The US economy did not boom in 2018 At the beginning of each year, I try to identify economic series that I think will be most important in the next 12 months. This year I asked: Is the US economy going to enter a Boom in 2018? There is no standard definition of a Boom. But in my lifetime there have been two occasions when the “good times” feeling was palpable, and the economy was working extremely well on a very broad basis: the 1960s and the late 1990s tech era. During both times, employment was rampant and average people felt that their situations were going well. Back in January I identified five markers that, taken together, marked off the two eras as unique: the low unemployment rate the duration of a very good rate of growth of

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

The US economy did not boom in 2018

At the beginning of each year, I try to identify economic series that I think will be most important in the next 12 months. This year I asked: Is the US economy going to enter a Boom in 2018?

There is no standard definition of a Boom. But in my lifetime there have been two occasions when the “good times” feeling was palpable, and the economy was working extremely well on a very broad basis: the 1960s and the late 1990s tech era. During both times, employment was rampant and average people felt that their situations were going well.

- the low unemployment rate

- the duration of a very good rate of growth of industrial production

- strong growth in real average hourly wages

- strong growth in real aggregate hourly wages, and

- increasing inflation.

Now that the year is ending, let’s update all of these.

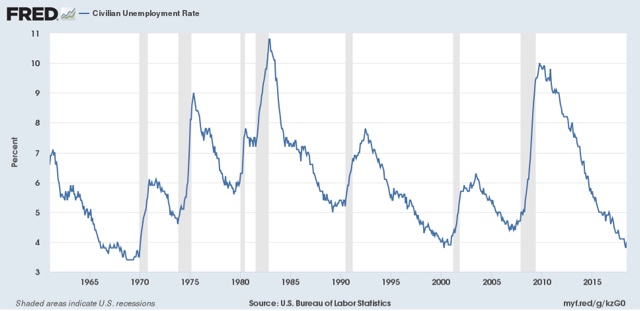

1. Unemployment remains very low

In both the 1960s and late 1990s, the unemployment rate (note that the U6 underemployment rate wasn’t reported in its current configuration until 1994, and so is not helpful), hit 4.5% or below for extended periods of time:

While these weren’t the only two periods of low unemployment, they are among those that stand out.

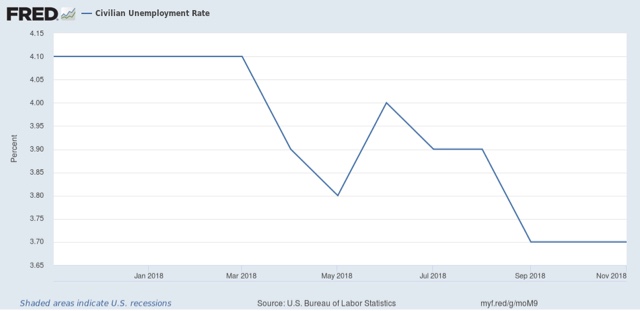

We had already hit that marker at the beginning of the year, and through the course of the year, it has only improved:

The unemployment rate is now the lowest in 48 years, since 1970.

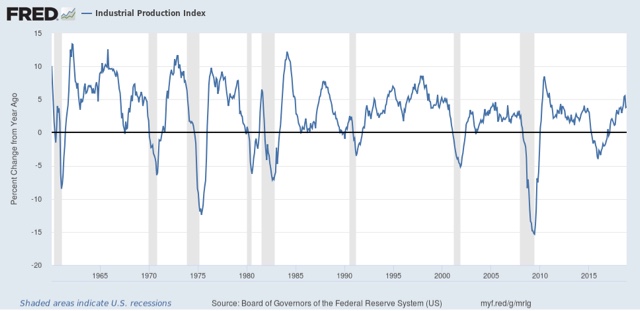

2. Industrial production did briefly boom, but has backed off.

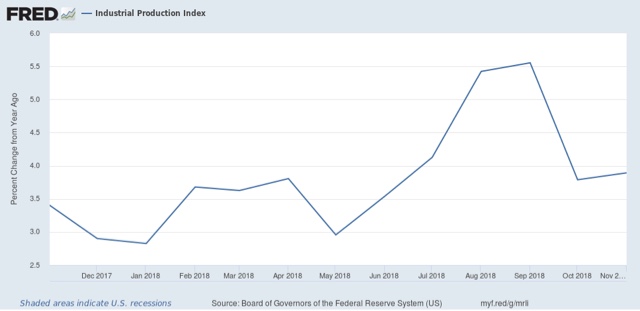

During both the 1960s and 1990s, production grew at or over 4% a year for extended periods of time, not just right after the end of a recession. At the beginning of this year, production was under 4%:

