Summary:

If you are under about 45 years of age, the odds are that you agree with one statement made by Dick Cheney: that “Reagan proved that deficits don’t matter.” As I mention from time to time, I am a fossil. I remember the “guns and butter” inflation of the late 1960s (Google is your friend) and the stagflationary 1970s. Here is a graph of the interest yield on the 10 year bond from 1981 through 2013: In an era of declining interest rates, deficits don’t matter — or at least very little. Suppose the national debt runs up from Trillion to Trillion while at the same time interest rates decline from 4% to 3%. In that situation annual interest due on the debt goes from 0 Billion to 0 Billion — an actual decline of Billion

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

If you are under about 45 years of age, the odds are that you agree with one statement made by Dick Cheney: that “Reagan proved that deficits don’t matter.” As I mention from time to time, I am a fossil. I remember the “guns and butter” inflation of the late 1960s (Google is your friend) and the stagflationary 1970s. Here is a graph of the interest yield on the 10 year bond from 1981 through 2013: In an era of declining interest rates, deficits don’t matter — or at least very little. Suppose the national debt runs up from Trillion to Trillion while at the same time interest rates decline from 4% to 3%. In that situation annual interest due on the debt goes from 0 Billion to 0 Billion — an actual decline of Billion

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

If you are under about 45 years of age, the odds are that you agree with one statement made by Dick Cheney: that “Reagan proved that deficits don’t matter.”

As I mention from time to time, I am a fossil. I remember the “guns and butter” inflation of the late 1960s (Google is your friend) and the stagflationary 1970s.

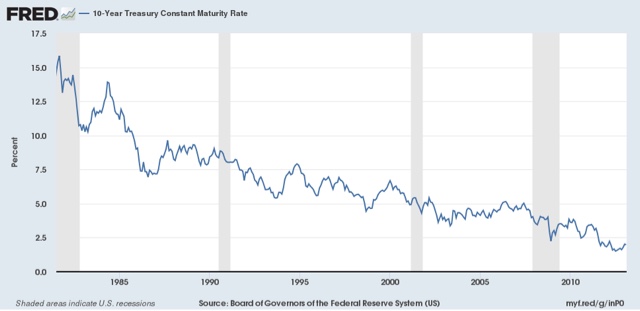

Here is a graph of the interest yield on the 10 year bond from 1981 through 2013:

In an era of declining interest rates, deficits don’t matter — or at least very little.

Suppose the national debt runs up from $20 Trillion to $25 Trillion while at the same time interest rates decline from 4% to 3%. In that situation annual interest due on the debt goes from $800 Billion to $750 Billion — an actual decline of $50 Billion a year. That can cover a multitude of sins.

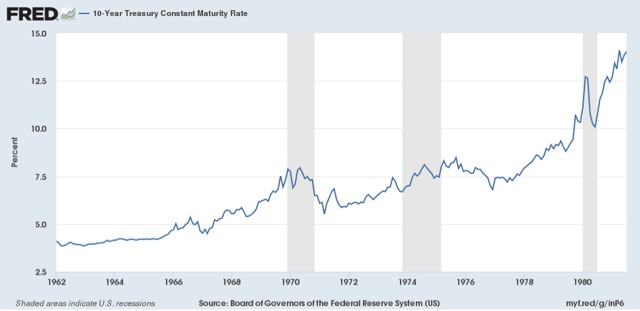

Now here is a graph of the interest yield on the 10 year bond from 1961 through 1980:

In an era of increasing interest rates, deficits DO matter very much.

Suppose in that era the national debt runs up from $20 Trillion to $25 Trillion while at the same time interest rates rise from 3% to 4%. In that situation annual interest due on the debt goes from $600 Billion to $1 Trillion — an increase of $400 Billion a year. That’s $400 Billion that can’t be spent on infrastructure or social or insurance programs.

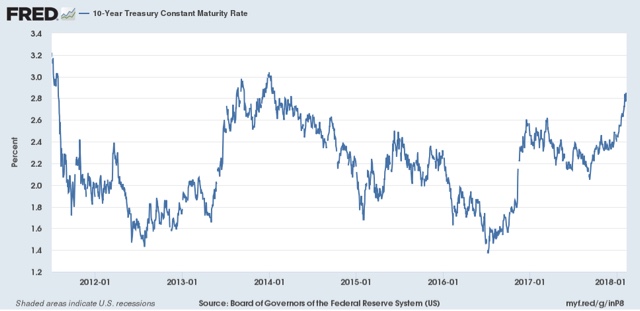

Even if interest rates remain relatively stable as they have for the last five years:

Then the annual interest due in our example rises from $600 Billion to $750 Billion — a deadweight loss of $150 Billion per year.

Now look at those three graphs again. I would say that the odds of a further decline in interest rates of any significance is close to zero. So the choices are whether interest rates over the next decade or two go sideways from here, or rise.

Since I am a fossil, I may not live to see it. But, dear reader, if you are 45 years old or younger, it is high time you disabuse yourself of the “wisdom” of Dick Cheney.

.