The consumer / employment sector of the economy continues powering along ….. aaaaand, I’m back. Did you miss me? Here is the essence of my view of the economy right now: 1. The producer sector of the economy is struggling, partly due to higher interest rates in the last two years filtering through the system, and partly due to stupid and irrational trade wars. 2. The consumer + employment sector of the economy, on the other hand, is moving right along, fueled mainly by very low inflation (low gas prices continue) and also by lower mortgage rates. 3. The longer term outlook (one year or more out) continues to improve. This morning we got three reports focused on the consumer/employee. Let’s take a look at each. First, real personal income improved by +0.3%

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

The consumer / employment sector of the economy continues powering along

….. aaaaand, I’m back. Did you miss me?

Here is the essence of my view of the economy right now:

1. The producer sector of the economy is struggling, partly due to higher interest rates in the last two years filtering through the system, and partly due to stupid and irrational trade wars.

2. The consumer + employment sector of the economy, on the other hand, is moving right along, fueled mainly by very low inflation (low gas prices continue) and also by lower mortgage rates.

3. The longer term outlook (one year or more out) continues to improve.

This morning we got three reports focused on the consumer/employee. Let’s take a look at each.

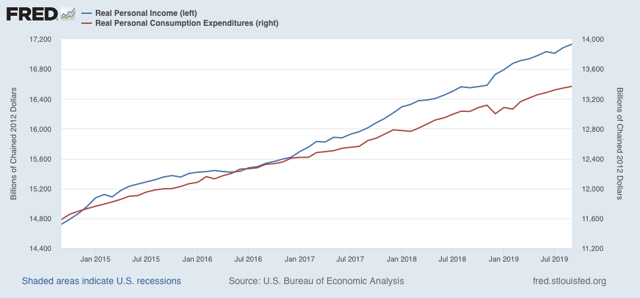

First, real personal income improved by +0.3% in September, and real personal spending improved by +0.2%:

That’s all to the good.

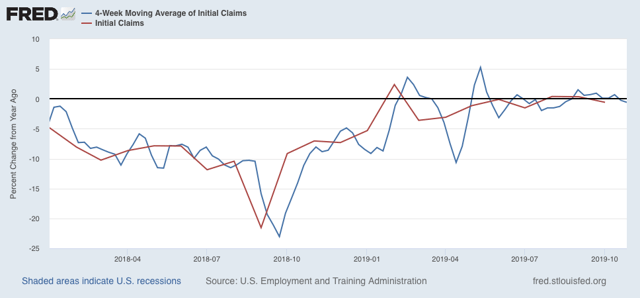

Second, initial jobless claims continue to be close to their bottom. The four week moving average and the monthly average for October, both at 214,750, are lower than they were one year ago:

So long as the employment situation continues like this, I see little chance of any imminent downturn. Needless to say, the employment situation continues to be good.

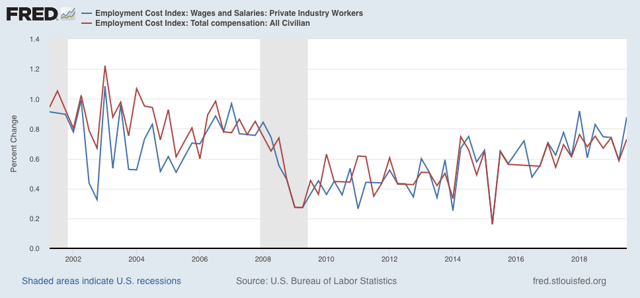

Finally, the employment cost index for the Third Quarter also came in very positive, both for wages and total compensation (things like pensions and medical insurance). The former was up +0.9%, and the latter up +0.7%:

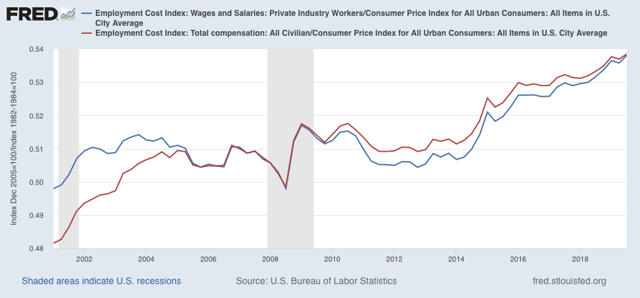

Both set new record highs in real, inflation-adjusted terms, if only slightly so:

So, both on the employment end and the compensation end, things are looking pretty good at the moment for average middle/working class Americans.