Subdued inflation helps gains in real average and aggregate wages With the consumer price report Tuesday morning, let’s conclude this weeklong focus on jobs and wages by updating real average and aggregate wages. Through July 2018, consumer prices are up 2.7% YoY, while wages for non-managerial workers are up 2.8%. Thus real wages have finally grown, ever so slightly, YoY: In the longer view, real wages have still been flat — up only 0.5% — for 2 1/2 years: But because employment and hours have increased, real *aggregate* wage have continued to grow: Real aggregate wages — the total earned by the American working and middle class — are now up 26.1% from their October 2009 bottom. Finally, because consumer spending tends to

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Subdued inflation helps gains in real average and aggregate wages

With the consumer price report Tuesday morning, let’s conclude this weeklong focus on jobs and wages by updating real average and aggregate wages.

Through July 2018, consumer prices are up 2.7% YoY, while wages for non-managerial workers are up 2.8%. Thus real wages have finally grown, ever so slightly, YoY:

In the longer view, real wages have still been flat — up only 0.5% — for 2 1/2 years:

But because employment and hours have increased, real *aggregate* wage have continued to grow:

Real aggregate wages — the total earned by the American working and middle class — are now up 26.1% from their October 2009 bottom.

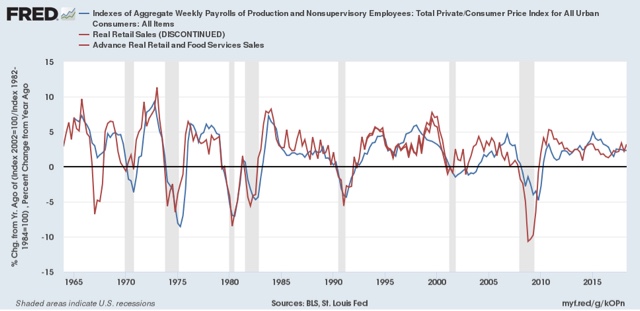

Finally, because consumer spending tends to slightly lead employment, let’s compare YoY growth in real retail sales, first measured quarterly (red), with that in real aggregate payrolls (blue):

Since we are two months into the next quarter, here’s the monthly close-up on the last 10 years (excluding this morning’s decline of -0.1% in real retail sales):

Since late last year real retail sales growth has accelerated YoY, and again further this morning, as last August’s -0.3% monthly number was replaced by the less negative -0.1% this morning, bringig the YoY% change up to +3.8%. So we should expect the recent string of good employment reports to continue for at least a few more months.