This is a somewhat late 10th anniversary of the Lehman failure post. I am not going to write much that is new, but will restate an argument I have been making for years (following John Quiggin and Miles Kimball). It is trivially easy for the US Treasury (and other treasuries) to make huge profits on the carry trade. These huge profits are, I claim, actual wealth created by the operation. In general, the argument is that, over all recorded long time intervals, returns to a diversified pool of risky assets (such as the market portfolio of stocks) are greater than returns to Treasury bills. The average difference in returns is huge (on the order of 5% per year). This suggests that long term public debt problems could be relieved (or eliminated) if

Topics:

Robert Waldmann considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

This is a somewhat late 10th anniversary of the Lehman failure post. I am not going to write much that is new, but will restate an argument I have been making for years (following John Quiggin and Miles Kimball). It is trivially easy for the US Treasury (and other treasuries) to make huge profits on the carry trade. These huge profits are, I claim, actual wealth created by the operation.

In general, the argument is that, over all recorded long time intervals, returns to a diversified pool of risky assets (such as the market portfolio of stocks) are greater than returns to Treasury bills. The average difference in returns is huge (on the order of 5% per year). This suggests that long term public debt problems could be relieved (or eliminated) if Treasuries issued more low return bonds and purchased a diversified portfolio of risky assets.

The common response seems to be that it can’t be so easy and there must be some catch. I claim it is easy to beat the market, so why am I not rich. The response to that is that the huge gains are available to an agent with deep pockets and a long planning horizon — that is states which can borrow at low rates in their own currency.

I think the 2008 financial crisis was an accidental experiment proving providing very strong evidence for these claims. The US Federal Government purchases trillions in risky assets at prices higher than private agents were willing to pay. This was done to save the economy and it was assumed that it would cost the Federal Government hundreds of billions. In the event, the Tr easury and the Federal reserve system made the highest profits ever recorded.

The reason for the huge forecast error (largest forecast error ever) is that Congress banned consideration of the expected gains from bearing risk. Normally, the CBO scores policies based on the change in the expected value of the federal debt 10 years later. This means that the scores are risk neutral. In the case of the Treasury’s rescue efforts (TARP and the earlier rescue of Fannie Mae and Freddie Mac) they were ordered to mark assets to market — to assume that risky assets had the same value for the deep pocketed infinite horizon Treasury as for private investors (which include wealth managers investing other people’s money who are fired if they have a few quarters of sub-market returns). It was possible to calculate the expected value of corrections to the estimates as uncertainty was resolved. It was in the hundreds of billions of dollars. Almost everyone was surprised by the result that things turned out as (mathematically not subjectively) expected. Barney Frank was the only policy maker who noted this before uncertainty was resolved. He was pilloried for having been soft on Fannie Mae before 2008, and had a strong personal interest in arguing that the bailout would not be a disaster for the Treasury. Also he turned out to be right.

Just google Fannie Mae profits and get to the latest report

Looking at 2017 as a whole, I am very pleased with our progress. We paid $12.0 billion in dividends to Treasury in 2017, bringing our total dividends to taxpayers to $166.4 billion. This compares to the $119.8 billion in draws that we have received or expect to receive shortly. Our pre-tax income was $18.4 billion, very much in line with pretax income of $18.3 billion 2016.

Now the $119.8 billion does not include interest paid on the Treasury securities sold to get the money to loan to Fannie Mae. These interest rates were near zero (Tand could have been even lower if the Treasury issued only Treasury bills and didn’t pay investors to bear term risk). The money sent by Fannie Mae to the Tresury does not sum up the gains to the Treasury which currently owns preferred shares, 80% of the common stock (if it were higher they would have to consolidate accounts and violated the debt ceiling) and the rights (just take but with the approval of judges) to all future dividends.

The huge profits were a side product of the effort. The main point of the rescue is that it was necessary to prevent a total collapse of the housing industry. In the crisis years, Fannie Mae and Freddie Mac were bearing the vast bulk (80% IIRC) of default risk on newly issued mortgages.

Of course Congress’s conclusion is that something has to be done to eliminate the terrible problem that a Federal Government agency is too successful in a market. That has to be inefficient because it is socialism and look at Venezuela. There are proposals to do something about this problem of a hugely profitable government agency. They never go anywhere fortunately. The arguments are

1) Fannie and Freddie are subsidizing residential investment

This is true. No one is forced to do business with them. Mortgage initiators do because unloading risk on Fannie and Freddie makes it possible for them too to get high profits. But the cost of this subsidy was negative 12 billion last year. So why is it a problem ?

