Based on my wage equation, last January I warned to expect a sharp acceleration in wage growth in 2018. Now that wage growth has risen from 2.4% in 2017 to 3.4% in 2018, the same economic variables imply that wage growth may be flattening out. If wage growth remains near current levels it will be one less factor pressurizing the Fed to tighten. One of the key variables driving wages higher a year ago was inflation expectations. Because there are no good long run measures of inflation expectations I use the three year trailing growth in the CPI as a proxy for inflation expectations. A year ago that measure was starting to accelerate, but now it appears to be flattening out and should be an important factor limiting wage gains. The

Topics:

Spencer England considers the following as important: Featured Stories, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

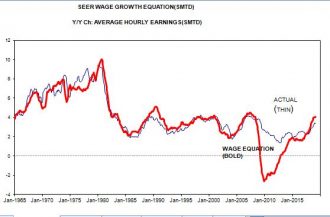

Based on my wage equation, last January I warned to expect a sharp acceleration in wage growth in 2018. Now that wage growth has risen from 2.4% in 2017 to 3.4% in 2018, the same economic variables imply that wage growth may be flattening out. If wage growth remains near current levels it will be one less factor pressurizing the Fed to tighten.

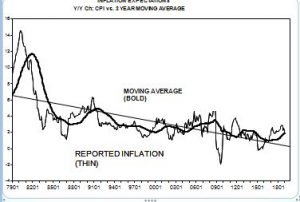

One of the key variables driving wages higher a year ago was inflation expectations. Because there are no good long run measures of inflation expectations I use the three year trailing growth in the CPI as a proxy for inflation expectations. A year ago that measure was starting to accelerate, but now it appears to be flattening out and should be an important factor limiting wage gains.

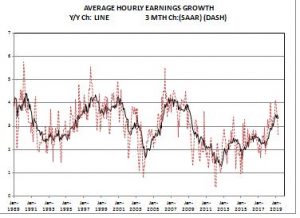

The first sign of slower wage growth was the 3 month growth rate of average hourly earnings slipping below the year over year change in this months employment report.