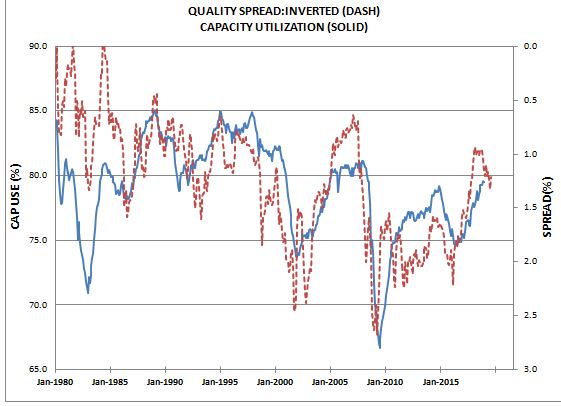

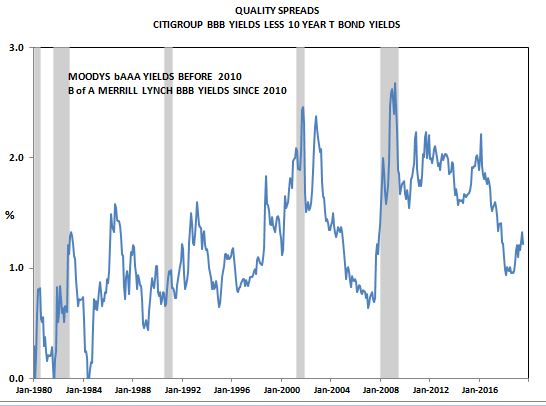

While the yield curve turning negative is getting a lot of attention and seems to be the main excuse for yesterdays stock market drop, there are other financial indicators that are also signaling weaker economic growth ahead. The primary one is quality spreads as the yield on corporate bonds are rising relative to treasuries. This is driven by investors fear that in a weak economy, recession environment the risk of corporate defaults rises and bond buyers demand a larger premium to take that larger risk.It is easy to see that quality spreads are driven largely by economic weakness by comparing them to capacity utilization.

Topics:

Spencer England considers the following as important: Featured Stories, US/Global Economics

This could be interesting, too:

Ken Melvin writes A Developed Taste

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

While the yield curve turning negative is getting a lot of attention and seems to be the main excuse for yesterdays stock market drop, there are other financial indicators that are also signaling weaker economic growth ahead.

The primary one is quality spreads as the yield on corporate bonds are rising relative to treasuries. This is driven by investors fear that in a weak economy, recession environment the risk of corporate defaults rises and bond buyers demand a larger premium to take that larger risk. It is easy to see that quality spreads are driven largely by economic weakness by comparing them to capacity utilization.

It is easy to see that quality spreads are driven largely by economic weakness by comparing them to capacity utilization.