Summary:

The simple jobs and interest rates model generates a yellow flag Several months ago, I started toying with a simple model of interest rates and job growth.* Based on the historical evidence, I suggested that: 1. a YoY increase in the Fed funds rate equal to the YoY% change in job growth has in the past almost infallibly been correlated with a recession within roughly 12 months. Figure 1 2. the YoY change in the Fed funds rate (inverted in the graph below) also does a very good job forecasting the *rate* of YoY change in payrolls 12 to 24 months out. One shortfall of that model is that there are two “false negatives” in the low interest rate environment of the 1950s, during which the YoY increases in interest rates by the Fed were relatively

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

The simple jobs and interest rates model generates a yellow flag Several months ago, I started toying with a simple model of interest rates and job growth.* Based on the historical evidence, I suggested that: 1. a YoY increase in the Fed funds rate equal to the YoY% change in job growth has in the past almost infallibly been correlated with a recession within roughly 12 months. Figure 1 2. the YoY change in the Fed funds rate (inverted in the graph below) also does a very good job forecasting the *rate* of YoY change in payrolls 12 to 24 months out. One shortfall of that model is that there are two “false negatives” in the low interest rate environment of the 1950s, during which the YoY increases in interest rates by the Fed were relatively

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

The simple jobs and interest rates model generates a yellow flag

Several months ago, I started toying with a simple model of interest rates and job growth.* Based on the historical evidence, I suggested that:

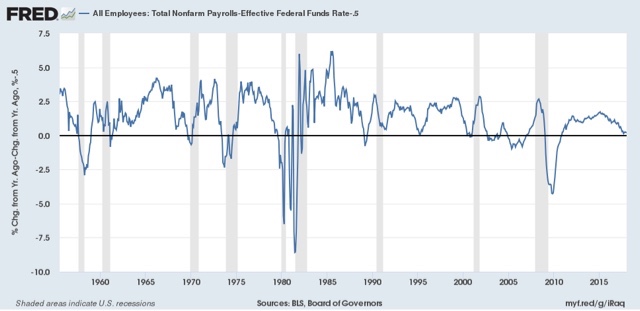

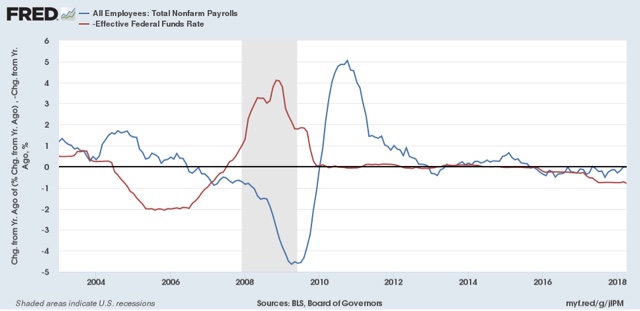

1. a YoY increase in the Fed funds rate equal to the YoY% change in job growth has in the past almost infallibly been correlated with a recession within roughly 12 months.

Figure 1

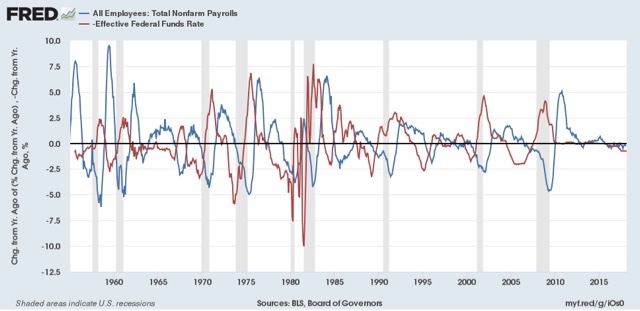

2. the YoY change in the Fed funds rate (inverted in the graph below) also does a very good job forecasting the *rate* of YoY change in payrolls 12 to 24 months out.

One shortfall of that model is that there are two “false negatives” in the low interest rate environment of the 1950s, during which the YoY increases in interest rates by the Fed were relatively modest, and did not exceed the YoY change in payrolls until after the recessions had already begun.

A variation on the model is that, since the 1950s, the simple rise in the Fed funds rate from its low near the beginning of an expansion, has always exceed the YoY% change in job growth *before* the onset of all of the subsequent recessions. This variation has limited value as a “yellow flag,” strongly cautioning that there is a heightened probability of a recession is within 18 months, with the “red flag” suggesting the near certainty of a recession within 12 months only if/when the YoY increase in interest rates exceeds the (decelerating) YoY% growth in jobs.

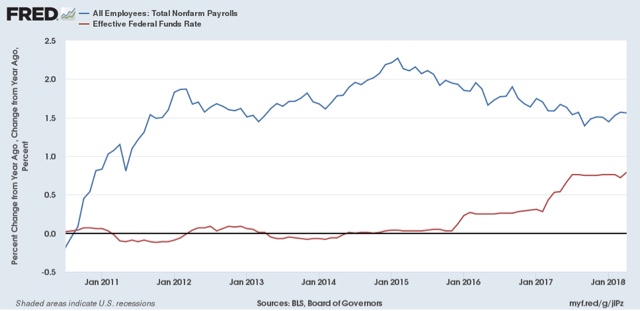

With YoY employment growth at 1.6%, and the YoY change in the Fed funds rate of 0.75%, there is no “red flag” warning:

But because the total increase in the Fed funds rate during this expansion has been 1.7%, the “yellow flag” has been activated:

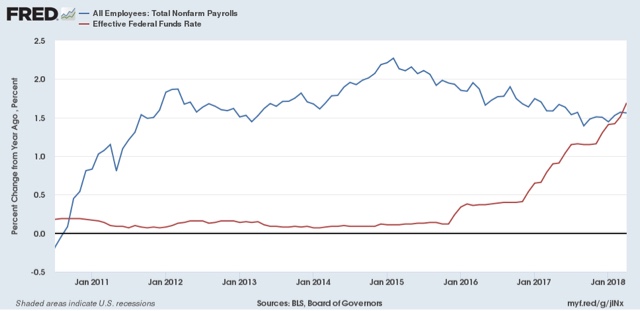

Further, because the Fed funds rate has been hiked by 0.75% in the last year, that suggests that a further YoY% decline in payrolls growth is already “baked in the cake” over the next 12-24 months, to a level of roughly +0.8% YoY:

That suggests that if the Fed makes 3 more 0.25% interest rate hikes in the next year, the “red flag” will be triggered at some point in that 12-24 month window.

———-

*N.B. This is only one of a number of forecasting metrics I use. The most important is the long/short leading indicator method based on the work of Prof. Geoffrey Moore and Prof. Edward Leamer. This is supplemented by the much more timely but volatile “Weekly Indicators” method. I also have a fundaments-based forecast based on consumer behavior, and a less-organized corporate model as well.