Both long leading components of Q2 GDP declined UPDATED with revisions and further comments The headline number for the first estimate of real GDP in Q2 2019 was 2.1%, as I’m sure you’ve read elsewhere. As is usual, I’m not so interested in what is, after all, what the view in the rear view mirror is, as what the leading components can tell us about what lays ahead. In that regard, both leading components of GDP declined. – Real private fixed residential investment declined at a -1.5% rate annualized. This is the 6th quarter in a row of a decline in that number. In the past half century, declines this long have typically been seen either right before or right after a recession has started – although the magnitude of the decline has been smaller.

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Both long leading components of Q2 GDP declined UPDATED with revisions and further comments

The headline number for the first estimate of real GDP in Q2 2019 was 2.1%, as I’m sure you’ve read elsewhere.

As is usual, I’m not so interested in what is, after all, what the view in the rear view mirror is, as what the leading components can tell us about what lays ahead.

In that regard, both leading components of GDP declined.

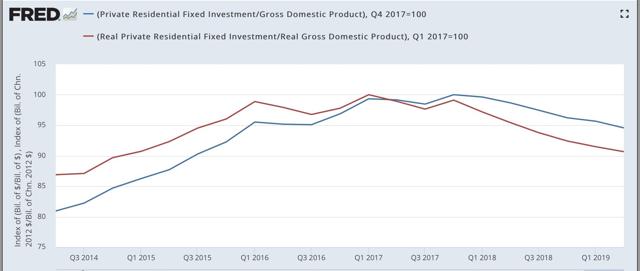

– Real private fixed residential investment declined at a -1.5% rate annualized. This is the 6th quarter in a row of a decline in that number. In the past half century, declines this long have typically been seen either right before or right after a recession has started – although the magnitude of the decline has been smaller.

UPDATE: Here is private fixed residential investment measured both nominally and in real terms as a share of GDP:

Nominally this is down about 5% from peak; in real terms about 10%. This is far short of what is typically the case going into recessions, but it *is* on par with the producer-led 2000-01 period.

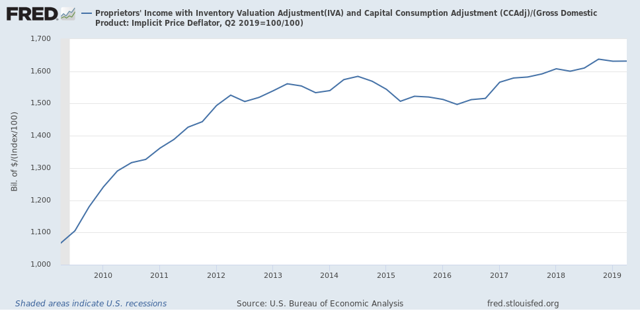

– Proprietors income (a proxy for the more reliable corporate profits, which won’t be released until next month) rose 0.6% nominally. Since the GDP deflator rose 2.2%, this means that “real” proprietors income declined. UPDATE: the 2.2% figure was annualized. Thus the “real” number was essentially flat, but is below its recent peak of Q4 2018:

I will update later once graphs are available. For now, the important takeaway is that one long leading indicators in the GDP release declined, and the second was flat but below peak level, *consistent with* (but not necessarily implying) a recession either being imminent, or possibly not occurring until next year.

THURSDAY, JULY 25, 2019

I have started to monitor initial jobless claims to see if there are any signs of stress.

My two thresholds are:

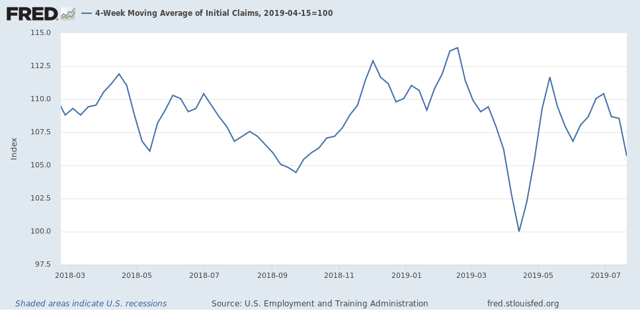

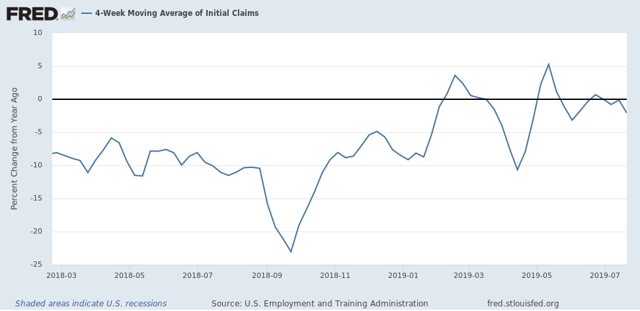

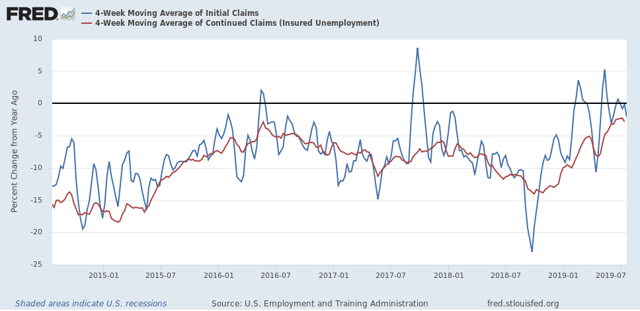

1. If the four week average on claims is more than 10% above its expansion low.

2. If the YoY% change in the monthly average turns higher.

Here’s this week’s update.