Comments on personal consumption expenditures: the September anomaly and the Fed’s 2% inflation ceiliing Let me make a few comments on yesterday’s (Aug. 30) report on personal income and spending. Well, actually, just the spending part for now. First, there is a long-time relationship going back 60 years in the data whereby the YoY% growth in retail sales is higher in the first part of an economic expansion, and lower in the latter part, compared with wider measures of spending, such as personal consumption expenditures (PCE’s). In fact, it is so reliable it is one of my “mid-cycle” indicators. Well, it hasn’t been that way for the past year. Here’s the graph: YoY retail sales have been higher than PCE’s in the past year — and the YoY growth has

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Comments on personal consumption expenditures: the September anomaly and the Fed’s 2% inflation ceiliing

Let me make a few comments on yesterday’s (Aug. 30) report on personal income and spending. Well, actually, just the spending part for now.

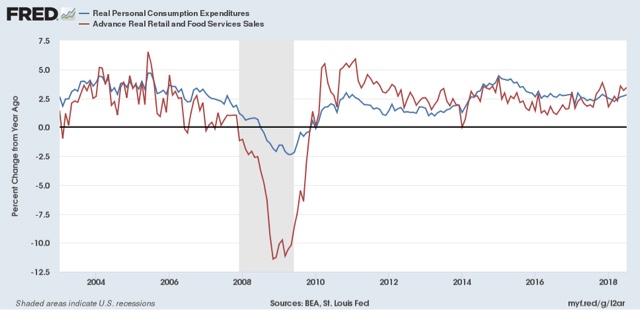

First, there is a long-time relationship going back 60 years in the data whereby the YoY% growth in retail sales is higher in the first part of an economic expansion, and lower in the latter part, compared with wider measures of spending, such as personal consumption expenditures (PCE’s). In fact, it is so reliable it is one of my “mid-cycle” indicators.

Well, it hasn’t been that way for the past year. Here’s the graph:

YoY retail sales have been higher than PCE’s in the past year — and the YoY growth has been rising. So has the economic cycle been rejuvenated?

Probably not, although the tax cut that took effect in January probably is having an effect.

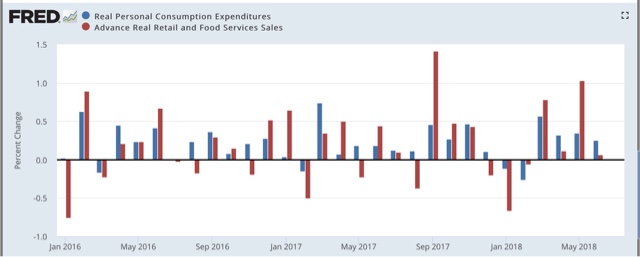

It all seems to boil down to an anomalously huge monthly surge in retail sales, even after adjusting for inflation, last September. It is easily seen in this next graph, which shows the monthly change in real retail sales (red) vs. real PCE’s (blue):

That’s a 1.4% real, inflation-adjusted increase in retail sales in just one month!

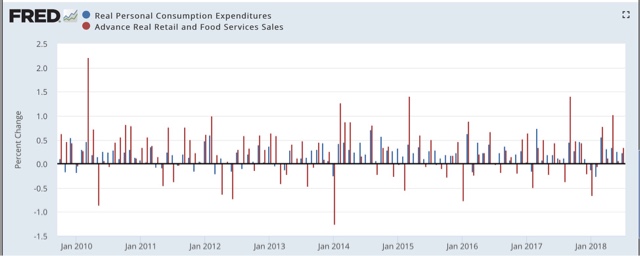

How anomalous? Well, here’s the same graph expanded back to October 2009:

Only three other months are comparable (1.0% or above), and only one of them, at the beginning of the expansion, is significantly larger.

The suspicion has been that the spike in spending was due to the hurricanes along the Gulf Coast and perhaps also the California wildfires. If that’s true, then in two months we’ll see that spike drop out of the YoY comparisons, and the normal long-term relationship between retail sales and PCE’s should assert itself. We’ll see.

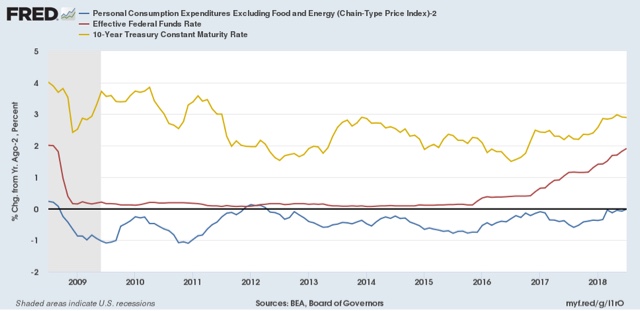

A second point I want to make is about the Fed’s asymmetric 2% inflation “target.” In practice, it is actually a ceiling. We had a report by the Fed staff earlier this week warning that if they don’t move to increase rates now, inflation could get out of control.

Well, core PCE’s are the Fed’s favorite inflation metric. They are shown in blue in the graph below, which subtracts 2%, so that 2% YoY core PCE inflation is at the zero line:

I want to call your attention to two things. First, the gold line is the 10 year Treasury rate. Note than in mid-2013 it spiked from roughly 1.5% to 3%. That was the “taper tantrum,” when the Fed announced it was going to taper off its quantitative easing. This occurred with core PCE growing at less than 1.5%. Second, the red line is the Fed funds rate. The Fed started raising rates with core PCE’s running only a little over 1%.

In other words, despite the fact that core PCE inflation running significantly below the Fed’s alleged “target,” it stopped easing and started tightening. Now that it has arrived at their “target,” they are talking about the need to tighten more aggressively to prevent inflation.

You know, in things like workers’ wages.

That’s a ceiling, not a target. And if anything, the asymmetric risks run the other way. But apparently the only way the Fed is going to have an “OH SHIT” moment is if there is actual wage deflation in the next recession.