Industrial production, jobless claims, and retail sales As I noted this morning, a slew of important data was released. Let me deal with the “normal” weekly and monthly data in this post. First, industrial production continues to languish, down significantly from the end of last year, whether measured in total or just as to manufacturing: The saving grace here is that it has not declined as much as it did during the 2015-16 “shallow industrial recession” which was not sufficient to cause the economy as a whole to contract. Second, initial jobless claims rose, and are (slightly) higher YoY for the first two weeks of August: The 4 week average is only about 6% higher than their trough this past April: The four week average of continuing claims,

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Industrial production, jobless claims, and retail sales

As I noted this morning, a slew of important data was released. Let me deal with the “normal” weekly and monthly data in this post.

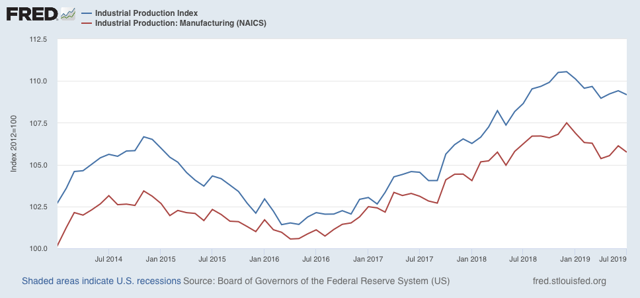

First, industrial production continues to languish, down significantly from the end of last year, whether measured in total or just as to manufacturing:

The saving grace here is that it has not declined as much as it did during the 2015-16 “shallow industrial recession” which was not sufficient to cause the economy as a whole to contract.

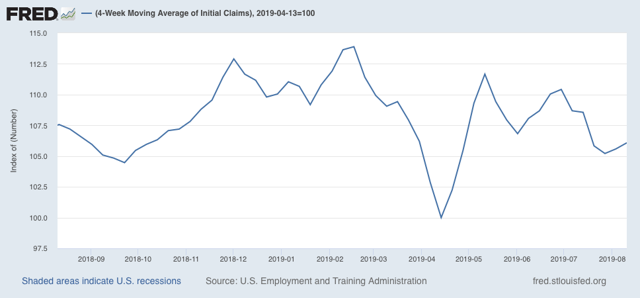

Second, initial jobless claims rose, and are (slightly) higher YoY for the first two weeks of August:

The 4 week average is only about 6% higher than their trough this past April:

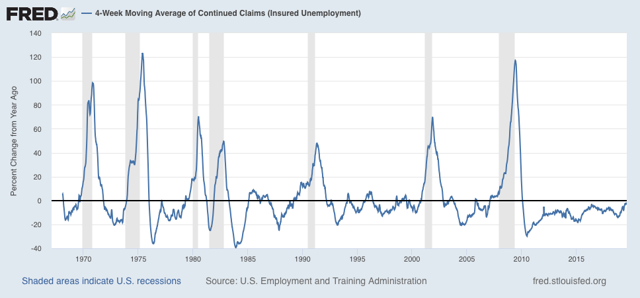

The four week average of continuing claims, which is much less volatile, is about -2.5% lower than it was a year ago. Should it turn higher YoY, that would be a yellow flag; if it were to reach 10% higher, that has always meant recession:

For now, jobless claims are just showing a slowdown.

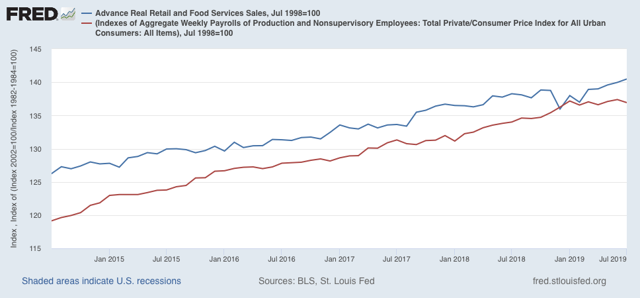

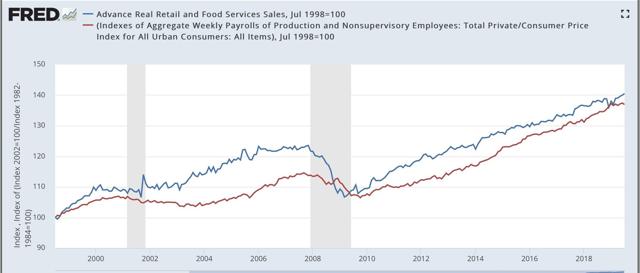

Finally, real retail sales (blue) rose 0.4% to another new high in July:

Here’s the longer term look for the past 20+ years:

The red line is real aggregate payrolls. Since sales tend to lead payrolls (note the former flattened out about 6 months before the latter prior to each of the last two recessions), this is an encouraging sign.

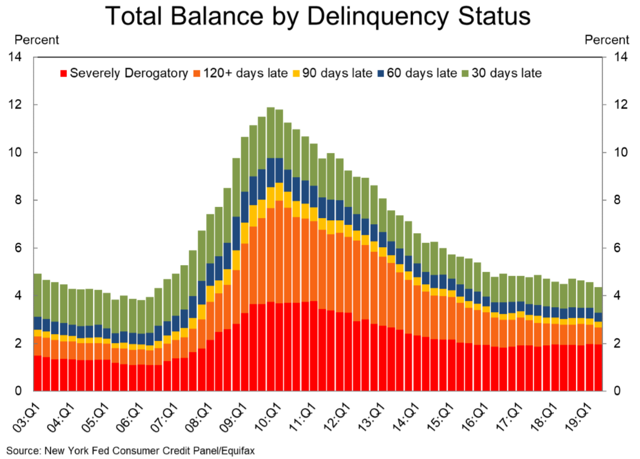

A couple of other recent data points also suggest that the consumer continues to be in decent shape. The NY Fed’s report on consumer debt delinquencies was released this week, showing a slight decline to expansion lows:

If the consumer were getting stressed and ready to cut back, I would expect this metric to be rising.

Also, the American Banking Association’s report on consumer bankruptcies showed only a small uptick from expansion lows during the 2nd Quarter:

Right now the consumer, relatively speaking, is doing pretty well. If we are on the cusp of a recession, it is almost certainly going to be producer led.