Summary:

A US economic Boom in 2018?

For the last several years, I have tried to identify several graphs that most bear watching over the ensuing 12 months. This year, in addition to watching bond yields like everybody else, the data that most bears watching, it seems to me, can be summed up in the question: Is the US economy about to enter a Boom?

The recent economic news has almost all been good. In particular the unemployment rate has dropped as low as 4%. Meanwhile, the GOP certaionly believes — I most certainly don’t — that the recent tax changes are going to unleash a torrent of Capex spending and wage increases (as opposed to mergers, acquisitions, stock buybacks and executive pay bonanzas).

So, is the economy on the verge of firing on all cylinders?

Topics:

NewDealdemocrat considers the following as important:

US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

For the last several years, I have tried to identify several graphs that most bear watching over the ensuing 12 months. This year, in addition to watching bond yields like everybody else, the data that most bears watching, it seems to me, can be summed up in the question: Is the US economy about to enter a Boom?

The recent economic news has almost all been good. In particular the unemployment rate has dropped as low as 4%. Meanwhile, the GOP certaionly believes — I most certainly don’t — that the recent tax changes are going to unleash a torrent of Capex spending and wage increases (as opposed to mergers, acquisitions, stock buybacks and executive pay bonanzas).

So, is the economy on the verge of firing on all cylinders?

There is no standard definition of a Boom. But since I am a fossil, in my lifetime I have experienced two times when it certainly felt like the economy was working extremely well and on a very broad basis: the 1960s and the late 1990s tech era. The “good times” feeling of both eras was palpable. Employment was rampant and average people felt that their situations were going well.

What distinguished those to eras from all the other economic expansions? I found five markers that stand out, and two that, oddly, didn’t.

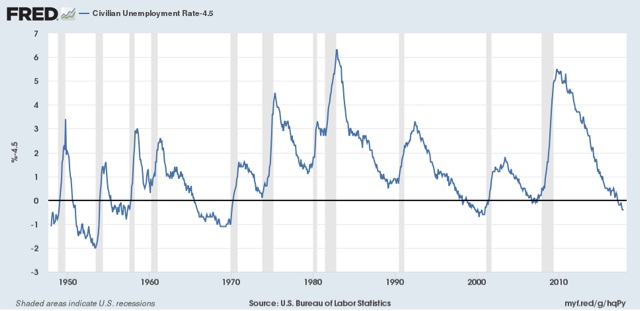

Let’s start with the first marker: the unemployment rate (note that the U6 underemployment rate wasn’t reported in its current configuration until 1994, and so is not helpful). In both the 1960s and the late 1990s, the unemployment rate hit 4.5% or below for extended periods of time:

While these weren’t the only two periods of low unemployment, they are among those that stand out, in particular vs. the 1970s and 1980s, none of which expansions hit such a low mark.

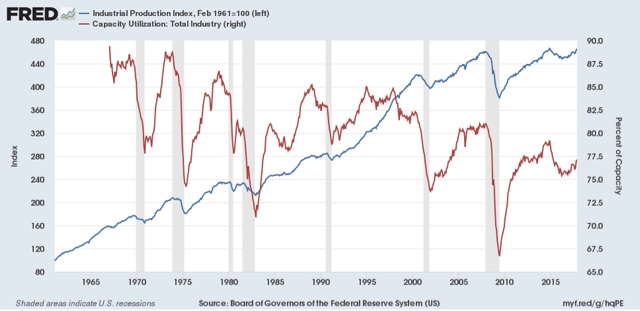

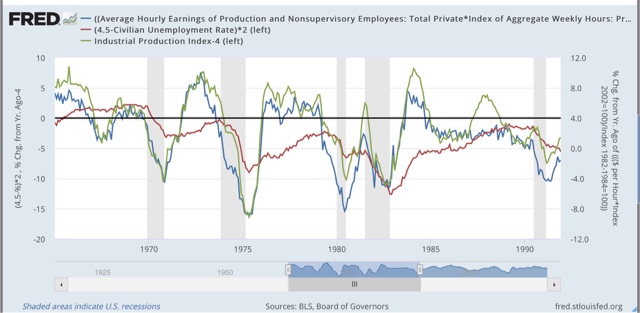

Now let me examine the two markers that didn’t make the cut. You would think that industrial production and capacity utilization would be making strong new peaks during Booms vs. other expansions. But that isn’t the case. industrial production (blue, left scale below) has made new peaks during each expansion, while capacity utilization (red, right scale) has been relentlessly declining:

