Gas prices fail to ignite overall inflation in April, but real wages flat so far for 2019 The consumer price index rose +0.3% in April, just as in March mainly as a result of a big monthly increase in gas prices. This is actually a surprisingly small increase because, as I pointed out last month, almost every time gas prices have increased by as much as they did — up 9% in March and 11% for April — consumer prices as a whole have gone up at least +0.4%. I’m showing just the last 10 years in the graph below (wages in blue, gas prices in red): Figure one Ex-gas, consumer inflation ex-energy has been remarkably stable between 1.5% and 2.5% YoY ever since gas prices made their long term bottom in early 1999. The only big exceptions were in the year before

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Gas prices fail to ignite overall inflation in April, but real wages flat so far for 2019

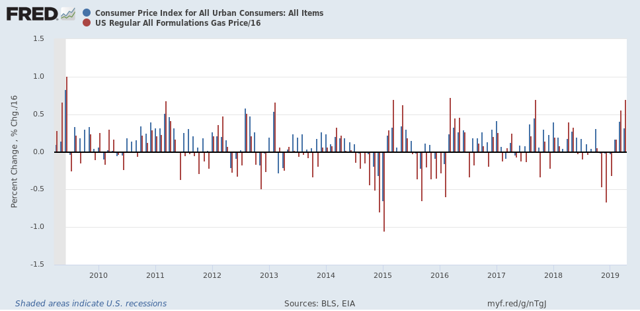

The consumer price index rose +0.3% in April, just as in March mainly as a result of a big monthly increase in gas prices. This is actually a surprisingly small increase because, as I pointed out last month, almost every time gas prices have increased by as much as they did — up 9% in March and 11% for April — consumer prices as a whole have gone up at least +0.4%. I’m showing just the last 10 years in the graph below (wages in blue, gas prices in red):

Figure one

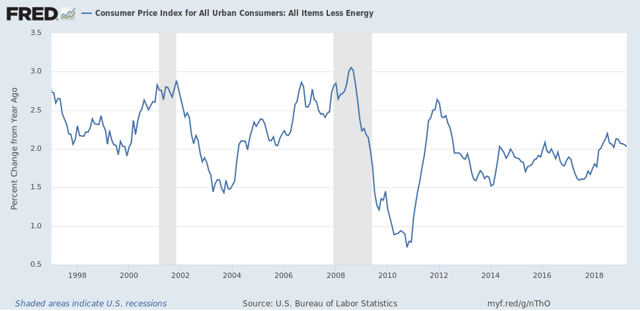

Ex-gas, consumer inflation ex-energy has been remarkably stable between 1.5% and 2.5% YoY ever since gas prices made their long term bottom in early 1999. The only big exceptions were in the year before each of the last two recessions:

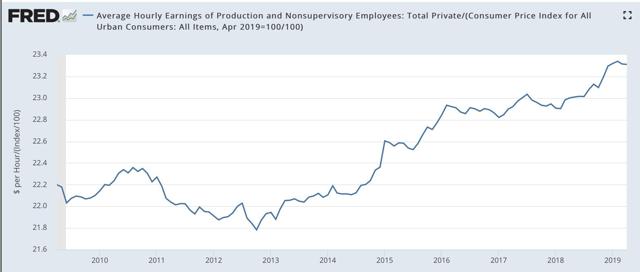

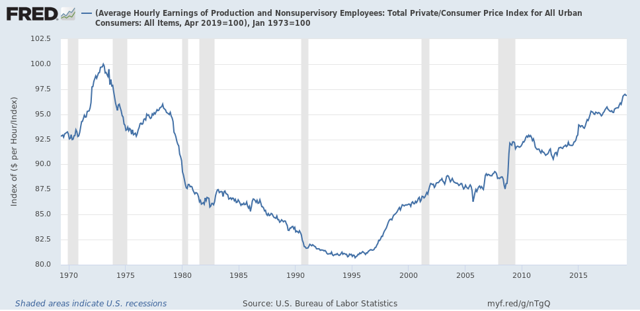

Now let’s turn to wages. Nominally, wages for non-supervisory employees increased +0.3% in April, so after inflation they were flat, as they have been all this year so far:

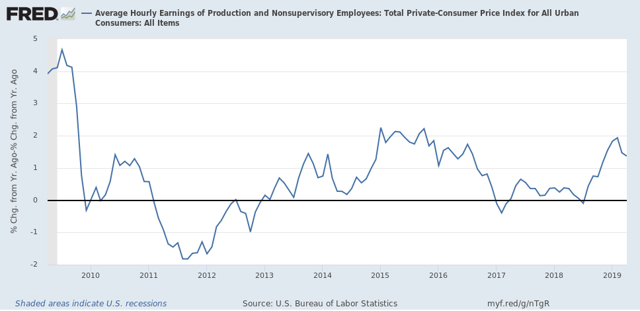

YoY non-supervisory wages nominally were up +3.4%. With YoY inflation rising to +2.0%, in real terms, real wages are only up +1.4%, a decline from their YoY high in February:

In the long view, real wages are still -3.1% below their January 1973 peak, and -0.1% below where they were in February:

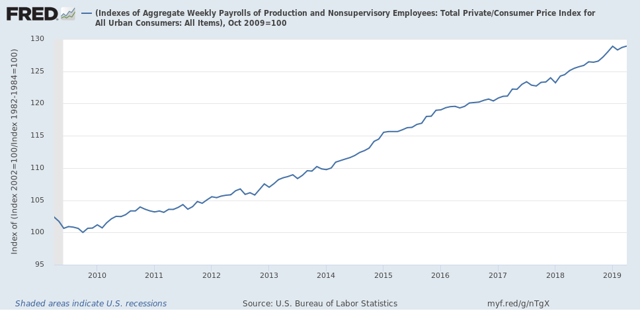

Finally, here are aggregate real wages. This tells us how much more American workers as a whole in real terms since the bottom just after the Great Recession. These improved to 28.9% above their low, but only tied with their January peak:

While in real terms American workers have made no progress so far this year, nevertheless it’s no surprise that in public opinion polls, Americans feel pretty good about the economy right now. Unemployment is lower than it has been in several decades. Underemployment is at least approaching its lows in the past 25 years. And wage growth, while subpar in historical terms, has improved to the point where it is not the kind of source of discontent it was in the first years of this expansion. I don’t expect this to change unless there is a further jump in gas prices, or else a significant tightening of consumer credit.