The last long leading indicator, corporate profits, declined in Q4 2018 Three months after the quarter ended, corporate profits for Q4 of 2018 were reported this morning, and they were down slightly (-0.1%). Here’s the quote from the BEA: Corporate profits deflated by unit labor costs are a long leading indicator. Since these costs were already reported at +1.6% q/q, that means that adjusted corporate profits were down about the same percentage. >Earlier, proprietors income for Q4 had been reported at positive, but that is a less accurate placeholder. In contrast, Q4 corporate earnings for the S&P 500, with 99.7% reporting, declined over -3% q/q. This means that, in Q4 of last year, almost *all* of the long leading indicators declined, the first time

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

The last long leading indicator, corporate profits, declined in Q4 2018

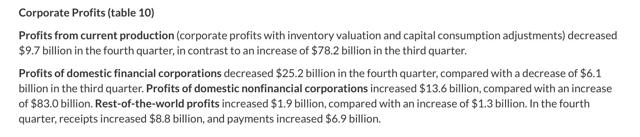

Three months after the quarter ended, corporate profits for Q4 of 2018 were reported this morning, and they were down slightly (-0.1%). Here’s the quote from the BEA:

Corporate profits deflated by unit labor costs are a long leading indicator. Since these costs were already reported at +1.6% q/q, that means that adjusted corporate profits were down about the same percentage.

>Earlier, proprietors income for Q4 had been reported at positive, but that is a less accurate placeholder. In contrast, Q4 corporate earnings for the S&P 500, with 99.7% reporting, declined over -3% q/q.

This means that, in Q4 of last year, almost *all* of the long leading indicators declined, the first time that has happened since – perhaps not coincidentally – shortly before the last recession.