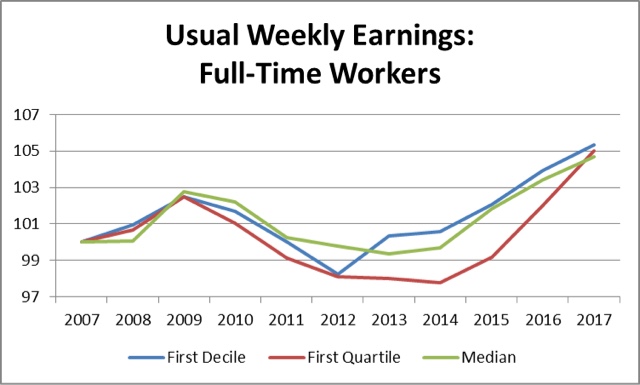

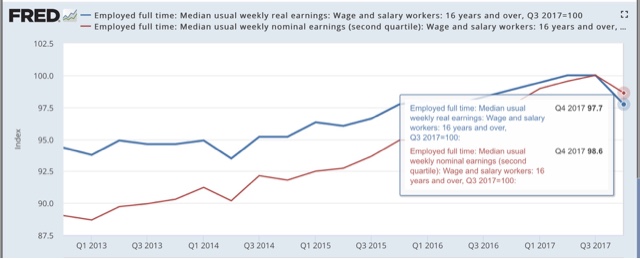

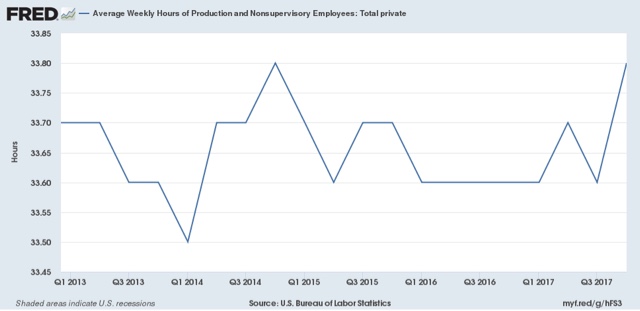

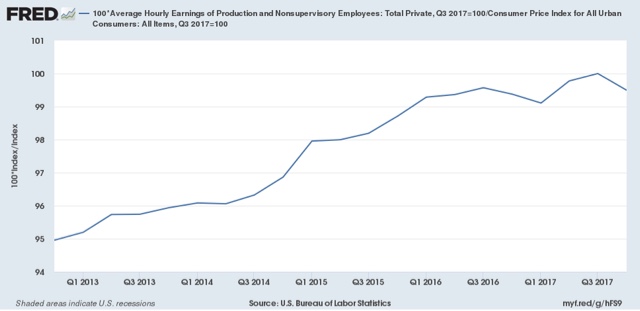

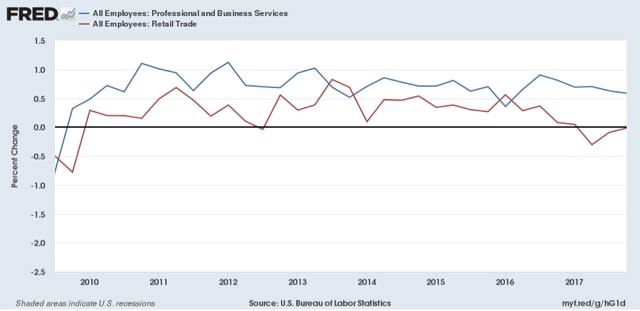

What’s behind the big Q4 decline in real median weekly wages? [Note: This is a post I was working on last week. I hypothesized that the employment cost index would validate the analysis. Well, I didn’t get around to posting it, and the ECI came out this morning. So, how did I do? ] Last week the Bureau of Labor Statistics reported that real weekly median wages declined by over 2% in the 4th quarter of last year! This is quite the anomaly in the face of generally good data that has been reported in the last few months. Dean Baker put it in context, noting that for the year 2017, real weekly median wages rose signficantly over 2016: But I thought I would dig deeper to see why the anomaly had occurred. So I took a detailed look at each of the three

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

What’s behind the big Q4 decline in real median weekly wages?

[Note: This is a post I was working on last week. I hypothesized that the employment cost index would validate the analysis. Well, I didn’t get around to posting it, and the ECI came out this morning. So, how did I do? ]

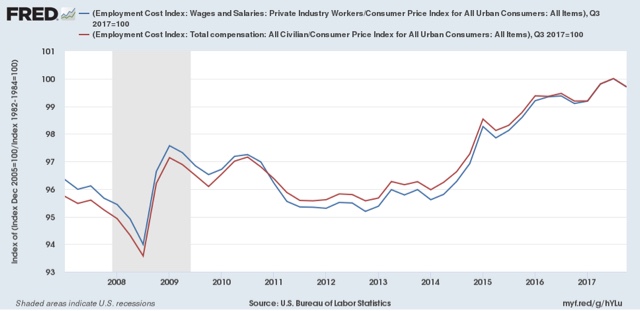

The best way to test this hypothesis is to see what happened quarter over quarter to pay for identical jobs. That is exactly what gets measured by the Employment Cost Index. If what mainly happened in the 4th quarter is that the mix of jobs in the economy changed, then the only decline we should see in the E.C.I. is that due to inflation. That report comes out next week, so we will have the answer soon enough.

—-

AAAAND, this morning the Employment Cost index showed that wages *ROSE* 0.5% in Q4, and total compensation rose 0.6%. The nominalYoY% increase for each was 2.5%:

In real, inflation adjusted terms both wages median compensation declined -0.3%:

So the big dropoff in weekly median wages does indeed appear to be a story of a change in the mix of jobs, rather than a drop in actual pay of a job. Still, nominal wage growth in the latter part of 2017 was eclipsed by the uptick in inflation. This, by the way, adds to the evidence that the increase in consumer spending in the last few months has been driven by the wealth effect (increasing house and stock prices for the affluent and wealthy) and dipping into savings for everybody else.