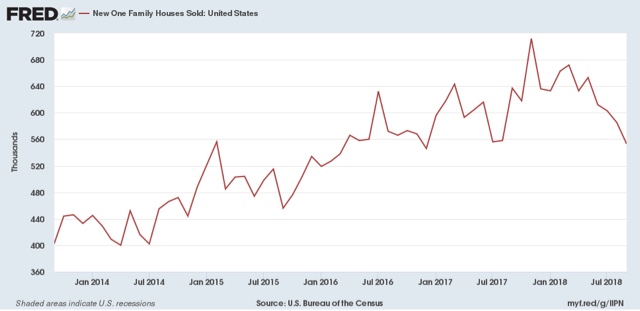

New home sales bombed in September Needless to say, this morning’s report on new home sales was another big miss in the housing sector. Not only were sales a new 12 month low, they were the lowest in nearly 2 years, and are off over -150,000 from their peak 10 months ago: Typically new home sales are down about -200,000 when a recession starts. That median prices have fallen in sync with sales, and not with their typical lag: makes me think that the tax law change of last December, which capped the mortgage tax deduction in a way calculated to hit the highest priced housing markets the hardest, is a big driver of the decline. Obviously this is not good for the economy next year, and bodes poorly for fixed private residential

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

New home sales bombed in September

Typically new home sales are down about -200,000 when a recession starts.

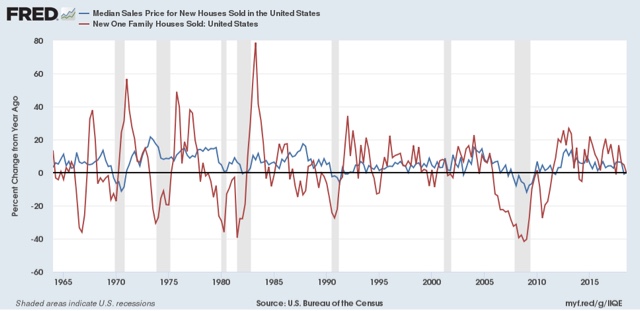

That median prices have fallen in sync with sales, and not with their typical lag:

makes me think that the tax law change of last December, which capped the mortgage tax deduction in a way calculated to hit the highest priced housing markets the hardest, is a big driver of the decline.

Obviously this is not good for the economy next year, and bodes poorly for fixed private residential investment, which will be reported as part of Q3 GDP on Friday.

BUT, one important caveat: new home sales are among the most volatile, and most heavily revised, of all data series, which is why I pay more attention to housing permits. So it wouldn’t be a surprise at all for most of this month’s decline to be revised away in next month’s report.

I’ll have more tomorrow or Friday with my comprehensive housing update for the month.