Commercial and industrial loans: another sign of a slowdown? There are lots of cross-currents in the economy right now. At the absolute tip of the spear is the decline in interest rates since November, which has led to an improvement in some of the housing market metrics. In the shorter-term outlook, a simple quick-and-dirty metric of initial jobless claims (new 49 year lows) and the stock market (just made new all-time highs) suggests all clear. But there are contrary signs as well. For example, the weekly measure of temporary jobs by the American Staffing Association just fell to -1.8%, its worst YoY comparison since the 2015-16 shallow industrial recession. Here’s one other little tidbit. Yesterday I read an article elsewhere about how a near-term

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Commercial and industrial loans: another sign of a slowdown?

There are lots of cross-currents in the economy right now. At the absolute tip of the spear is the decline in interest rates since November, which has led to an improvement in some of the housing market metrics. In the shorter-term outlook, a simple quick-and-dirty metric of initial jobless claims (new 49 year lows) and the stock market (just made new all-time highs) suggests all clear. But there are contrary signs as well. For example, the weekly measure of temporary jobs by the American Staffing Association just fell to -1.8%, its worst YoY comparison since the 2015-16 shallow industrial recession.

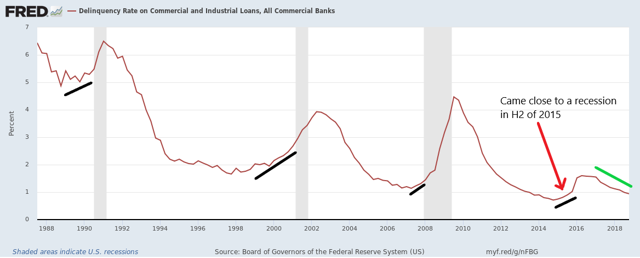

Here’s one other little tidbit. Yesterday I read an article elsewhere about how a near-term recession isn’t in the cards, citing among other things a declining delinquency rate for commercial and industrial loans. Here’s their accompanying graph:

True enough, although if you look carefully, in the lead up to both the 1990 and 2008 recessions there were only two quarters of significant increases off the bottom before the recessions began. Since the latest data in the graph is for Q4 2018, a similar pattern wouldn’t rule out a recession beginning as soon as Q3 of this year, i.e., July.

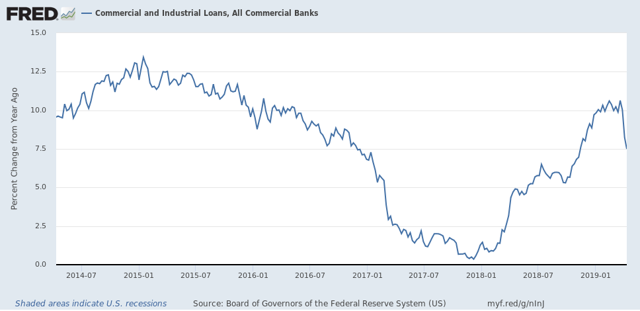

The value of commercial and industrial loans is a lagging indicator, typically not bottoming on a YoY basis until after a recession is already over:

But here’s the interesting thing. The same graph shows that YoY volume of such loans significantly *decelerated* from its YoY peak before 8 of the 11 recessions since 1945, as well as for all of the significant slowdowns, e.g., 1966 and 1995.

No big deal, right? At the far right of the graph, the YoY volume of loans was increasing as of March.<

Except for this: when we zoom in on the recent weekly, rather than monthly data, we get this:

A very sharp deceleration over the past three weeks.

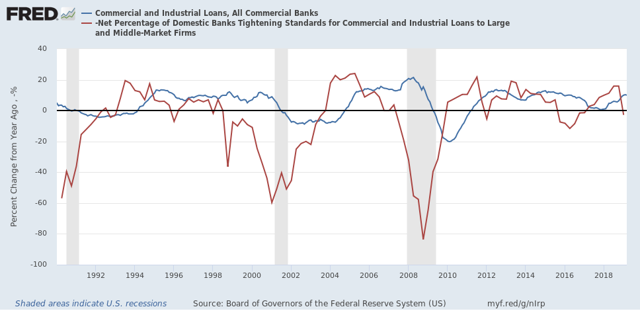

Of course, this could reverse with this Friday’s report. And since loans tend to follow bank tightening by about 5 quarters:

I tend to doubt the deceleration will go too far.

But nevertheless something to keep an eye on in terms of another sign of a slowdown.