June consumption was strong, while production was weak Tuesday morning’s retail sales and industrial production releases for June are consistent with my take that the consumer sector of the economy is doing OK, while the production sector remains in trouble. Let’s start with retail sales. Retail sales are one of my favorite indicators, because in real terms they can tell us so much about the present, near term forecast, and longer term forecast for the economy. This morning retail sales for June were reported up +0.4%, while May was revised downward by -0.1%. Since consumer inflation increased by less than 0.1% last month, through the magic of rounding, real retail sales also rose +0.4%. The strength of the past two months means that YoY real retail

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

June consumption was strong, while production was weak

Tuesday morning’s retail sales and industrial production releases for June are consistent with my take that the consumer sector of the economy is doing OK, while the production sector remains in trouble.

Let’s start with retail sales.

Retail sales are one of my favorite indicators, because in real terms they can tell us so much about the present, near term forecast, and longer term forecast for the economy.

This morning retail sales for June were reported up +0.4%, while May was revised downward by -0.1%. Since consumer inflation increased by less than 0.1% last month, through the magic of rounding, real retail sales also rose +0.4%. The strength of the past two months means that YoY real retail sales are now up +1.7%.

Here is what the last five years look like:

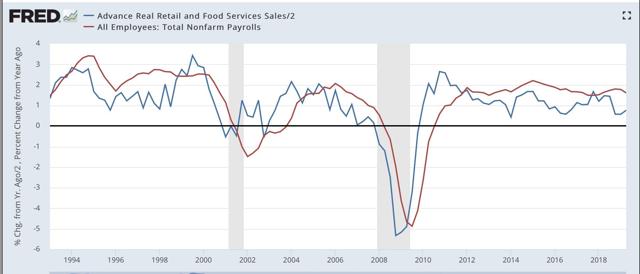

Next, although the relationship is noisy, because real retail sales measured YoY tend to lead employment (red in the graph below) by a number of months, here is that relationship for the past 25 years, measured quarterly to cut down on noise:

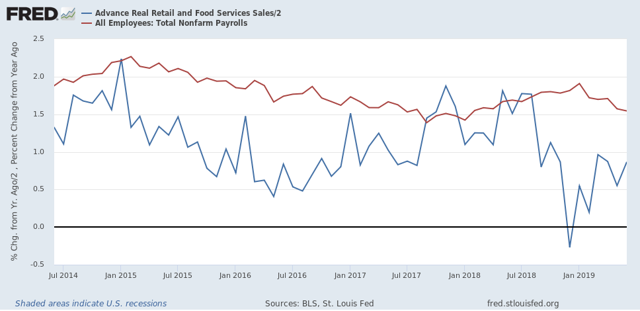

Now here is the monthly close-up of the last five years. You can see that it is much noisier, but helps us pick out the turning points:

I still expect some softness in the employment reports in the next few months, but the renewed strength in real retail sales means that it may pass.

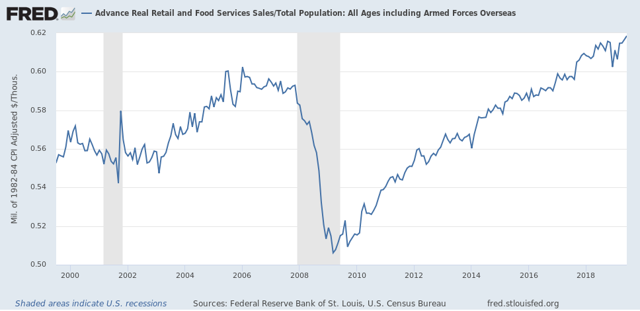

Finally, real retail sales per capita is a long leading indicator. In particular it has turned down a full year before either of the past two recessions:

As these made yet another new high in June, that is an argument against any actual downturn in the economy for the rest of this year.

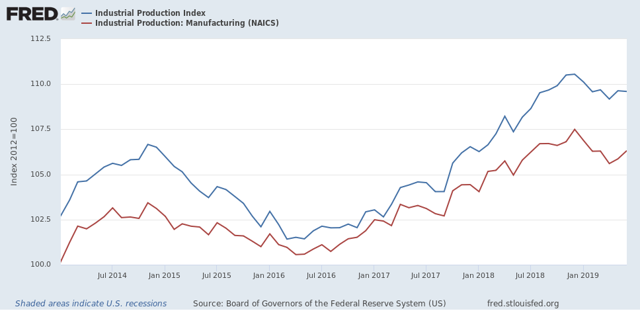

But if the consumer side of the economy looks pretty good, the production side continued to lag in June, as industrial production as a whole was unchanged. Manufacturing production did increase +0.4%:

On the one hand, both may have bottomed in April, following the “mini-recession” brought on by the January government shutdown and some trade war fallout. On the other, both remain significantly below their expansion peaks set six months ago.

If an actual downturn is going to begin in the production sector, it will show up first in the new orders portions of the regional Fed indexes, the average of which has remained above zero so far.