Summary:

Recent increased interest rates probably won’t derail housing In the last couple of weeks, long term interest rates have moved significantly higher. As of yesterday, the 10 year bond closed at roughly 2.66%, its highest yield in 3 1/2 years. If this move is sustained for a few months, I expect it to have an effect on the housing market, but how much? Here is an updated variation on a graph I have run many times over the last 5 years: the YoY change in the 10 year treasury bond, inverted (blue), versus the YoY% change in housing permits for single family homes (green). I’ll explain the red line below: In general, the housing market responds first and foremost to interest rates. So when interest rates rise (shown as a negative YoY in the graph),

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Recent increased interest rates probably won’t derail housing In the last couple of weeks, long term interest rates have moved significantly higher. As of yesterday, the 10 year bond closed at roughly 2.66%, its highest yield in 3 1/2 years. If this move is sustained for a few months, I expect it to have an effect on the housing market, but how much? Here is an updated variation on a graph I have run many times over the last 5 years: the YoY change in the 10 year treasury bond, inverted (blue), versus the YoY% change in housing permits for single family homes (green). I’ll explain the red line below: In general, the housing market responds first and foremost to interest rates. So when interest rates rise (shown as a negative YoY in the graph),

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Recent increased interest rates probably won’t derail housing

In the last couple of weeks, long term interest rates have moved significantly higher. As of yesterday, the 10 year bond closed at roughly 2.66%, its highest yield in 3 1/2 years. If this move is sustained for a few months, I expect it to have an effect on the housing market, but how much?

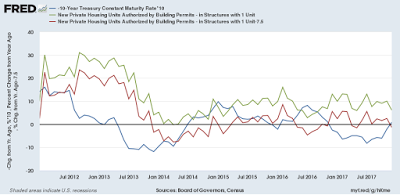

Here is an updated variation on a graph I have run many times over the last 5 years: the YoY change in the 10 year treasury bond, inverted (blue), versus the YoY% change in housing permits for single family homes (green). I’ll explain the red line below:

In general, the housing market responds first and foremost to interest rates. So when interest rates rise (shown as a negative YoY in the graph), permits historically have fallen.

But in this expansion, permits have responded by decelerating increases rather than by actual declines. A decent estimate is that the demographic tailwind of the large Millennial generation arriving at home-buying age is that it has added 7.5% growth YoY vs. what we would otherwise expect. That is what is shown by the red line in the graph above.

I still expect a few months of restrained *YoY* growth (not m/m, which has already increased to new highs) before improvement in that metric.

But the above graph does not show the uptick in rates this month, so the below is the same graph, limited to the last year, but with daily values in treasury rates:

The bottom line is that the recent increase in rates isn’t enough to derail the housing market. I suspect that rates would have to go above their 2013 high of 3.03% for that to happen.

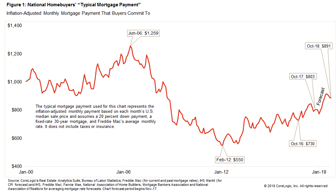

Finally, there is another factor to consider, which is monthly mortgage payments. As I pointed out several months ago, monthly mortgage payments got downright cheap at the bottom of the housing market, and still are quite reasonable compared with their 2005 highs. Here’s an update graph of real, inflation-adjusted mortgage payments from Core Logic:

This is probably also a factor in why housing has responded relatively tepidly to changes in interest rates. Especially with soaring rents and constrained supply, owning is — relative to renting — still a bargain. It will probably take another 10% increase in real monthly carrying costs for that to become at all comparable to its surge during the housing bubble.