Initial claims weaker, but still not at cautionary levels I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of a slowdown turning into something worse. Simply put, no recession is going to begin unless and until layoffs increase, and the lack of any such increase has been the best argument that no recession is imminent. My two thresholds for initial claims are: 1. If the four week average on claims is more than 10% above its expansion low. 2. If the YoY% change in the monthly average turns higher. I’ve also added a threshold for the less leading, but also much less volatile 4 week average of continuing claims at 5% higher YoY. This week’s reading of 227,000, the second such reading in a row,

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Initial claims weaker, but still not at cautionary levels

I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of a slowdown turning into something worse. Simply put, no recession is going to begin unless and until layoffs increase, and the lack of any such increase has been the best argument that no recession is imminent.

My two thresholds for initial claims are:

1. If the four week average on claims is more than 10% above its expansion low.

2. If the YoY% change in the monthly average turns higher.

I’ve also added a threshold for the less leading, but also much less volatile 4 week average of continuing claims at 5% higher YoY.

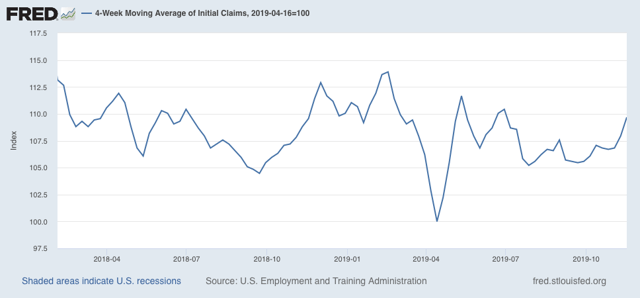

This week’s reading of 227,000, the second such reading in a row, is certainly weak compared with the past 4 months. As a result, the 4 week moving average of claims, at 221,000, is 9.7% above the lowest reading of this expansion:

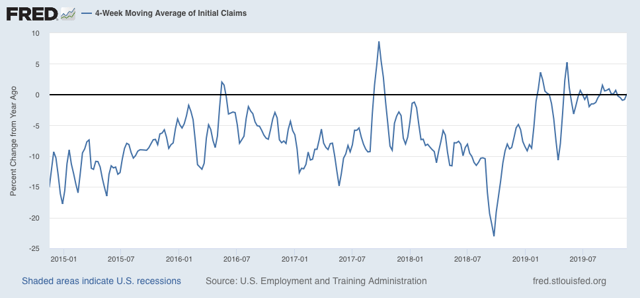

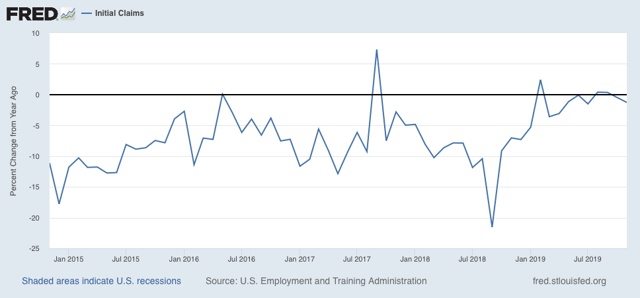

On a YoY% change basis, the 4 week average is very slightly, as in 0.1%, above its level one year ago:

For the first three weeks of November, the average is 221,667 vs. 224,500 for the entire month of November last year, or less by -1.3%:

Although these readings are all weak, they remain positive. Neither threshold for a cautionary recession signal has been met.

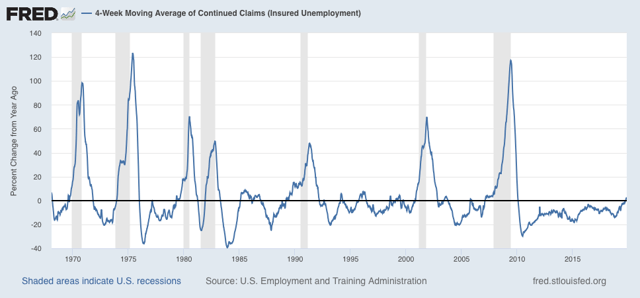

Meanwhile, the less volatile 4 week average of continuing claims is 1.8% above where it was a year ago:

This certainly is cautionary, and is consistent with a significant slowdown. But there have been similar readings in 1967, 1985-6, 3 times in the 1990s, and briefly in 2003 and 2005, all without a recession following. So the threshold for continuing claims being a negative has not been met either.

Barring additional poor government policies – I.e., if the economy is left to its own devices – the long leading indicators strongly suggest that the threat of a recession will end by about mid year next year. Unless initial claims start to be reported in the 230’s, and continuing claims continue to trend higher, into the 1.770 million range (by mid-December, after which the YoY comparisons for continuing claims get much easier), no interim recession will be signaled.