I have been looking at the data recently to find economic series that would quickly reflect the impact of rising tariffs on the consumer. One is Retail Sales: GAFO. Think of it as department store type merchandise — goods excluding autos, food and energy. It is reported every month in both the Census retail sales press release and in the BEA measures of retail sales they compile in putting together personal spending and GDP. I have long preferred the BEA data because it provides very detailed measures of retail sales and real growth. Moreover, the practice of some to deflate the Census retail sales data with the CPI overstates retail price increases and under states real sales growth.As the chart shows price changes in GAFO sales moves very closely with

Topics:

Spencer England considers the following as important: Taxes/regulation, Uncategorized, US/Global Economics

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Joel Eissenberg writes How Tesla makes money

I have been looking at the data recently to find economic series that would quickly reflect the impact of rising tariffs on the consumer.

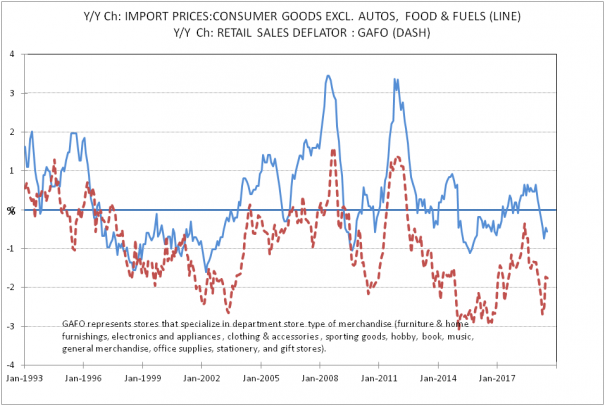

One is Retail Sales: GAFO. Think of it as department store type merchandise — goods excluding autos, food and energy. It is reported every month in both the Census retail sales press release and in the BEA measures of retail sales they compile in putting together personal spending and GDP. I have long preferred the BEA data because it provides very detailed measures of retail sales and real growth. Moreover, the practice of some to deflate the Census retail sales data with the CPI overstates retail price increases and under states real sales growth. As the chart shows price changes in GAFO sales moves very closely with prices of consumer goods imports excluding autos, food and fuels.

As the chart shows price changes in GAFO sales moves very closely with prices of consumer goods imports excluding autos, food and fuels.

However, there is a problem with using the price index for imports as a measure of the impact of tariffs. It is a measure of prices FoB, or freight on board. So it does not include tariffs that are added as the merchandise moves through customs. In the current environment importers reaction to tariffs could show up here. One, if China absorbs some of the price increase while consumers would see higher import prices, this measure of import prices would actually fall as it shows prices China receives. Alternatively, if production is shifted to other countries their prices could be higher that the original Chinese price but less than the new Chinese price including the tariff. In this case, this measure of import prices would rise. So we do not know ahead of time how this price index will change.

Just a footnote, GAFO is about a quarter of all retail sales and this measure of consumer imports is also about a quarter of all imports.