Strong manufacturers new orders in November ISM report There are a lot of economic writers who won’t tell you when something moves against their thesis. Those guys trumpeting a flatlining of commercial and industrial growth last year? They never heard of it this year (hint: because it’s up!). To the contrary, one of the reasons I do my Weekly Indicators piece is that it forces me to mark my forecasts to market each week. If a forecast doesn’t work out, I want to undertake a post mortem and understand why. I certainly don’t have to do that today, but yesterday one piece of evidence did move against my thesis of a slowdown next year: ISM new orders for November. As I reiterated in today’s piece at Seeking Alpha on yesterday’s yield curve inversion, the

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Strong manufacturers new orders in November ISM report

There are a lot of economic writers who won’t tell you when something moves against their thesis. Those guys trumpeting a flatlining of commercial and industrial growth last year? They never heard of it this year (hint: because it’s up!).

To the contrary, one of the reasons I do my Weekly Indicators piece is that it forces me to mark my forecasts to market each week. If a forecast doesn’t work out, I want to undertake a post mortem and understand why.

I certainly don’t have to do that today, but yesterday one piece of evidence did move against my thesis of a slowdown next year: ISM new orders for November.

As I reiterated in today’s piece at Seeking Alpha on yesterday’s yield curve inversion, the long leading indicators have pretty much been deteriorating all year long, to the point where for the last three weeks they have been negative. So there is simply a lot of evidence to suspect that the economy is going to follow suit after a year or so.

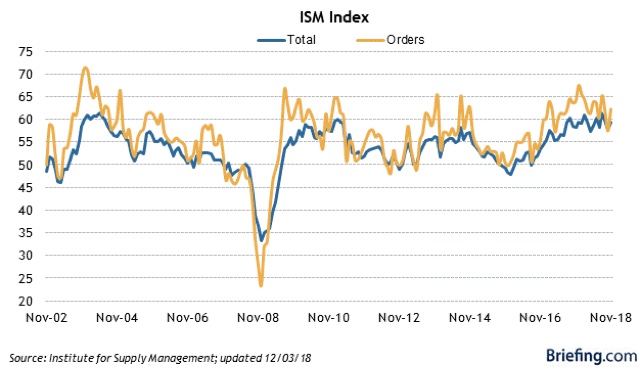

In the meantime, I’ve started to focus on whether the short leading indicators are also beginning to show signs of weakness. One such measure is manufacturers’ new orders. On a semi-weekly basis, I track that via the regional Fed indexes. On a monthly basis, the ISM new orders index is the go-to metric.

Well, one month ago the ISM new orders subindex declined to nearly a 2 year low. Then, during November, the average of the five Fed regional indexes declined further. So far, looking pretty good for my hypothesis.

Then, at the last minute, the Chicago PMI Index completely blew out to the upside, including a very strong new orders index. And yesterday, the ISM report’s new orders subindex for November rose back strongly. Here’s the graph, from Briefing.com:

Yesterday’s reading was about average from earlier this year.

So, fair is fair. Yesterday’s ISM report is contra my thesis. On the other hand, the general trend over the last few months has been a gradual backing off from extremely strong growth seen at the beginning of this year.