September existing home sales: yet another poor housing report While existing home sales are roughly 90% of the entire housing market, they are much less important as an economic indicator because they do not have the knock-on effects of construction improvements, and less of the landscaping and indoor improvements, that new homes do. But they certainly do help us track the trend. And like housing permits and starts, and new home sales, the trend has not been good this year. In September, existing home sales were at a 5.15 million annualized trend, down for the sixth month in a row, down YoY, and close to a 3 year low. Further, existing home sales have not made a new monthly high since last November, 10 months ago. The 3 month average has not made a

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

September existing home sales: yet another poor housing report

While existing home sales are roughly 90% of the entire housing market, they are much less important as an economic indicator because they do not have the knock-on effects of construction improvements, and less of the landscaping and indoor improvements, that new homes do.

But they certainly do help us track the trend. And like housing permits and starts, and new home sales, the trend has not been good this year.

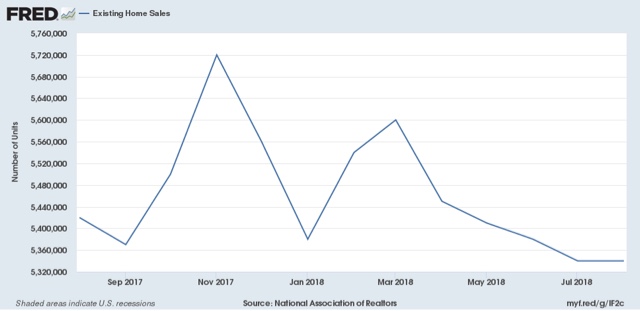

In September, existing home sales were at a 5.15 million annualized trend, down for the sixth month in a row, down YoY, and close to a 3 year low. Further, existing home sales have not made a new monthly high since last November, 10 months ago. The 3 month average has not made a meaningful new high since April of last year.Here’s what the last year (excluding this month not shown) looks like:

If there was a silver lining in this report, it was that the YoY increase in the median price of an existing home, at 4.2%, while still outpacing wage and household income growth, decelerated from last month’s 4.6% level, and was well below the 5%+ YoY readings from earlier this year Because prices have pronounced seasonality, the YoY metric is the only way to track them. My typical workaround, that if the increase declines by more than 1/2, then the top has probably been set, is valid for this number, but of course we would need to fall below a 3% YoY increase for that to kick in.

Inventory is now increasing, and I expect that to last until sales decline enough to drag prices down with them.

Bottom line: this is another negative report from the housing sector. We still have September new home sales and Q3 fixed residential spending to be reported next week for the picture to be complete.