Brief JOLTS update I’m still traveling, so this will be a quick update. In re yesterday’s JOLTS report (June 7), the main take seems to be that job openings were higher than the total number of unemployed, so presumably they could all be hired and we’d have actual full employment next month, right? I don’t think so. Month after month, hires have totaled considerably fewer than openings for several years. If full employment were so close, why wouldn’t hires be catching up? And every month, there are new layoffs, quits, and other separations, all of whom (except for those who retire) are available to fill those job openings. In any event, let me focus on the simple metric of “hiring leads firing.” Here’s the long term relationship since 2000,

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Brief JOLTS update

I’m still traveling, so this will be a quick update.

In re yesterday’s JOLTS report (June 7), the main take seems to be that job openings were higher than the total number of unemployed, so presumably they could all be hired and we’d have actual full employment next month, right?

I don’t think so. Month after month, hires have totaled considerably fewer than openings for several years. If full employment were so close, why wouldn’t hires be catching up? And every month, there are new layoffs, quits, and other separations, all of whom (except for those who retire) are available to fill those job openings.

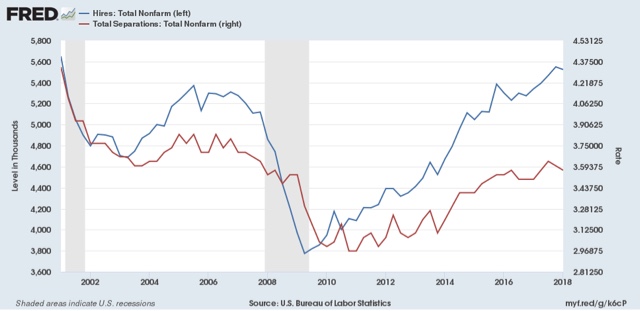

In any event, let me focus on the simple metric of “hiring leads firing.” Here’s the long term relationship since 2000, quarterly through the end of March:

No sign yet of either turning down, although both may be plateauing.

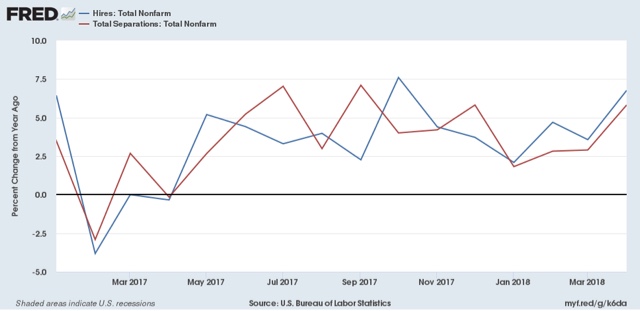

In the 2000s business cycle, hires YoY turned down well in advance of the recession. That isn’t the case now:

so there’s no danger sign of any oncoming economic downturn in this month’s report.

Here is a close-up of the last several years, monthly, of hiring vs. separations:

The YoY comparisons will get more challenging starting next month, as hires have been within a 2% range since last May, and have not made a new high since last October.

Since we are late in the cycle, my anticipation is that we will indeed see negative YoY readings on hiring at some point in the second half of this year, but we’ll see.