Not doomed yet v.2.0: beware recession porn Way back when I first started writing online almost 15 years ago, my very first post on Daily Kos was a little note called “Not Doomed Yet.” It was pretty pathetic compared with the standards of my writing since the Great Recession, but the point of it was, back in 2005, that the conditions necessary for an economic downturn hadn’t quite happened yet. Needless to say, it went nowhere. To the contrary, my big recollection is that my posts that got the most attention by far were the ones I wrote once I did see that a recession looked baked in the cake. The simple fact is, when it comes to online clicks and reads, DOOOM sells. This is a timely reminder, because I have noticed across a variety of platforms in

Topics:

NewDealdemocrat considers the following as important: politics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Not doomed yet v.2.0: beware recession porn

Way back when I first started writing online almost 15 years ago, my very first post on Daily Kos was a little note called “Not Doomed Yet.” It was pretty pathetic compared with the standards of my writing since the Great Recession, but the point of it was, back in 2005, that the conditions necessary for an economic downturn hadn’t quite happened yet.

Needless to say, it went nowhere. To the contrary, my big recollection is that my posts that got the most attention by far were the ones I wrote once I did see that a recession looked baked in the cake. The simple fact is, when it comes to online clicks and reads, DOOOM sells.

This is a timely reminder, because I have noticed across a variety of platforms in which the economy is discussed, including back at Daily Kos, but also including financial sites and Twitter feeds, a surge in recession porn, I.e., why we are DOOOMED. Usually although not always this is because people have suddenly discovered that whatever portion of the Treasury yield curve they have focused upon has an infallible record of predicting the end of the world.

Now, over a year ago I forecast a sharp slowdown during this year. Over six months ago I went on “recession watch” with a starting date of Q4. So I’ve seen this coming for a long time. But I am disappointed to remind you, once again, that we are Not Doomed Yet.

There are at least three reasons for that.

First, while the “infallible” yield curve (except for the 1950s, 1966, and 1998) is forecasting recession, the *equally* “infallible” housing market (except for 2001) says no.

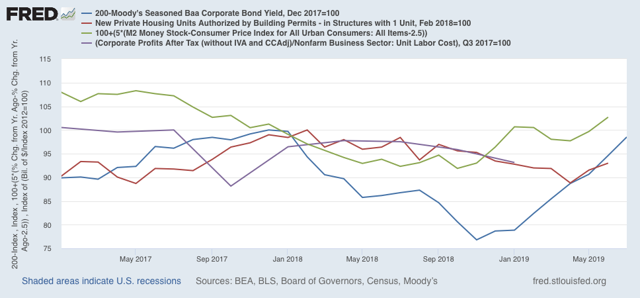

Additionally, long term interest rates have to fallen to, or at least near, expansion lows. Real money supply has been accelerating since the beginning of this year. Here’s what these long leading indicators look like together for the past 3 years:

This is at very least as consistent with a near-miss as it is with an actual downturn.

