Summary:

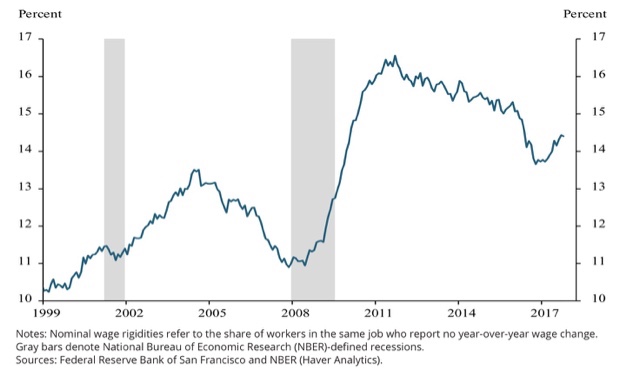

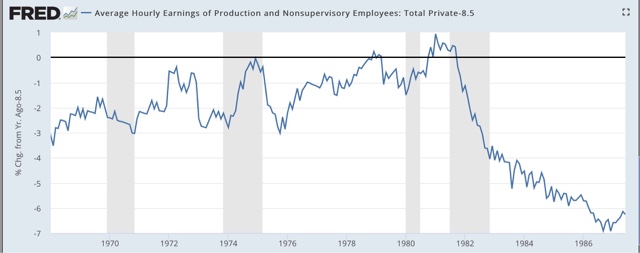

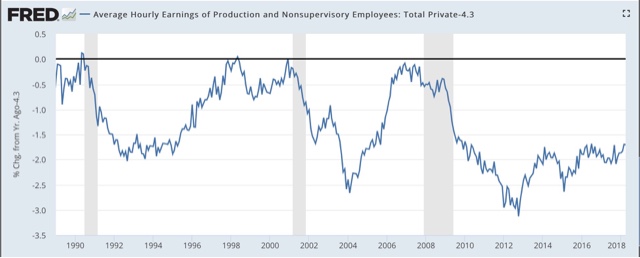

More evidence of increasing deflationary pressure on wages One of my pet peeves is that economics as a discipline needs to import the entirety of learning theory from psychology, not just parlor tricks like the endowment effect. For example, learning from models. To wit, once Jack Welch was successful in using a pay scheme at GE that ensured that a given percentage of employees would not get a raise in any given year, it was inevitable that other employers who adopt the idea until it spread throughout corporate America. And it not giving raises to a certain percentage of employees was successful, why not implement it across the board with *all* employees? Monkey see, monkey do. As I noted several weeks ago, even though we are at least closing in on

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

More evidence of increasing deflationary pressure on wages One of my pet peeves is that economics as a discipline needs to import the entirety of learning theory from psychology, not just parlor tricks like the endowment effect. For example, learning from models. To wit, once Jack Welch was successful in using a pay scheme at GE that ensured that a given percentage of employees would not get a raise in any given year, it was inevitable that other employers who adopt the idea until it spread throughout corporate America. And it not giving raises to a certain percentage of employees was successful, why not implement it across the board with *all* employees? Monkey see, monkey do. As I noted several weeks ago, even though we are at least closing in on

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada