Update: wholesalers’ sales and inventories — it’s all good Another slow start to the data this week, so let’s take a look at relationship I haven’t updated in awhile. Total sales in the economy are broken up into three categories: manufacturers’, wholesalers’, and retailers’. We’ll get retail sales, the biggest component of the three, later this week. But wholesalers’ sales and inventories were released last week, and are a useful coincident barometer. They are a better measure than manufacturers’ sales, since those have been very much secularly affected by the adoption of just-in-time inventory controls. The important thing to remember is that sales (blue, left scale) lead inventories (red, right scale). Here’s both for the last 20 years: Note

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Update: wholesalers’ sales and inventories — it’s all good

Another slow start to the data this week, so let’s take a look at relationship I haven’t updated in awhile.

Total sales in the economy are broken up into three categories: manufacturers’, wholesalers’, and retailers’. We’ll get retail sales, the biggest component of the three, later this week.

But wholesalers’ sales and inventories were released last week, and are a useful coincident barometer. They are a better measure than manufacturers’ sales, since those have been very much secularly affected by the adoption of just-in-time inventory controls.

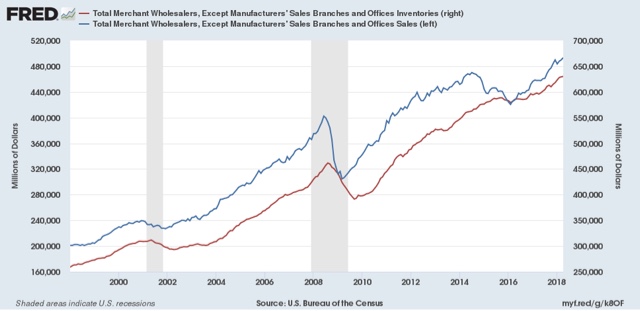

The important thing to remember is that sales (blue, left scale) lead inventories (red, right scale). Here’s both for the last 20 years:

Note than in addition to the two last recessions, sales also plateaued first in 2012 slightly before inventory growth did, and again during the “shallow industrial recession” of 2016. As of April, both sales and inventory were both rising, a very typical result during an expansion.

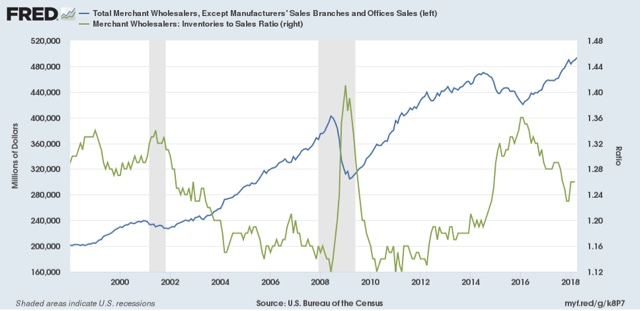

Also, frequently commentators will write about gyrations in the inventory to sales ratio. But a comparison of the ratio (green, right scale) to the more leading measure of sales (blue, left scale) reveals that there the inventory to sales ratio only started to rise significantly coincident (literally, as of the same month) with the downturn in sales for each of the last two recessions as well as the shallow industrial recession of 2016.

Before that, any such upturn in the ratio was within the range of noise and so gave no meaningful signal. In other words, that inventories might be rising at a faster rate than sales doesn’t give us information that is useful in terms of analyzing the business cycle. And, if anything, the trend in the ratio recently is downward.

So the overall message is that, for now, where sales are concerned, it’s all good.