A note about the financial markets The markets are closed today in observation of former President George H.W. Bush’s funeral. In the meantime, let me offer a brief few observations (pontifications?) about my sense of the immediate and longer term trend. First off, here is a broad look at the last 10 years for the S&P 500 (blue, right scale) and 10 year Treasury bond (red, left scale): The moves in the bond market look exaggerated, because the values are between 1.4% at its lowest, and 4% at its highest. Basically in the last 10 years yields on the 10 year bond completed their slow decline from about 20% in 1980, then went sideways 2011 and 2017, and this year started what I suspect will be an equally long term climb (although whether they will peak

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

A note about the financial markets

The markets are closed today in observation of former President George H.W. Bush’s funeral. In the meantime, let me offer a brief few observations (pontifications?) about my sense of the immediate and longer term trend.

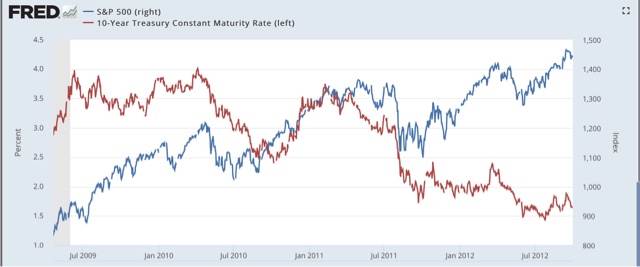

First off, here is a broad look at the last 10 years for the S&P 500 (blue, right scale) and 10 year Treasury bond (red, left scale):

The moves in the bond market look exaggerated, because the values are between 1.4% at its lowest, and 4% at its highest. Basically in the last 10 years yields on the 10 year bond completed their slow decline from about 20% in 1980, then went sideways 2011 and 2017, and this year started what I suspect will be an equally long term climb (although whether they will peak in a few decades at 6% or 600%, I have no clue).

Meanwhile the stock market quadrupled in value (!), although with a few hiccups along the way, particularly in 2010, 2011, 2015-16, and this year.

In other words, in the past 10 years bonds paid you very little, while stocks rewarded you handsomely.

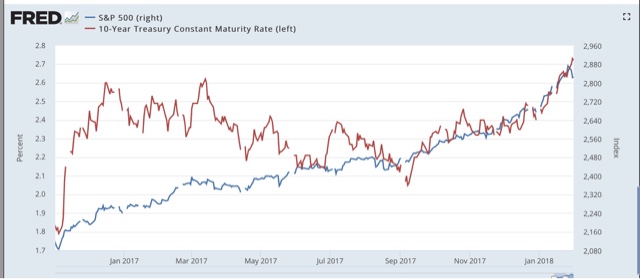

Next, let me take a look at a few of those hiccups. First, here is the 2010-11 period:

Note that on several occasions (roughly mid-2010 and mid-2011) stocks declined by roughly 10%, and bond yields declined in tandem.

The same pattern appears in October 2014 and January 2016:

This is called a “flight to safety.” Stock investors get spooked for some reason or other, and run into the relative safety of bonds. Stock prices fall, and bond prices rise, which means bond yields fall.

That’s what I think is happening at the moment. After a 40% run-up beginning immediately after the 2016 US Presidential election (20% of which was in December 2017 and January 2018 alone):

this year stocks have gone sideways in roughly a 15% range:

In the broad view, investors got too exuberant in 2017 mainly, I suspect, in anticipation of the tax cut goodies, and once the goodies took effect, realized that all of their value – and then some – was already priced in. In the close-up view, the past month looks like another “flight to safety.”

NOTE: Complete speculation alert!: Because these things tend to inflict surprise on as many people as possible, my *guess* is that the carnage will continue until roughly the moment that 2 to 10 year bond yields invert. Then, once people are sure that the end is nigh, both will reverse higher, at least temporarily ending the inversion.

Finally, what is also interesting about this year is that it appears to mark a “change of season” in the relationship between stock and bond performance. From 1981 through 1998, stock prices and bond yields generally moved in the opposite directions (stocks up, yields down). Then, from 1998 until this past January, bond yields and stock prices tended to move in the same direction — not on a daily basis, but in the longer view. This year, as the first and third graphs above show, stock prices and bond yields have again generally become mirror images of one another.

This year’s pattern (with rising bond yields) last happened in the 1950s, which was a period of “reflation,” i.e., bond yields and the YoY change in prices gradually increased. That’s another reason why I think we have started a new secular financial era.

End of observations/pontifications.