Scenes from the September jobs report Leaving aside wages, there was lots of sunshine in September’s jobs report, although there were a few gray if not dark clouds on the horizon. Here’s a look at each: 1. Weekly jobless claims did lead the unemployment rate Two weeks ago, I wrote that the new 40+ year lows in weekly initial jobless claims forecast new lows in the unemployment rate. Here’s what I said: [I]nitial jobless claims tend to lead the unemployment rate by a few months. Here’s the 50 year+ graph: If jobless claims decline, then over the next 2-3 months it’s a good bet that the monthly unemployment rate will decline too. And that it did. Here’s the updated graph of the last few years: You have to go back half a century, to

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Scenes from the September jobs report

Leaving aside wages, there was lots of sunshine in September’s jobs report, although there were a few gray if not dark clouds on the horizon. Here’s a look at each:

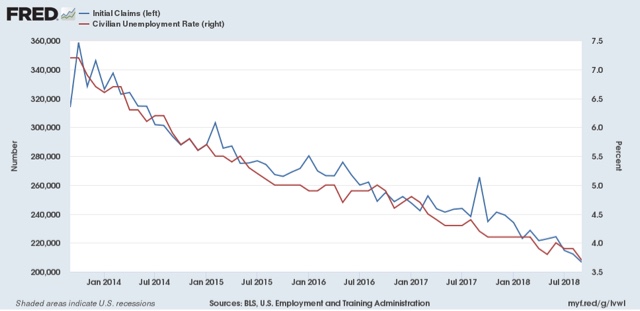

1. Weekly jobless claims did lead the unemployment rate

Two weeks ago, I wrote that the new 40+ year lows in weekly initial jobless claims forecast new lows in the unemployment rate. Here’s what I said:

[I]nitial jobless claims tend to lead the unemployment rate by a few months. Here’s the 50 year+ graph:

If jobless claims decline, then over the next 2-3 months it’s a good bet that the monthly unemployment rate will decline too.

And that it did. Here’s the updated graph of the last few years:

You have to go back half a century, to 1969, to find an unemployment rate lower than September’s.

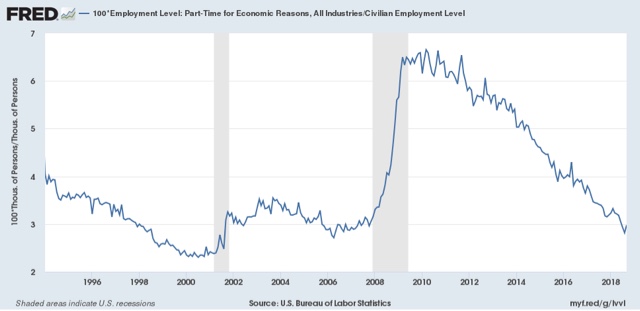

2. Involuntary part time employment remains on trend

While the number of persons working part-time because they could not find full time work rose slightly from August, the declining trend remains intact:

A hair under 3% of the civilian labor force is involuntarily employed part time, only 0.7% above its modern low. It shows no signs of bottoming out yet, which is particularly positive since typically this series moves sideways before increasing in advance of a recession.

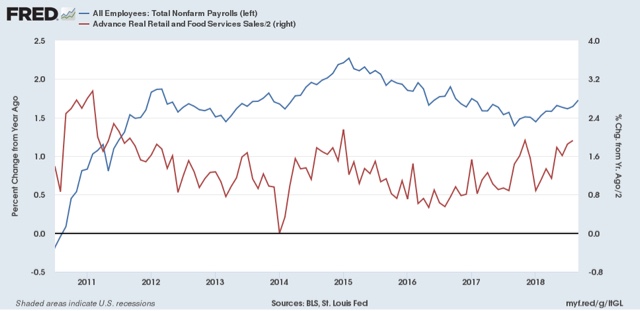

3. Consumption leads employment: YoY employment is still accelerating

As I have written many times over the years, real retail sales leads jobs growth by about 3-6 months. YoY real retail sales have accelerated over the past year, and jobs growth has accelerated in response:

That big spike from a year ago is last September’s +1.3% real retail sales growth in a single month, in response to the hurricanes. Next week’s report on this September’s number will be particularly important to see if the accelerating trend in consumption comes to an end.

4. Fraying at the edges #1: an increase in people not in the labor force who want a job now

But if the lion’s share of the data in the jobs report was positive, there were several measures which indicate some fraying at the edges, which is typically where weakness starts.

In that vein, the number of discouraged workers who haven’t been looking for a job at all, but who say they want a job now, made a low half a year ago at just under 5.1 million people:

While it declined in September compared with August, the fact that it has turned up is a caution flag going forward.

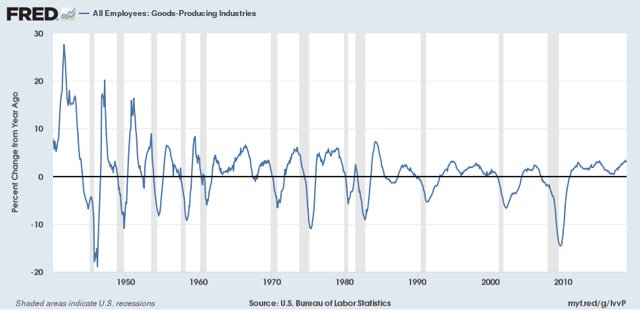

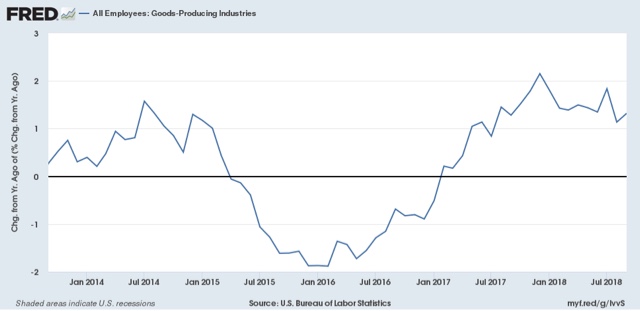

5. Fraying at the edges #2: growth in goods producing jobs may be stalling

The YoY growth in goods-producing employment is an excellent leading indicator. It is very un-noisy, and has turned down well in advance of all but two of the recessions (1973 and 1981) in the last 80 years:

In fact, this series is so un-noisy that even a decline for just 2 months in a row has almost always signaled a change in trend.

Well, two months ago this made a 28 year high at 3.3% as revised, in line with the many red hot manufacturing data points this year. It backed off in August, but then rose again slightly to 3.2% in September. While there has been no definitive change in trend, the rate of acceleration in the growth of goods-producing jobs has slowed down:

As I have written a number of times in the last few months, the bulk of the long leading indicators forecast a significant slowdown in the economy by roughly next summer. If growth in goods-producing jobs were to top out and start to decline, that would be an important confirmation of the forecast.