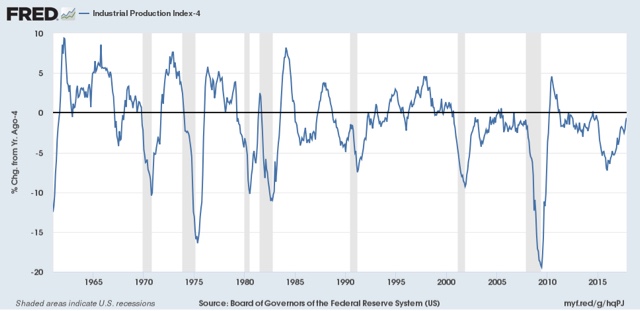

What does stand out at least somewhat is the duration and rate at which industrial production grew during both Booms. During both the 1960s and 1990s, production grew at or over 4% a year for extended periods of time, not just right after the end of a recession

So the rate of growth of industrial production is the second marker of a Boom.

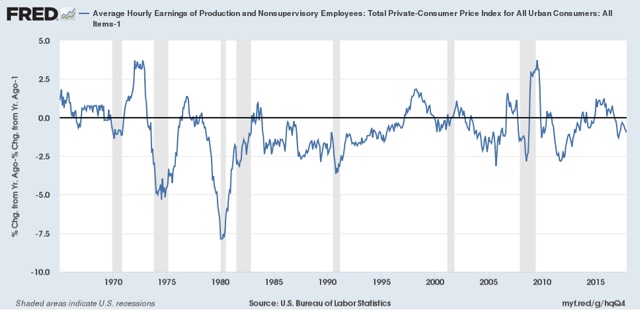

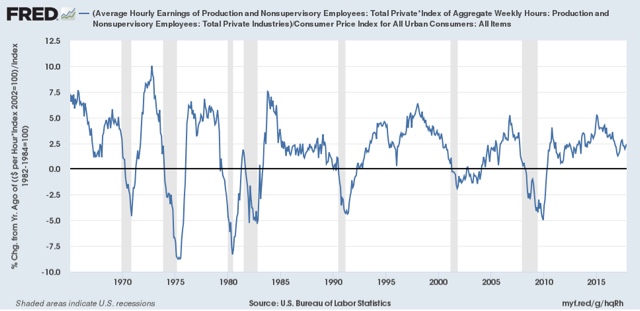

The third and fourth markers iare the rate of growth of real average earnings for non-managerial employees, both individually and in the aggregate. During the two Booms, in contrast to other expansions, real average hourly earnings also grew at roughly 1% YoY or better:

Meanwhile, real aggregate earnings grew at a rate of 4% YoY or better:

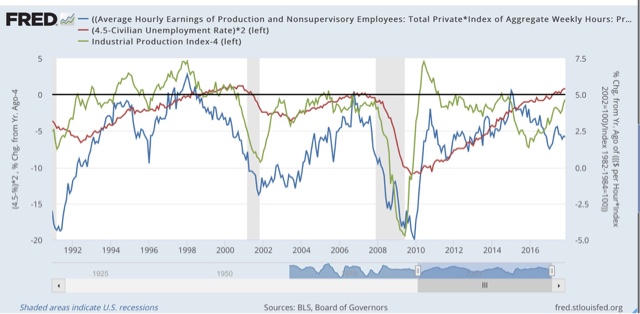

Here’s what three of those markers look like when put together in one graph:

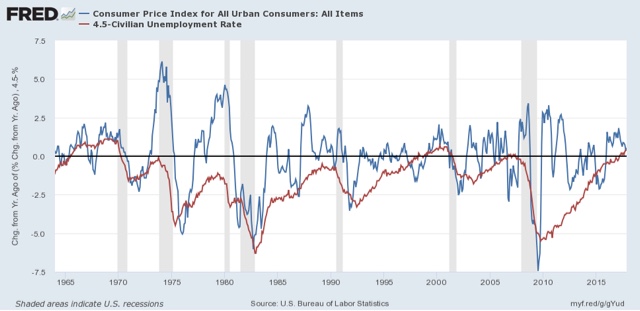

The fifth and final marker of a Boom — probably as the byproduct of the first four — is an increase in the YoY rate of inflation:

So, to summarize, when they occur together, the five markers of an economic Boom are the following:

1. An unemployment rate under 4.5%

2. YoY industrial production growth of at least 4%

3. YoY real wage growth of at least 1%

4. YoY real aggregate wage growth of at least 4%

5. Increasing YoY inflation.

As we begin 2018, only the first and last markers are present: we have low unemployment, and at least temporarily, the YoY inflation rate is higher than it was a year ago. But industrial production is not growing as fast as either of the last two Booms, and real wage growth has continued to be lackluster.

Based on my lieffetime experience, while the US economy is currently doing pretty well in general, it is not anywhere near a Boom, at least not yet.

I’ll continue to track these indicators during 2018.