Manufacturing holds on in February The theme for most reports remains that the government shutdown in December and January, plus a 30 year record cold snap for a week in January, put a real dent in the economy. That certainly was the message of December personal spending and December and January personal spending this morning. But it looks like there was no significant damage to manufacturing. This week three regional Fed banks reported February manufacturing in their region, followed by the Chicago PMI, and finally ISM manufacturing this morning. At the end of January, the average new orders reading of the five regional Feds was +5. After much storm and drang, notably a big downdraft in the Kansas City region, but an even bigger updraft in Richmond, the

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Manufacturing holds on in February

The theme for most reports remains that the government shutdown in December and January, plus a 30 year record cold snap for a week in January, put a real dent in the economy. That certainly was the message of December personal spending and December and January personal spending this morning.

But it looks like there was no significant damage to manufacturing. This week three regional Fed banks reported February manufacturing in their region, followed by the Chicago PMI, and finally ISM manufacturing this morning.

At the end of January, the average new orders reading of the five regional Feds was +5. After much storm and drang, notably a big downdraft in the Kansas City region, but an even bigger updraft in Richmond, the average for February increased +1 to 6.

One regional Fed that does not report is Chicago, but the Chicago PMI’s new orders index, which has been running hotter than the other regional reports for months, also bounced back strongly in February, from 53.2 to 68.4 (which is still not quite as positive as it was for a number of months earlier last year). Subtracting 50 to make this compatible with the Fed indexes gives us an increase in the average from +5 in January to +10 in February.

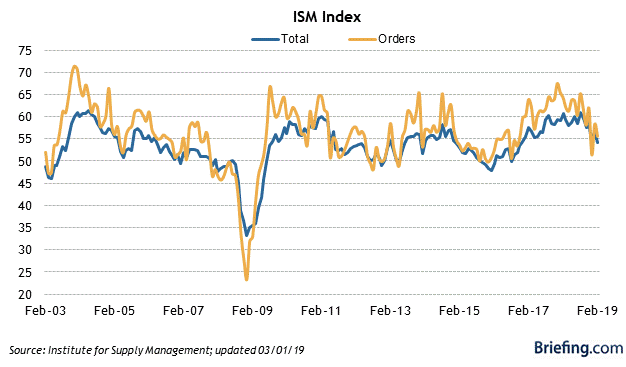

Finally, this morning the ISM new orders index for February declined to 55.5 from January’s 58.2 reading. The total index declined from 56.6 to 54.2, the lowest in nearly two years (h/t Briefing.com):

This of course is still well into positive territory, and in line with most of this expansion. It is also in line with the average of the regional Fed reports. Chicago looks like the outlier.

The bottom line remains that manufacturing is decelerating from its torrid pace last summer, but is still expanding decently. Because I anticipate further slowing in the economy over the next 6 to 9 months, I am still expecting further deceleration in manufacturing. Whether it goes beyond that into outright contraction is very much an open question.