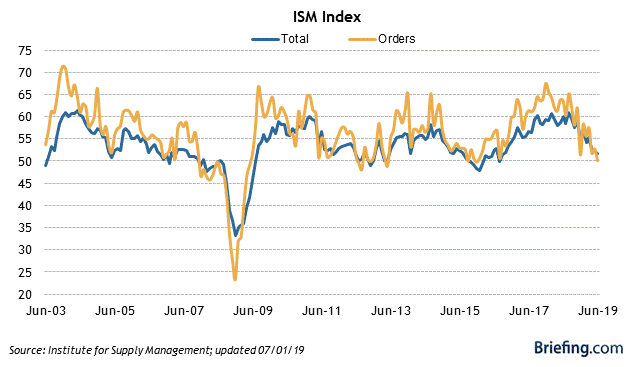

As we start the second half of 2019 . . . (Updated: manufacturing almost exactly flat in June) First of all, I forgot to post a link to my post at Seeking Alpha on how a near-term recession is not likely to be centered on either the consumer and financial sectors of the economy, which are doing OK at the moment, but the producer sector – manufacturing – which is getting pretty shaky. We’ll find out more later this morning when ISM manufacturing for June gets reported. As usual, clicking over and reading puts a penny or two in my pocket to reward me for my efforts. Now that we are in the second half of the year, I expect the slowdown that we’ve seen over the past few months to become more entrenched. I remain on “recession watch” because risks are elevated

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

As we start the second half of 2019 . . . (Updated: manufacturing almost exactly flat in June)

First of all, I forgot to post a link to my post at Seeking Alpha on how a near-term recession is not likely to be centered on either the consumer and financial sectors of the economy, which are doing OK at the moment, but the producer sector – manufacturing – which is getting pretty shaky. We’ll find out more later this morning when ISM manufacturing for June gets reported.

As usual, clicking over and reading puts a penny or two in my pocket to reward me for my efforts.

Now that we are in the second half of the year, I expect the slowdown that we’ve seen over the past few months to become more entrenched. I remain on “recession watch” because risks are elevated (see, for example, this post by Menzie Chinn), but despite the inverted yield curve, my base case remains slowdown only because the Fed can lower rates substantially without being worried about inflation. The main wild card is that Trump probably simply cannot control his urge to roil producers with chaotic tariff and trade policies.

There is no manufacturing recession. There is the barest of manufacturing expansion.