Real wage growth: November 2018 update Now that November inflation has been reported (as unchanged), let’s update what that means for real wages. Nominally, wages for nonsupervisory workers grew +0.3% in November. With inflation flat, that means real wages also grew +0.3%: Even so, although they are at a new 40 year high, real hourly wages are nevertheless below their peak level set in the early1970s! On a YoY basis, real wages have risen 1%: Since 1999, the change in real wages has almost explusively been determined by the price of gas. Finally, real aggregate wages have now risen 26.8% from their bottom in October 2009: The total advance during this expansion is only exceeded by the 1960s and 1990s at this point. On the other

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Real wage growth: November 2018 update

Now that November inflation has been reported (as unchanged), let’s update what that means for real wages.

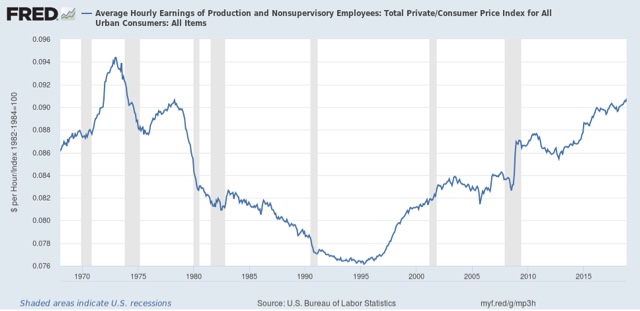

Nominally, wages for nonsupervisory workers grew +0.3% in November. With inflation flat, that means real wages also grew +0.3%:

Even so, although they are at a new 40 year high, real hourly wages are nevertheless below their peak level set in the early1970s!

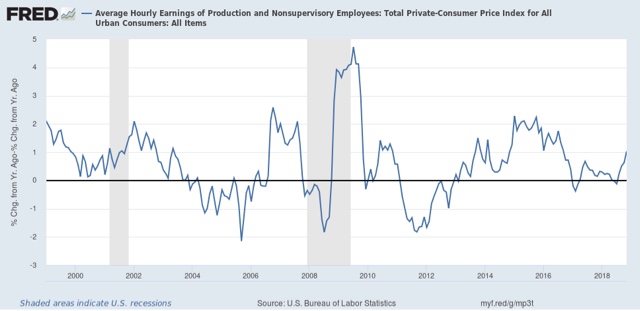

On a YoY basis, real wages have risen 1%:

Since 1999, the change in real wages has almost explusively been determined by the price of gas.

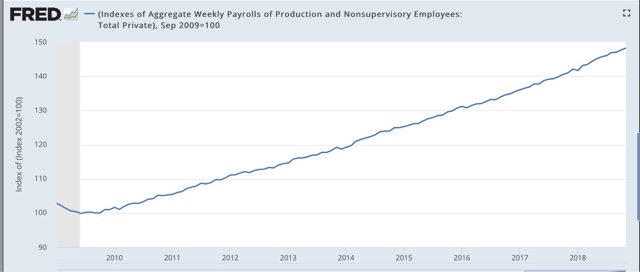

Finally, real aggregate wages have now risen 26.8% from their bottom in October 2009:

The total advance during this expansion is only exceeded by the 1960s and 1990s at this point.

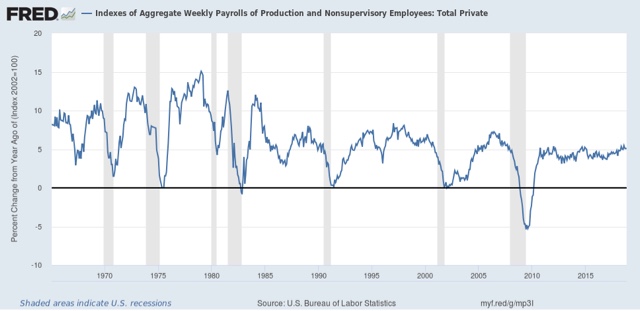

On the other hand, growth in real aggregate wages has averaged 2.5% in this expansion, varying from 1% to 8% depending on what has happened with gas prices:

This is a very weak rate of growth, ahead of only the 2000s expansion and on par with the 1980s expansion.

All in all, the grwoth in real wages is good news. It’s just nearly good enough compared with the growth in business profits generated by the expansion.