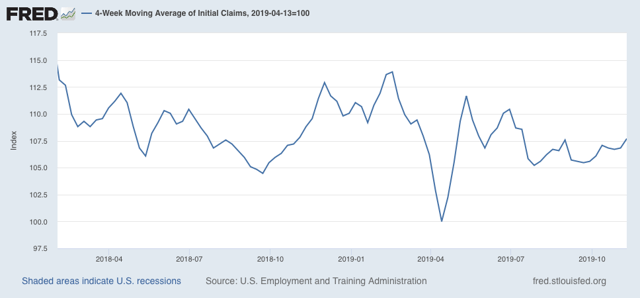

Initial claims continue to show slowdown, but no imminent recession I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of a slowdown turning into something worse. Simply put, no recession is going to begin unless and until layoffs increase. My two thresholds are: 1. If the four week average on claims is more than 10% above its expansion low. 2. If the YoY% change in the monthly average turns higher. As of this week, initial claims continue to be very close to their expansion lows. The 4 week moving average of claims Is 217,000, only 7.7% above the lowest reading of this expansion: On a YoY% change basis, the 4 week average is -1.0% below its level one year ago: In the first two weeks

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Initial claims continue to show slowdown, but no imminent recession

My two thresholds are:

1. If the four week average on claims is more than 10% above its expansion low.

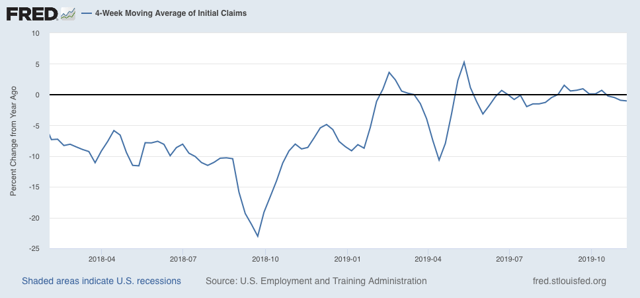

2. If the YoY% change in the monthly average turns higher.

On a YoY% change basis, the 4 week average is -1.0% below its level one year ago:

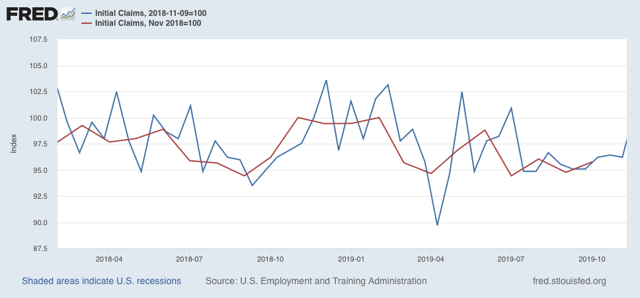

In the first two weeks of November(blue), the average is 218,500 vs. 224,500 for November last year (red):

Although these readings are all weak, they remain positive. Neither threshold for a cautionary recession signal has been met.

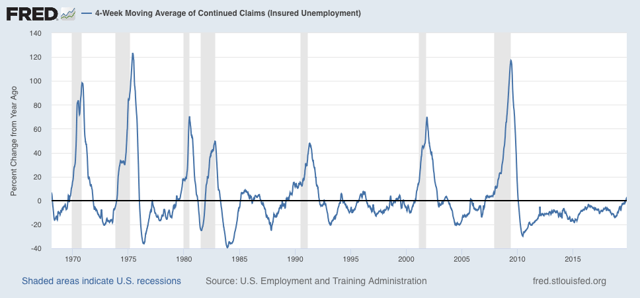

On the other hand, the less volatile (but less leading) 4 week average of continuing claims is 1.5% above where it was a year ago:

This certainly is cautionary, and is consistent with a significant slowdown. But there have been similar readings in 1967, 1985-6, 3 times in the 1990s, and briefly in 2003 and 2005, all without a recession following. If we were to get readings in this metric more than 5% higher YoY, then I would be concerned.

Bottom line: unless initial claims start to be reported in the 230’s, and continuing claims continue to trend higher, there isn’t a recession in the immediate future (and, based on the improvement in the long leading indicators this year, barring more poor government policies, if there is no recession by midyear next year at the latest, it’s not going to happen).