Manufacturing job losses now look virtually certain I’ll have a post going up at Seeking Alpha later, but between a steep decline in the manufacturing work week, lackluster regional Fed manufacturing indexes (still barely positive), a turndown in durable goods orders (in part due to Boeing’s woes), and increasing inventories, it now looks nearly certain that there will be an actual decline in manufacturing jobs over the next twelve months. To put this in perspective, here are the annual gains (losses in 2010) in manufacturing jobs through the end of 2018: Here is the same data monthly through May from the beginning of Obama’s second term: Hillary Clinton ran for President in 2016 in the teeth of a manufacturing recession. That is why the

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Manufacturing job losses now look virtually certain

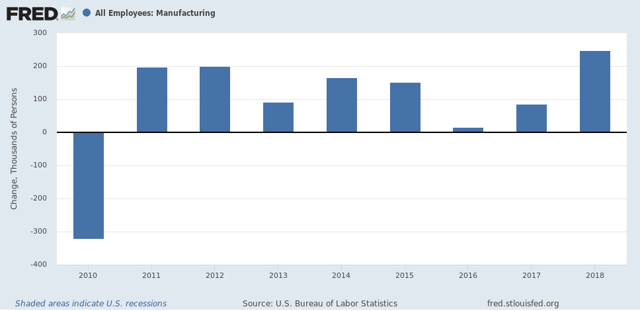

I’ll have a post going up at Seeking Alpha later, but between a steep decline in the manufacturing work week, lackluster regional Fed manufacturing indexes (still barely positive), a turndown in durable goods orders (in part due to Boeing’s woes), and increasing inventories, it now looks nearly certain that there will be an actual decline in manufacturing jobs over the next twelve months.

To put this in perspective, here are the annual gains (losses in 2010) in manufacturing jobs through the end of 2018:

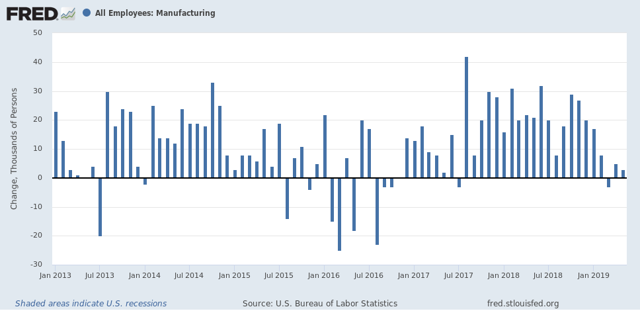

Here is the same data monthly through May from the beginning of Obama’s second term:

Hillary Clinton ran for President in 2016 in the teeth of a manufacturing recession. That is why the fundamentals-based economic models all forecast a very close election that year.

Of course, I’ve been forecasting a steep slowdown with an epicenter of roughly Q4 of this year since the middle of 2018. And — hey, look! — a big name economist or two are beginning to come around: