Summary:

Two real economic consequences of the Trump presidency Next week we will be 1/3 of the way through Trump’s Presidential term. Last year I used to point out that it was really still Obama’s economy, as the GOP had failed to pass, nor Trump commence, any economic policy of consequence. That is no longer the case. In late December the GOP Congress passed and Trump signed their huge giveaway for the wealthy. Yesterday, Trump pulled out of the Iran nuclear deal. Both of these are going to have significant consequences for average Americans. First, Trump’s election caused interest rates to spike. Wall Street guessed that there would be lots more business spending, meaning a stronger economy with higher inflation. As nothing much happened in 2017, interest

Topics:

NewDealdemocrat considers the following as important: politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Two real economic consequences of the Trump presidency Next week we will be 1/3 of the way through Trump’s Presidential term. Last year I used to point out that it was really still Obama’s economy, as the GOP had failed to pass, nor Trump commence, any economic policy of consequence. That is no longer the case. In late December the GOP Congress passed and Trump signed their huge giveaway for the wealthy. Yesterday, Trump pulled out of the Iran nuclear deal. Both of these are going to have significant consequences for average Americans. First, Trump’s election caused interest rates to spike. Wall Street guessed that there would be lots more business spending, meaning a stronger economy with higher inflation. As nothing much happened in 2017, interest

Topics:

NewDealdemocrat considers the following as important: politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Two real economic consequences of the Trump presidency

Next week we will be 1/3 of the way through Trump’s Presidential term. Last year I used to point out that it was really still Obama’s economy, as the GOP had failed to pass, nor Trump commence, any economic policy of consequence.

That is no longer the case.

In late December the GOP Congress passed and Trump signed their huge giveaway for the wealthy. Yesterday, Trump pulled out of the Iran nuclear deal. Both of these are going to have significant consequences for average Americans.

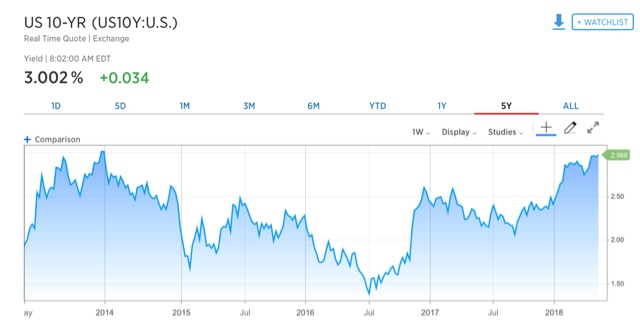

First, Trump’s election caused interest rates to spike. Wall Street guessed that there would be lots more business spending, meaning a stronger economy with higher inflation. As nothing much happened in 2017, interest rates settled back down somewhat. But then in late December the tax bill was passed, and shortly thereafter interest rates spiked to five year highs:

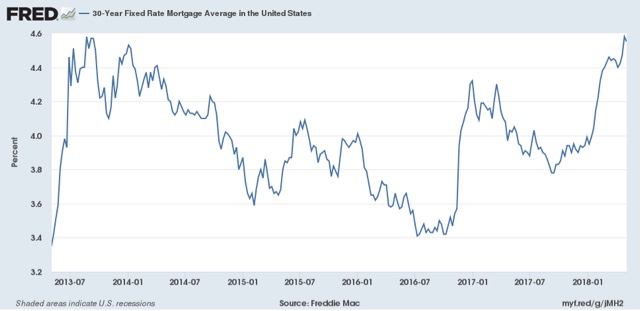

As I write this, 10 year Treasury yields are back over 3%. More importantly, mortgage rates are also at 5 year highs:

This is about 1.2% higher than just before the Presidential election. On at $300,000 house, that translates to $3600 a year in additional interest.

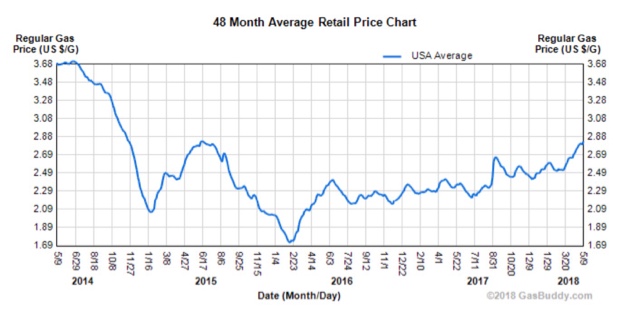

Second, as I write this Oil prices are over $71/barrel. This is a 3 year high:

Oil prices have recovered about half of their steep 2014 decline.

Prices for gas at the pump are following:

Nationwide gas prices are averaging about $2.80 a gallon at the moment. Since it takes several weeks for oil prices to feed through into gas prices, prices at the pump are likely to exceed $3 a gallon shortly. That is the sort of thing that consumers notice.

Certainly much of the increase in oil and gas prices is part of the typical commodity cycle, in which “the remedy for low (high) gas prices, is low (high) gas prices.” But the recent increase is at least partly a reaction to the likely consequences of further destabilization in the middle east.

So, Trump’s Presidency is beginning to have real consequences for ordinary Americans. The markets believe that the effects are stagflationary, i.e., leading to both increased inflation and decreased demand.