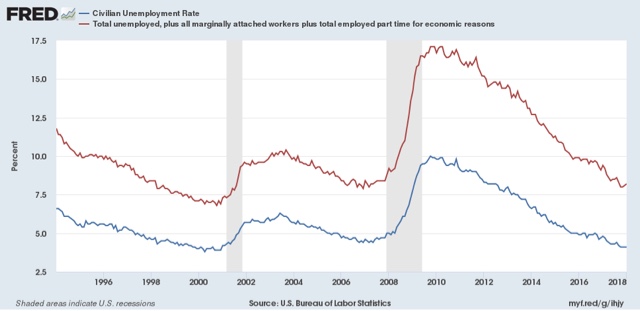

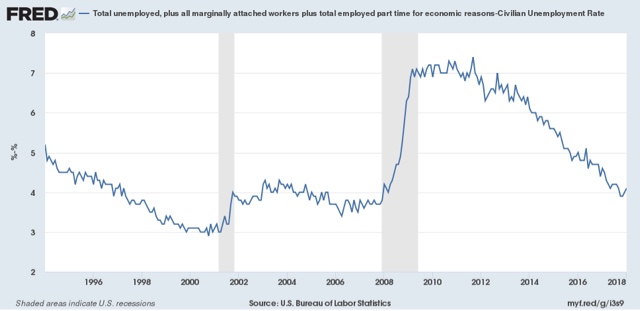

This is a post I’ve been meaning to put up all week (after all, this week was going to be very slow on data and news, right?). As the expansion gets more and more mature, the *relative* performance of certain measures of improvement become more interesting. One of those is the comparison between U3 unemployment, and the broader U6 underemployment measure. While we only have about 25 years of data, so caution is warranted, generally speaking, during that time as the expansion has improved, an increasing number of the more marginally employable find jobs. As a result, U6 declines faster than U3. Later on, as the expansion begins to wane, U6 underemployment has weakened first: Another way of looking at this is to subtract the U3 unemployment

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Once more into a the market abyss

Record low claims are the patina of policy success …. These record claims represent a bubble that was born out of and is joined at the hip with the financial engineering bubble that has been metastasizing in the US economy for a generation.

Just one problem: this quote comes from November 2015, when initial jobless claims were averaging 270,000 per week.

See the problem?

In my opinion, If you are middle or working class, and you have some money in the market via a 401k or similar, and you can’t stand a 10% downturn, then you shouldn’t be in the market at all, but rather devote that money to a cash-type of portfolio that allows you to sleep at night and not worry about your future. One rule of thumb I set for myself way back 25 years ago when I first got interested in this stuff, is what I called “the Turtle Method,” as in turtle vs. hare. That rule of thumb was that, for every month’s expenses I had saved, I could invest 1% of my assets. So if I had 10 months of savings, I could invest 10% of my total assets. That way I could sleep at night.

Bottom line: there are a lot of major problems in this country right now. How the economy is doing isn’t one of them, and that is very unlikely to change in the next 3-6 months.