It did surge above 4% during the three months of the third quarter, but for the last two months YoY growth in industrial production is back below 4%:

3. Real average hourly wages failed to ignite

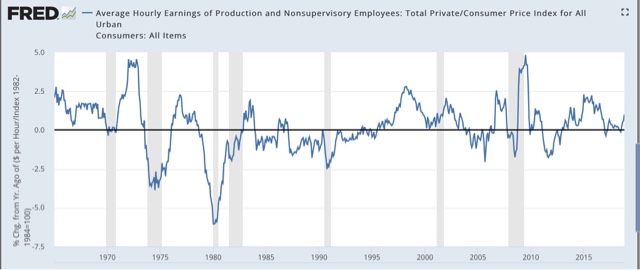

In contrast to other expansions, during the 1960s and the late 1990s, real average hourly earnings also grew at roughly 1% YoY or better, and even exceeded 2.5% growth for significant periods:

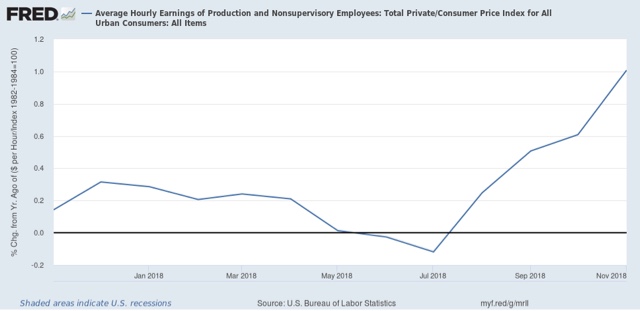

During the current expansion, by contrast, real wages have only grown by more than 1% when gas prices have declined dramatically. In 2018, the situation continued: real average hourly wages grew by no more than 0.3% YoY until the last three months, when a big decline in gas prices caused consumer inflation to subside, leading to a YoY rate of growth of exactly 1% in November:

4. Real aggregate payrolls continue to grow modestly

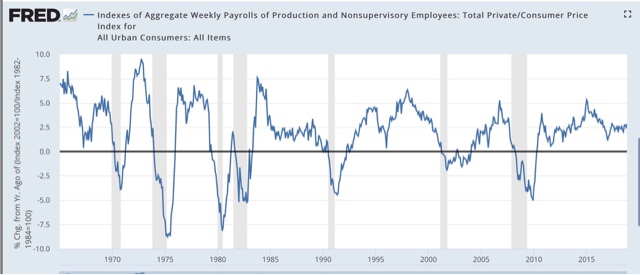

During the 1960s and 1990s booms (as well as some other expansions), real aggregate earnings grew at a rate of 4% YoY or better, for extended periods of time:

By contrast, during this expansion, and continuing this year, real aggregate payrolls have averaged growth of about 2.5% a year:

This is decent, but it’s simply not a boom.

5. Inflation has waned

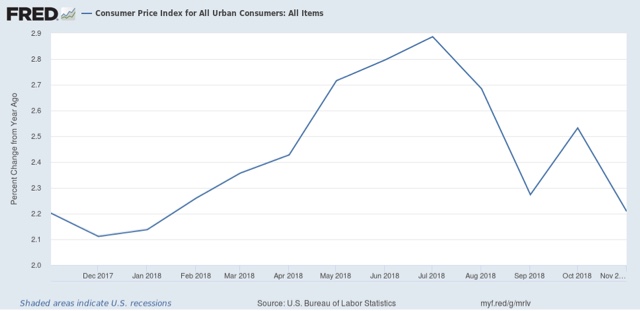

The fifth and final marker of a Boom — probably as the byproduct of the first four — is an increase in the YoY rate of inflation:

A boom means that resources are getting constrained, so bidding for them intensifies.

The rate of consumer inflation did increase throughout the first half of this year, but since July has waned, and with one month’s data left to go, is only 0.1% higher (2.2% vs. 2.1%) than the rate of inflation at the beginning of the year:

To sum up, the production side of US economy, which was doing well at the beginning of 2018, did briefly boom during the summer, but the consumer side never joined it. Only one of the five markers of a boom — low unemployment — persisted through the year. The US economy did not boom in 2018, and if anything is likely to decelerate sharply in 2019.