern era since 1982, the pattern has been:

1. the unemployment rate peaks, and begins to decline.

2. prime age labor force participation bottoms, and begins to rise

3. nominal wage growth bottoms, and begins to rise.

BUT…

4. If labor force participation grows too quickly, wage growth languishes.

In other words, as a recession deepens, not only are more people laid off, but an increasing number of people leave the labor force entirely. At some point, as more of the people remaining in the labor force get work, people who have been on the sidelines are drawn back into the labor force and look for work. As even a bigger share of this expanded pool of potential workers find employment, the wages needed to entice them to a job begin to rise. But sometimes the increased number of those entering the workforce causes the pool of available workers for hire to become temporarily saturated, and in that case the pressure for increased wage growth ebbs.

Now let me lay out the supporting graphs. All of these date from 1982 to the present.

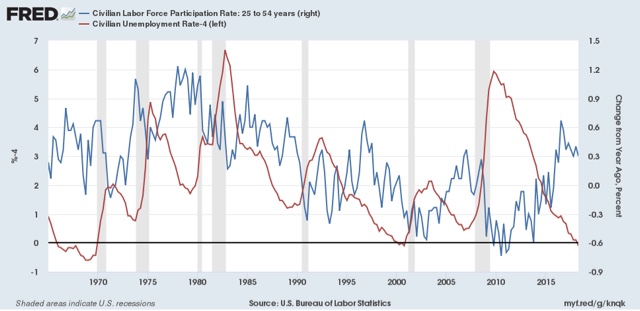

First, the unemployment rate leads prime age labor force participation:

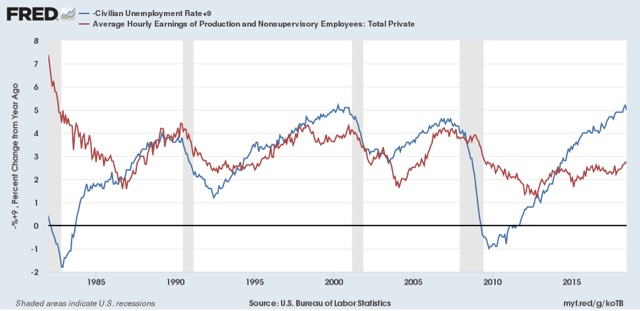

The unemployment rate (blue, inverted in the graph below) also leads wage growth:

Further, the prime age labor force force participation rate leads wage growth:

Thus, we have our progression: decreasing unemployment rate –> rising prime age participation –> increased wage growth.

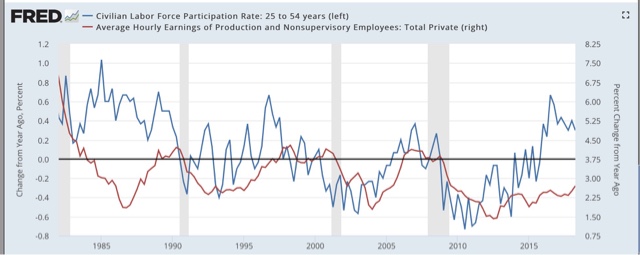

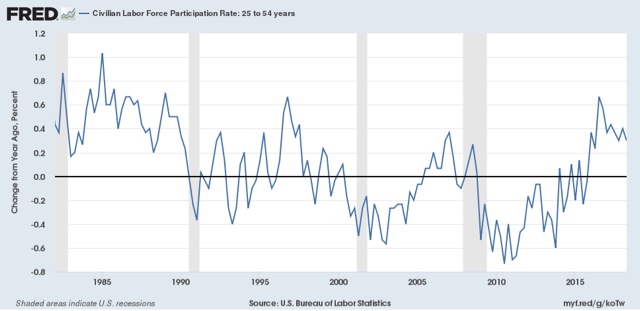

But while it seems pretty clear that, over an economic cycle, participation leads wages, within that cycle there may be waxing and waning rates of participation increase. That’s what is shown in this next graph, which shows the YoY change in the prime age labor force participation rate:

Note that the last several years have shown the sharpest growth in prime age labor force participation since the 1980s, except for 1996.

Further to the point, in the below graph, prime age labor force participation in inverted, with any YoY rate of increase greater than +0.3% showing as a negative:

We can see that when there is a surge in labor force participation, wage growth tends to wane. In the 1980s, when there was persistent growth in participation YoY over more than 0.3%, wages actually declined.

Let’s now zoom in on the last 5 years:

Prime age labor force participation has grown by more than 0.3% YoY in 22 of the last 24 months. While there has been some acceleration in wage growth during the first part of this year, it has still not hit so much as 3%.

To put my whole theory together, I think employers increasingly developing a the behavior of a taboo against raising wages (“wages are also sticky to the upside” in econospeak) is a powerful explanation of the decades’-long secular trend; while the pattern I have set forth in this post is an equally good hypothesis to explain the within-cycle behavior of labor force participation and wages over the last 35 years.