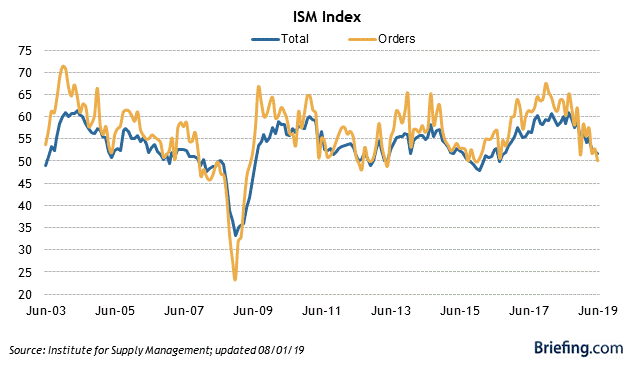

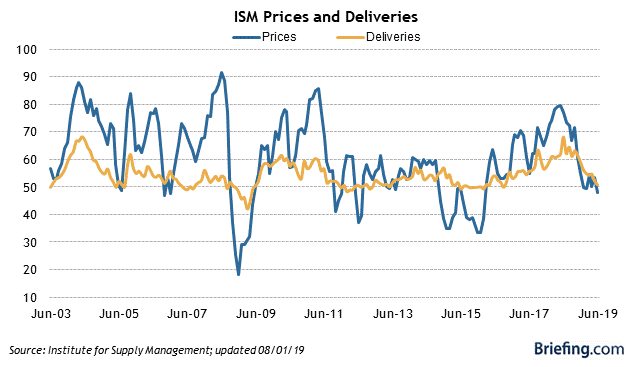

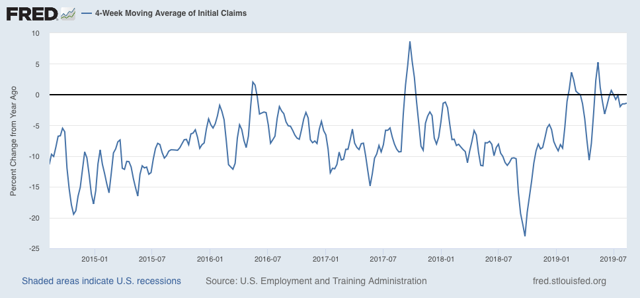

Second, the short leading indicators really haven’t confirmed the long leading indicators (of which the yield curve and housing are two) yet. In particular, neither the ISM manufacturing indexes (first two graphs below) nor initial jobless claims (third) have turned negative yet:

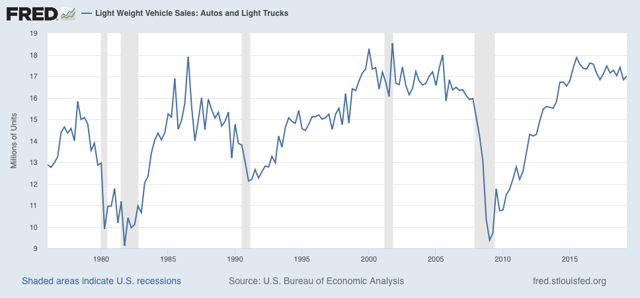

Additionally, durable goods orders and sales, most notably motor vehicles, (as highlighted by the model of Prof. Edward Leamer of UCLA, haven’t declined the 10% or so that they typically have before the onset of recessions:

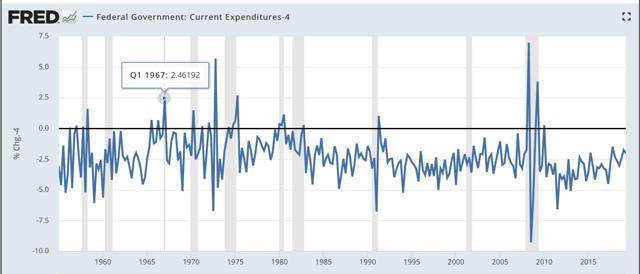

Third, as I pointed out when I went on “recession watch,” the economy is a “second order chaotic system.” That occurs when the thing being observed has the ability to observe right back, and react to your “infallible” forecast. In the case of the economy, that means either fiscal stimulus (LBJ’s 1966 “guns and butter” budget – note that in the graph below I have subtracted 4% so that the actual q/q increases in expenditures during 1966-67 are as much as 6.5% ):

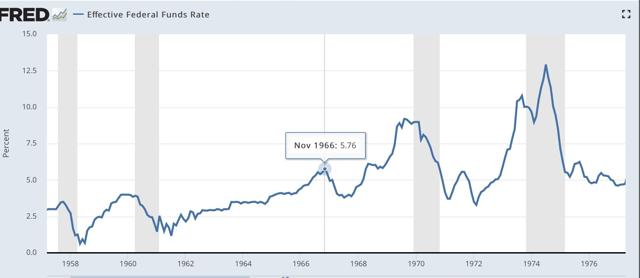

and/or monetary (the 0.75% easing by the Fed at the end of 1966 into early 1967):

(or the 1% easing in the three months immediately after the implosion of Long Term Capital Management in 1998):

So far, there has been neither (the recent 0.25% drop in the Fed funds rate merely took back the 0.25% *increase* the Fed implemented *after* the mid-portion of the yield curve started to invert last December). But that could still change.

Finally, there are some people already trumpeting the “Trump recession” with not-so-hidden glee. Let me point out that if a recession happens several million of their family, friends, neighbors, and countrymen will be thrown out of work, and in general there will be a lot of suffering. Also, there is a substantial chance no recession happens — in which case Trump can crow about his “economic stewardship” and besting his critics. Is that something his critics really want to chance? If people want to make political hay about a poor economy, personally I would suggest waiting until there is an actual decline in monthly payrolls before declaring it so.

In the meantime, I suggest lots of caution in your reading of recession porn.