Is the taboo against raising wages beginning to break? It’s a *really* slow news week for economic data — just producer and consumer prices tomorrow and Thursday. Even JOLTS doesn’t come out until next week. But there was one little nugget of good news this morning: the NFIB, which represents small businesses, came out with their September report, and there was some good news about wages: more small businesses — 37% — said they *actually* raised wages in the last 3 months, than during any other 3 month period over the last 30 years: If the taboo against raising wages is finally breaking, that is good news. Now we have to see if it is confirmed by actual data on wages. One small gray cloud on the horizon is that actual hiring has decelerated in

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Is the taboo against raising wages beginning to break?

It’s a *really* slow news week for economic data — just producer and consumer prices tomorrow and Thursday. Even JOLTS doesn’t come out until next week.

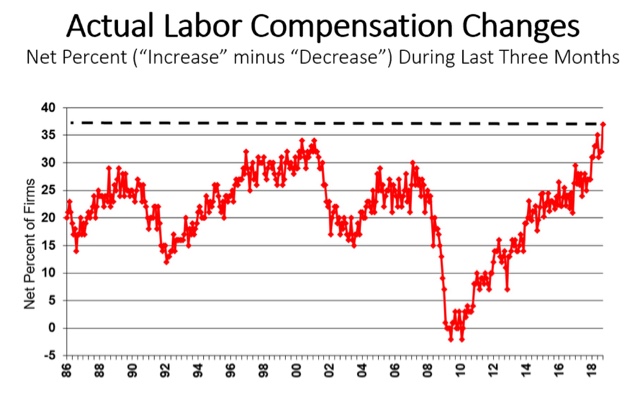

But there was one little nugget of good news this morning: the NFIB, which represents small businesses, came out with their September report, and there was some good news about wages: more small businesses — 37% — said they *actually* raised wages in the last 3 months, than during any other 3 month period over the last 30 years:

If the taboo against raising wages is finally breaking, that is good news. Now we have to see if it is confirmed by actual data on wages.

One small gray cloud on the horizon is that actual hiring has decelerated in the last couple of months:

Too soon to know if this is a trend or not, but as I have indicated frequently in the last couple of months, I am expecting a slowdown by next summer. The two big harbingers of that would be a decrease in real retail sales, which will be reported next wee, and a deceleration in employment growth.