2) Fannie and Freddie are sucking money out of the economy. Their profits are like a tax.

Not so true. Their profits are the result of private sector agents choosing to trade with them.

3) If there is another great recession, they will have huge losses automatically implying a larger budget deficit exactly when the economy is depressed.

True. They also serve as an automatic stabilizer. This is a good thing. It is better for the Treasury to lose money during recessions than for private agents to lose the money. Since the Treasury belongs to citizens, rational people would cut spending if it lost money (this is called Ricardian equivalence). But you make policy for the people you have not the people Fresh water economists want. In the real world Treasuries hide profits and losses from people who don’t act as fully rational agents (this is what Ricardo actually wrote).

4) It can’t be that easy. Why doesn’t everyone do that ?

Not everyone can borrow trillions at low interest rates

5) It’s socialism

Yes. So ?

This was supposed to be a brief post. After the jump, I discuss TARP and the really big bailout — QE 1.

Before I want to complain. My assertion is that partial public ownership of the means of production would benefit the country. Yet I often find myself criticized by leftists who think I am soft on bankers. I don’t understand this. It is certainly true that the 2008-9 bailouts were good for bankers. That doesn’t mean they were bad for the rest of us.

It also doesn’t mean that similar operations now that the financial system isn’t in crisis would be good for bankers. The other complaint is that, since the Treasury can borrow at low interest rates, publicly owned financial services agencies (such as Fannie and Freddie) have an unfair advantage. They can easily drive private firms out of currently profitable markets because the immense debt capacity of the US Treasury makes risk bearing and maturity transformation cheap. This is unfair to the poor bankers who can make huge incomes doing something that modestly paid bureaucrats can do better. Cry me a river.

Freddie Mac is huge compared to all financial firms except Fannie Mae. It too is profitable (and the profits belong to the US Treasury).

TARP was about as fun as a root canal (in a rare dissent Ezra Klein said Obama was wrong about this — he had recently had a root canal which was much more fun than TARP). TARP was also profitable. In particular, the Treasury made money rescuing the banks. It lost money saving GM, Chrystler, AIG and bailing out too few mortgagers with the HAMP flop.

Overall TARP other than HAMP was profitable. Some (including Joe Stiglitz) complain that the Treasury bailed out banks not homeowners with underwater mortgages. In fact, the Treasury made money dealing with the banks and spent it bailing out (too few) homeowners. Aside from HAMP (money given not lent with no expectation of any return) TARP was also used to save the US auto industry.

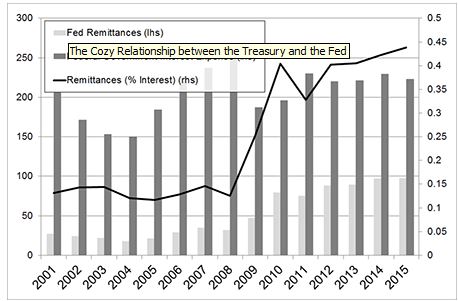

The Federal Reserve System. In QE 1, Federal Reserve banks spent a trillion dollars buying risky mortgage backed securities which no one else wanted. I almost typed “bought about $ 1 Trillion worth of RMBS” but that would be a very odd use of “worth” since no other entity was willing to pay that price for the assets. I think it is safe to say that QE 1 consisted of a purchase at market prices plus a huge gift. It was also hugely profitable. QE3 also involved buying risky assets with a huge net return since they paid more than 0.25% per year ex post including writoffs for the defaults (which mostly didn’t occur).

I’m pretty sure this part of the bailout caused the first 12 digit profit reported in human history

“In 2015, the Federal Reserve earned net income of $100.2 billion and transferred $97.7 billion to the U.S. Treasury.”

It is a particular pleasure to note that googling for evidence of gains from public ownership, I found this figure at mises.org (a site to which I have never linked)

Notice that these largest ever measured profits were earned as a result of an effort to save the financial system. They were an accident. This proves suggests that trillions of dollars worth of value are just sitting there and that prejudice against socialism (and the interests of bankers who don’t want to lose the competition) are keeping us from picking them up.