Is the rental vacancy rate a leading signal for the housing market? Here is something I noticed while putting together my piece yesterday on the housing market. Three of the series — new home sales, existing home sales, and single family starts — all peaked last November: That made me go back and think about an anomaly I had noticed, but hadn’t figured out, with regard to the rental vacancy rate: which, according to the graph, peaked in the 3rd Quarter of last year, and has declined since. It occurred to me that this is probably not a coincidence. If housing unaffordability has become a real constraint for potential buyers, then there should be an increasing number of such buyers who are forced to rent instead — which would drive down the

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Is the rental vacancy rate a leading signal for the housing market?

Three of the series — new home sales, existing home sales, and single family starts — all peaked last November:

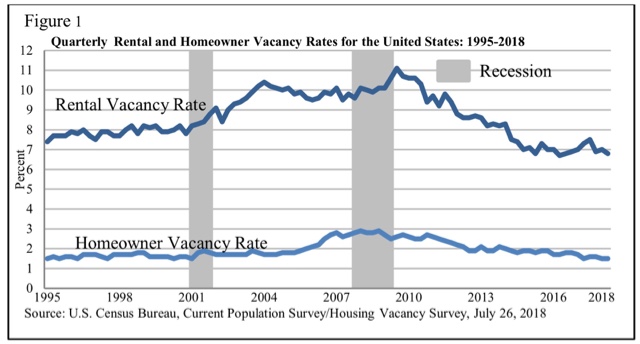

That made me go back and think about an anomaly I had noticed, but hadn’t figured out, with regard to the rental vacancy rate:

which, according to the graph, peaked in the 3rd Quarter of last year, and has declined since.

It occurred to me that this is probably not a coincidence. If housing unaffordability has become a real constraint for potential buyers, then there should be an increasing number of such buyers who are forced to rent instead — which would drive down the rental vacancy rate.

It also looks like the rental vacancy rate peaked in 1997-98 and early 2004, in advance of the last two cyclical housing peaks, which I suspect is also not a coincidence.

So, is there a leading signal for the housing market in the rental vacancy rate? My preliminary perusal makes me think it’s complicated. I’m chewing it over.