JOLTS report confirms November payrolls strength I’m changing my presentation of JOLTS data somewhat compared with the last year or two. At this point I’ve pretty much beaten the dead horses of (1) “job openings” are soft and unreliable data, and should be ignored in contrast with the hard “hires” series; and (2) the overall trend is that of late expansion but no imminent downturn.So let’s start a little differently, by comparing nonfarm payrolls from the jobs report with what should theoretically be identical data: total hires minus total separations in the JOTLS report, monthly (first graph) and quarterly (second graph): While there can be a considerable disparity in any one month, once we start looking longer term there is an incredibly tight fit.

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

JOLTS report confirms November payrolls strength

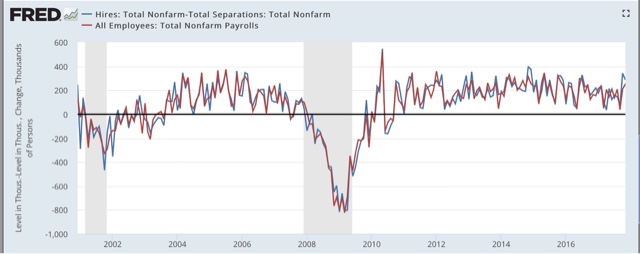

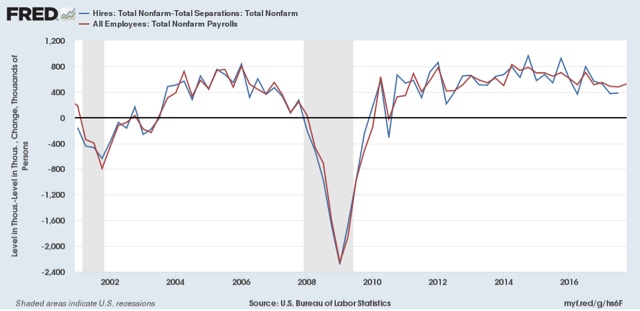

I’m changing my presentation of JOLTS data somewhat compared with the last year or two. At this point I’ve pretty much beaten the dead horses of (1) “job openings” are soft and unreliable data, and should be ignored in contrast with the hard “hires” series; and (2) the overall trend is that of late expansion but no imminent downturn.So let’s start a little differently, by comparing nonfarm payrolls from the jobs report with what should theoretically be identical data: total hires minus total separations in the JOTLS report, monthly (first graph) and quarterly (second graph):

While there can be a considerable disparity in any one month, once we start looking longer term there is an incredibly tight fit.

For our immediate purposes, it’s likely that the strength in the JOLTS hiring data over the last several months is the same trend as the very good post-hurricane October and November jobs reports, both of which showed that more than 200,000 jobs had been added. While any given month can be off significantly, it’s a fair bet that when the December JOLTS report is released in one month, it too will be weaker, just as was the December jobs report.

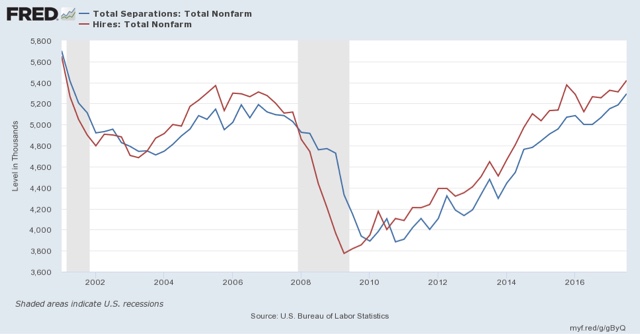

Just as at the bottom of the Great Recession, at the end of the “shallow industrial recession” of 2015, hiring (red) troughed first, followed later in 2016 by separations (blue). With hiring up, I expect the level of separations to also increase (note some of these are voluntary) in the next few months as well.

[Note: above graphs show quarterly data to smooth out noise]Here are hires vs. separations on a monthly basis for the last 24 months:

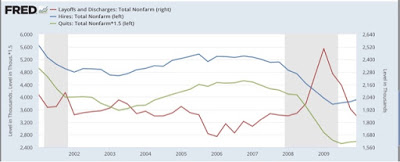

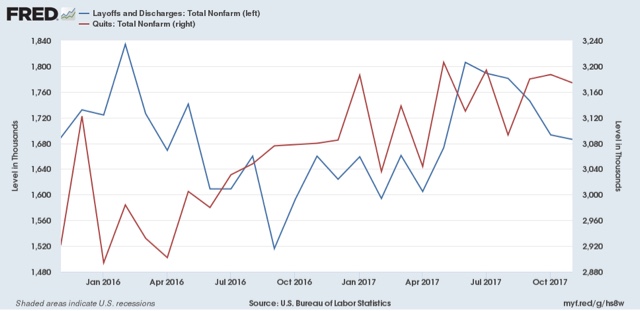

While quits remain at expansionary high levels, they seem to have stagnated in the last 6 months. With hiring increasing again, if the pattern from the last decade holds, I would expect quits to improve somewhat as well.

Meanwhile the good news is that involuntary separations have fallen in the last several months, even if we average the last two. At the same time, they remain above thei bottom they established a year ago: